Narratives are currently in beta

Key Takeaways

- Integration of new assets and joint ventures is expected to enhance margins, earnings, and revenue in a resilient manner.

- Strategic focus on profit optimization and shareholder returns is projected to boost revenue, earnings growth, and value creation.

- Sunoco faces profitability risks from fluctuating demand, operational disruptions, competitive pressures, regulatory uncertainties, and reliance on successful integration of acquisitions.

Catalysts

About Sunoco- Distributes and retails motor fuels in the United States.

- The integration of NuStar assets is expected to deliver $125 million in synergies by 2025 and $200 million by 2026, in addition to the $60 million already achieved. This is likely to enhance net margins and earnings.

- The joint venture with Energy Transfer in the Permian Basin is anticipated to drive additional growth and offer a more resilient performance in varying market conditions, potentially boosting earnings and revenue.

- Increased seasonal demand and completion of refinery maintenance activities are projected to strengthen performance in the Pipeline Systems segment in the fourth quarter, supporting revenue and margin growth.

- Development and successful execution of fuel profit optimization strategies, focusing on total profit rather than just margin or volume, are expected to continue driving revenue and earnings growth.

- Anticipated distribution increases in early next year and maintaining strong coverage and leverage ratios signal a focus on returning value to unitholders, potentially enhancing earnings per share.

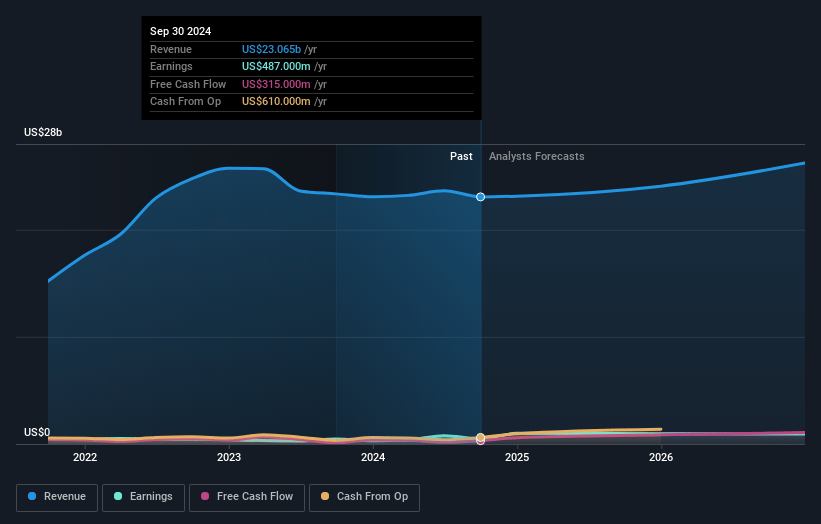

Sunoco Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sunoco's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.4% today to 4.1% in 3 years time.

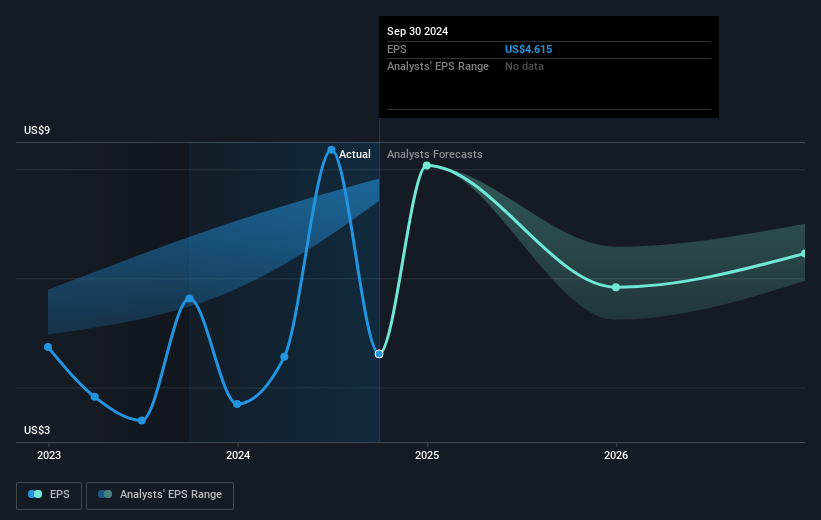

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $6.74) by about November 2027, up from $544.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.2x on those 2027 earnings, down from 12.9x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to grow by 6.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.53%, as per the Simply Wall St company report.

Sunoco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sunoco's revenues are subject to the broader macroeconomic environment and demand for refined products, which may fluctuate and impact profitability, especially if the demand for gasoline and diesel weakens. This could impact both revenue and net margins.

- Extended maintenance activity at refineries connected to Sunoco’s pipelines in certain regions led to decreased volumes in the third quarter, suggesting potential risks to revenue from operational disruptions.

- Competition and regulatory challenges, particularly in regions like California, present risks that could affect volumes and profitability of the legacy NuStar assets, influencing earnings negatively.

- Dependence on closing significant synergies and integration successes from major acquisitions, such as NuStar, presents execution risks that could affect net margins and profitability if expectations are not met.

- Regulatory and political uncertainties, such as the outcomes of FERC decisions and industry-wide legislation, could have varying impacts on pipeline rates and operational costs, affecting earnings stability and financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $62.88 for Sunoco based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $27.1 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 9.5%.

- Given the current share price of $51.47, the analyst's price target of $62.88 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives