Narratives are currently in beta

Key Takeaways

- Expansion projects in key basins and LPG exports boost revenue, operating efficiencies, and market competitiveness.

- Strategic infrastructure investments foresee higher NGL supply handling, cash flow, and shareholder returns through increased dividends and share repurchases.

- Accelerated capital spending and increased infrastructure demands may pressure cash flow, while competition and commodity price fluctuations could compress margins and affect earnings.

Catalysts

About Targa Resources- Together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic midstream infrastructure assets in North America.

- Targa's new plant projects in the Permian and the Delaware Basin, including the upcoming operations of Bull Moose, Bull Moose II, and Falcon 2, are expected to increase volumes, driving revenue growth and enhancing operating efficiencies, which should positively impact EBITDA and net margins.

- Targa's strategic investments in sour gas treating and acid gas injection infrastructure are expected to strengthen their competitive position in the Delaware Basin, leading to increased market share and improved revenue potential.

- The expansion of Targa's LPG export capacity at Galena Park and the anticipated robust global demand for U.S.-sourced LPGs are expected to significantly increase revenue and profit margins in their export business.

- Targa's strong position in the Permian Basin and strategic upgrades to their infrastructure, including the new fractionator Train 11, set to be on track for the third quarter of 2026, are expected to handle increased NGL supply growth, leading to substantial revenue and EBITDA increases.

- The company expects a meaningful inflection in free cash flow generation starting in 2025, driven by continued growth capital investments and the increasing return of capital to shareholders, including significant share repurchases and an anticipated 33% increase in the 2025 annual common dividend per share, directly enhancing earnings per share.

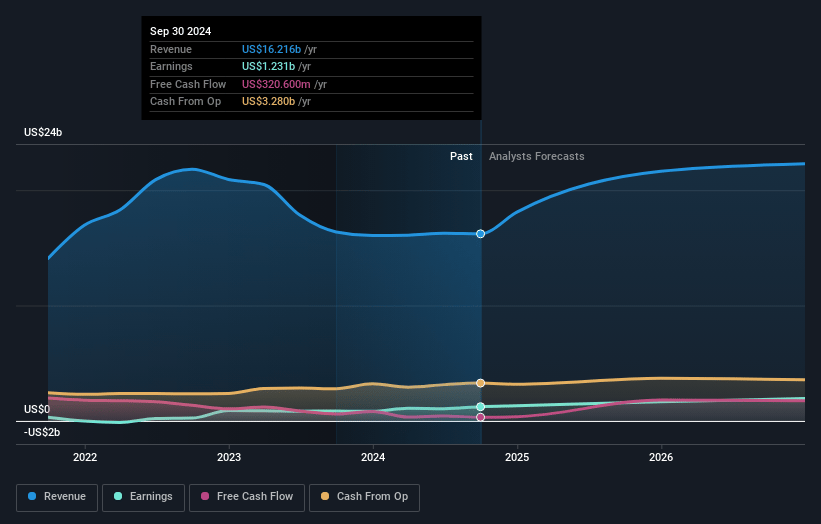

Targa Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Targa Resources's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.6% today to 11.2% in 3 years time.

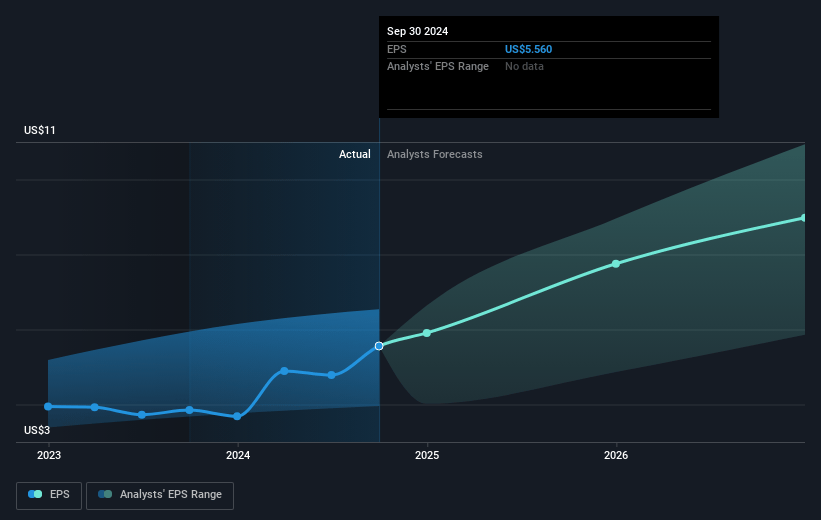

- Analysts expect earnings to reach $2.1 billion (and earnings per share of $10.46) by about November 2027, up from $1.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.2x on those 2027 earnings, down from 36.1x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to decline by 2.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.7%, as per the Simply Wall St company report.

Targa Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Targa Resources has accelerated growth capital spending, reaching over $2.7 billion in 2024, which could put pressure on free cash flow and impact future profitability.

- Increased permian volume forecast leads to higher infrastructure demands, necessitating further capital outlays which may slow cash generation and affect net margins.

- Competition in the LPG export market with additional capacity from other companies might compress profit margins and affect earnings from this segment.

- Exposure to commodity price variations remains, despite mitigating strategies, which could lead to revenue volatility in a downturn.

- Potential cash tax liabilities beginning in 2026 might reduce net income and cash available for other uses, impacting future financial flexibility and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $194.6 for Targa Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $246.0, and the most bearish reporting a price target of just $135.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $18.7 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 23.2x, assuming you use a discount rate of 7.7%.

- Given the current share price of $203.57, the analyst's price target of $194.6 is 4.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives