Narratives are currently in beta

Key Takeaways

- New contracts and innovations in Brazil and downhole environments are projected to boost TETRA's revenue growth significantly starting in 2025.

- Strategic collaborations and projects in energy storage and bromine production aim to enhance manufacturing output, revenue, and profitability.

- Financial instability and reliance on specific projects could affect future revenues, especially amid environmental disruptions and capital expenditure strains.

Catalysts

About TETRA Technologies- Operates as an energy services and solutions company.

- TETRA Technologies has secured a multi-well, multiyear deepwater Completion Fluids contract in Brazil, strengthening its position as a market leader. This contract is expected to drive revenue growth commencing in late Q1 2025.

- The company is innovating with its TETRA X corrosion inhibitor, targeting high-temperature downhole environments, potentially enhancing revenue and margins from oil and gas and other industrial sectors.

- TETRA's focus on produced water recycling, driven by seismic activities, is expected to increase demand for these services, potentially boosting both revenue and profit margins by reducing costs associated with water disposal.

- Collaborations with Eos Energy for long-duration energy storage electrolytes are set to increase TETRA's manufacturing and blending outputs significantly, which is poised to enhance revenue and profit margins as demand materializes in 2025 and beyond.

- The Arkansas bromine project presents compelling economics with potential adjusted EBITDA increases, promising to boost earnings once production capacity ramps up, and providing a strategic supply of bromine for TETRA's operations and external sales.

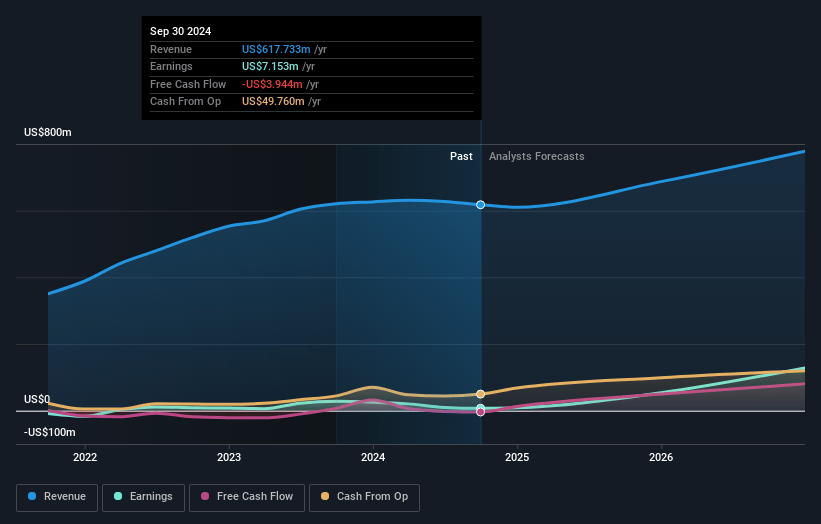

TETRA Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TETRA Technologies's revenue will grow by 14.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.2% today to 23.2% in 3 years time.

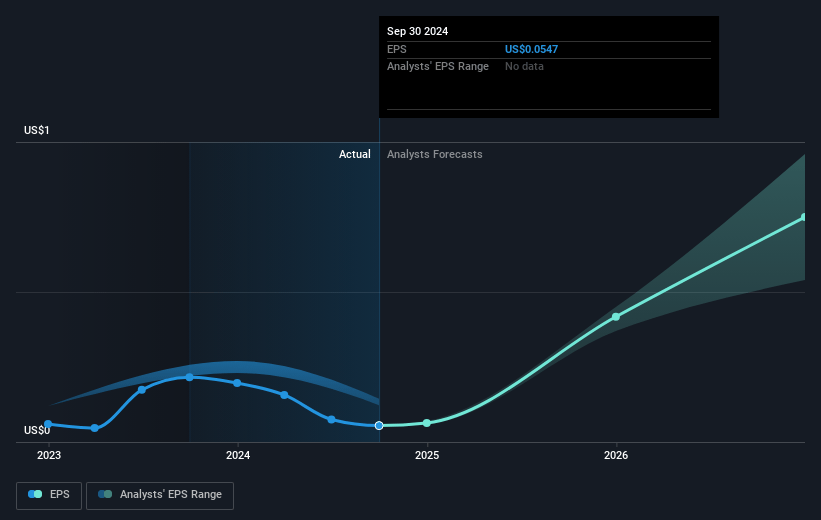

- Analysts expect earnings to reach $211.8 million (and earnings per share of $1.54) by about November 2027, up from $7.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.8x on those 2027 earnings, down from 73.2x today. This future PE is lower than the current PE for the US Energy Services industry at 16.6x.

- Analysts expect the number of shares outstanding to grow by 1.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.88%, as per the Simply Wall St company report.

TETRA Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in third quarter revenue by 6% year-on-year and from the first quarter 2024, as well as adjusted EBITDA being down $2.5 million from Q3 '23, indicates potential financial instability which could impact future revenues and earnings.

- Significant dependence on specific projects like the Neptune wells and the Brazil deepwater award presents a risk if these fail to materialize or face delays, affecting projected cash flows and revenue streams.

- The fourth quarter is expected to have revenue and adjusted EBITDA outcomes comparable to slightly below the third quarter due to delayed projects caused by Gulf of Mexico hurricanes, which highlights susceptibility to environmental disruptions impacting earnings and revenue cycles.

- The company’s substantial capital expenditure, such as the $270 million investment in the Arkansas bromine project, could strain financial resources, especially if anticipated returns are delayed or do not meet expectations, potentially affecting net margins and liquidity.

- Automation advancements in the Water & Flowback Services, while aimed at reducing costs, might not sufficiently counter the reduced U.S. onshore activity, potentially leading to lower revenues and pressured margins if market conditions do not improve.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.92 for TETRA Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $914.9 million, earnings will come to $211.8 million, and it would be trading on a PE ratio of 5.8x, assuming you use a discount rate of 8.9%.

- Given the current share price of $3.97, the analyst's price target of $6.92 is 42.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives