Key Takeaways

- Low-cost operations and advanced technologies position Permian Resources for strong margins, robust free cash flow, and resilience, even amid commodity market volatility.

- Strategic M&A, disciplined capital allocation, and growing dividends drive sustained growth, financial strength, and enhanced shareholder returns.

- High reliance on Delaware Basin operations, ongoing drilling, and exposure to regulatory and environmental risks threaten revenue stability, inventory quality, and long-term profitability.

Catalysts

About Permian Resources- An independent oil and natural gas company, focuses on the development of crude oil and associated liquids-rich natural gas reserves in the United States.

- The persistence of global oil and gas demand—particularly from emerging markets—continues to create a structurally robust pricing environment, and Permian Resources’ low-cost Delaware Basin position allows for outsized free cash flow and revenue upside as commodity prices rise.

- Continued geopolitical instability globally has made North American suppliers more strategic and reliable, positioning Permian Resources as a preferred supplier to global energy markets and likely leading to improved realized prices and increased revenue resilience.

- Permian Resources’ industry-leading capital and operating efficiency, driven by advanced drilling technologies and a highly contiguous acreage footprint, is expected to compress costs further and expand net margins, supporting higher EBITDA and free cash flow per share growth even in flat or modestly lower commodity price scenarios.

- Accretive, ongoing M&A and agile grassroots leasing provide a proven pathway to replenish and expand high-return drilling inventory, supporting sustained multi-year production and earnings growth, while simultaneously applying Permian’s cost structure to acquired assets for immediate margin expansion.

- Strengthening balance sheet fundamentals—the pathway to investment grade status, disciplined capital allocation, and a growing base dividend—enhance financial flexibility, support lower risk, and enable robust shareholder returns through both dividend growth and opportunistic share repurchases, directly contributing to higher per-share earnings and valuation potential.

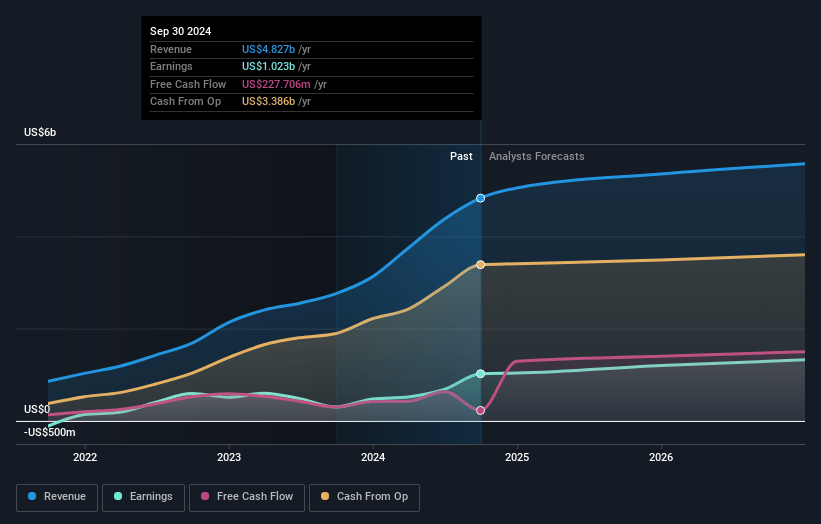

Permian Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Permian Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Permian Resources's revenue will grow by 6.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 19.7% today to 23.9% in 3 years time.

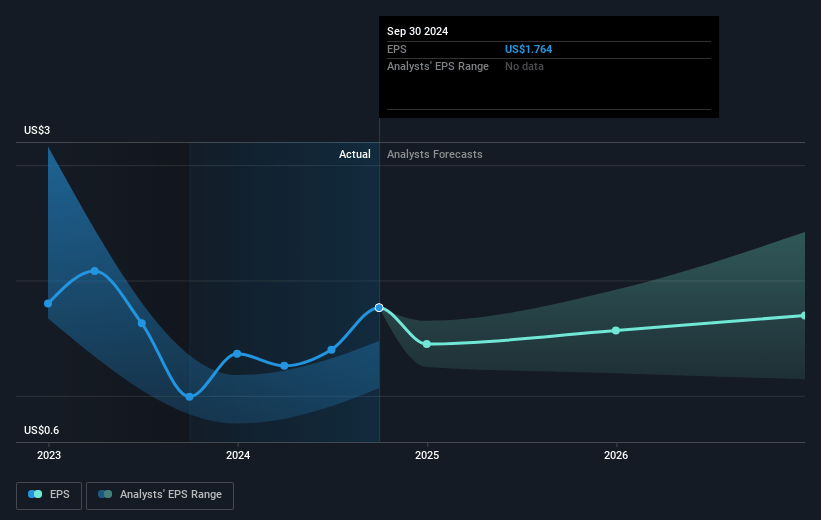

- The bullish analysts expect earnings to reach $1.4 billion (and earnings per share of $1.92) by about April 2028, up from $984.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, up from 8.4x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.32%, as per the Simply Wall St company report.

Permian Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Long-term secular global decarbonization efforts could drive persistent reductions in oil demand and pricing, potentially undermining Permian Resources’ ability to maintain or increase revenues and compressing net margins even if the company maintains operational efficiency.

- The company’s high concentration in the Delaware Basin and minimal diversification leaves it exposed to basin-specific risks, such as localized regulatory changes, infrastructure bottlenecks, or commodity price dislocations, which could create volatility in revenues and margins.

- Sustained growth depends on the company’s ability to continually replenish high-quality drilling inventory via acquisitions or grassroots leasing, but over time, as Tier 1 acreage is drilled, inventory quality may degrade, leading to lower well productivity and declining earnings growth prospects.

- The business model’s reliance on continuous drilling and capital spending to offset rapid shale decline rates may require higher capital expenditures over time, particularly if well productivity or cost efficiency plateaus, straining free cash flow and impacting shareholder returns.

- Increasing regulatory scrutiny around fracking, water usage, and environmental impacts may lead to higher compliance costs and operational constraints, raising operating expenses and reducing future profitability, particularly in a world more sensitive to ESG performance and carbon intensity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Permian Resources is $22.88, which represents two standard deviations above the consensus price target of $17.9. This valuation is based on what can be assumed as the expectations of Permian Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $6.0 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 7.3%.

- Given the current share price of $11.86, the bullish analyst price target of $22.88 is 48.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:PR. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.