Key Takeaways

- Strategic investments in deepwater projects and Water & Flowback Services are set to drive revenue growth, enhance margins, and improve cash flows.

- Expansion in zinc bromide-based electrolytes and tax strategies are poised to increase revenue contributions, optimize net income, and elevate shareholder value.

- U.S. operational volatility, regulatory risks, and inventory challenges may affect TETRA's revenue stability, margins, and growth prospects in key segments and markets.

Catalysts

About TETRA Technologies- Operates as an energy services and solutions company.

- TETRA Technologies is making strategic investments in equipment for deepwater completion fluids, particularly in Brazil and the Gulf of Mexico. This is expected to drive a significant increase in revenue and EBITDA in early 2025, which points to future earnings growth.

- The company's focus on Water & Flowback Services, through automation and desalination for produced water recycling, is expected to enhance margins and improve cash flows despite flattish revenue, thereby likely improving net margins.

- The Industrial Chemicals segment, particularly the expansion into zinc bromide-based electrolyte for energy storage, is seeing strong growth, which predicts an increased revenue contribution and potentially higher margins due to diversification and scale.

- There are significant tax savings expected through the use of net operating losses (NOLs), which could result in approximately $97.5 million savings on cash taxes in coming years, benefiting net income and cash flow, enhancing earnings and shareholder value.

- With ongoing strategic initiatives such as the bromine Arkansas project and potential lithium production, TETRA's investment in low-cost production facilities could lead to cost reductions and profitability improvements, impacting earnings and future revenue streams positively.

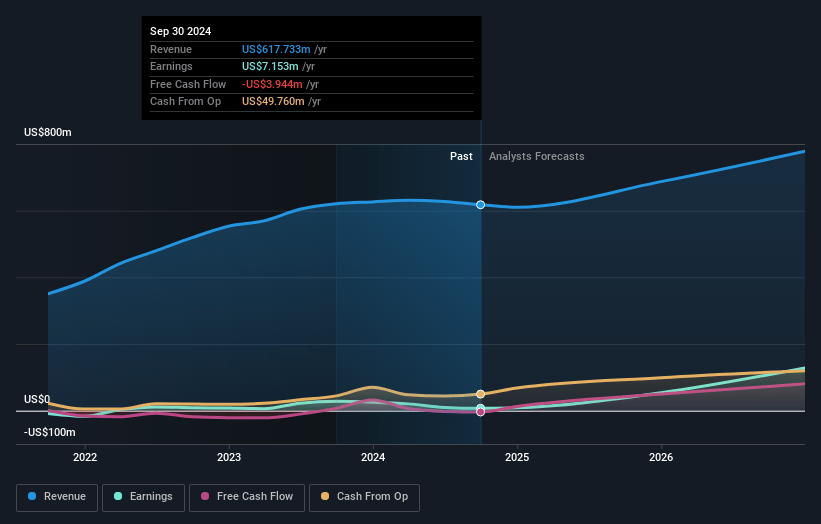

TETRA Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TETRA Technologies's revenue will grow by 9.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 19.0% today to 13.9% in 3 years time.

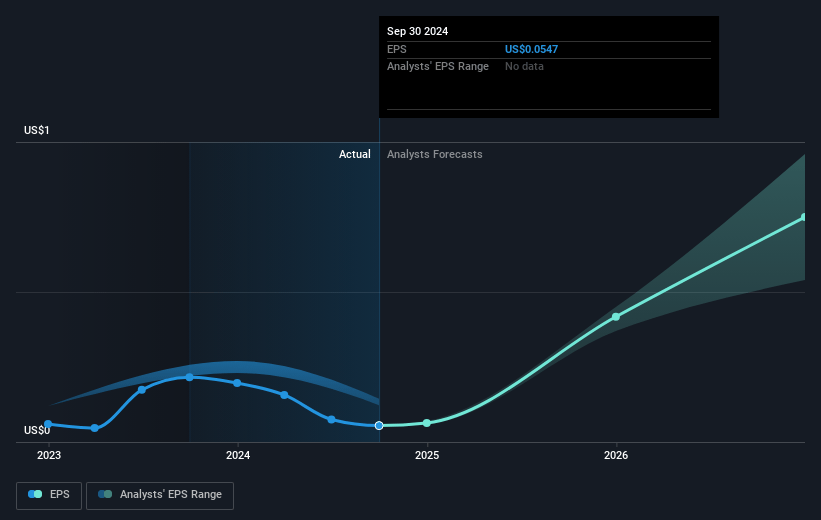

- Analysts expect earnings to reach $110.5 million (and earnings per share of $0.83) by about March 2028, down from $113.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.3x on those 2028 earnings, up from 3.8x today. This future PE is lower than the current PE for the US Energy Services industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.31%, as per the Simply Wall St company report.

TETRA Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The U.S. land operations experienced a weaker-than-expected year-end slowdown, indicating potential volatility and uncertainty in domestic revenue streams, which could impact overall revenue and net margins if trends continue.

- The Water & Flowback Services segment faced challenges due to operator consolidation and low natural gas prices, leading to a decline in rig count and frac fleets by 17% and 30%, respectively, affecting revenue stability and margins within this segment.

- The potential regulatory restrictions on water disposal in the Permian Basin present a risk that could increase operational costs and affect the net margins and earnings if TETRA faces increased expenses to comply with new regulations.

- Strategic investments in Brazil and the Gulf of America have led to increased inventory levels, raising working capital by $21 million year-on-year, which impacts liquidity and could affect net margins if expected returns do not materialize as anticipated.

- The reliance on acquiring bridging supply agreements for bromine to fund projects might delay or defer the construction of a key bromine plant, potentially impacting future revenue and growth opportunities linked to bromine production and the broader Chemical business expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.4 for TETRA Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $5.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $795.3 million, earnings will come to $110.5 million, and it would be trading on a PE ratio of 10.3x, assuming you use a discount rate of 9.3%.

- Given the current share price of $3.28, the analyst price target of $6.4 is 48.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

WaneInvestmentHouse

Community Contributor

mixed valauation - Launches TETRA Oasis TDS Water Treatment Technology for Oil and Gas Industry

Key Financial Results Revenue: US$599.1m (down 4.3% from FY 2023). Net income: US$113.6m (up 346% from FY 2023).

View narrativeUS$4.45

FV

26.5% undervalued intrinsic discount4.00%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

5users have followed this narrative

9 days ago author updated this narrative