Key Takeaways

- Transitioning to a specialty rental and services business is expected to improve profitability through higher margins and focused site access solutions.

- Optimizing overhead and reducing legacy costs could enhance net margins and position the company for robust revenue growth and increased investor interest.

- Shifts in energy priorities and unpredictable project timelines could challenge Newpark's growth, with revenue impacted by maintenance events, weather dependency, and capital allocation pressures.

Catalysts

About Newpark Resources- Provides products, rentals, and services primarily to the oil and natural gas exploration and production (E&P) industry.

- Newpark Resources is focusing on transforming from an oilfield services company to a vertically integrated specialty rental and services business, which is expected to lead to higher margins and profitability, positively impacting earnings as they focus on site access solutions.

- By optimizing their overhead structure and eliminating legacy costs from the Fluids divestiture, Newpark anticipates achieving $5 million in cost savings by 2026, which will reduce SG&A as a percentage of revenue, enhancing net margins.

- The strong rebound in rental volume in late September and October, including record rental volume in October, positions the company for strong revenue growth in Q4 2024 and into 2025.

- With significant liquidity approaching $100 million, along with a targeted share repurchase program, Newpark is well-positioned to execute a capital allocation strategy that includes organic investment and shareholder returns, which will positively impact EPS.

- Potential reclassification by the NYSE to a new industry category post-rebranding could attract a new investor base that recognizes its strategic focus on critical infrastructure markets, potentially boosting the company's stock value and overall market perception.

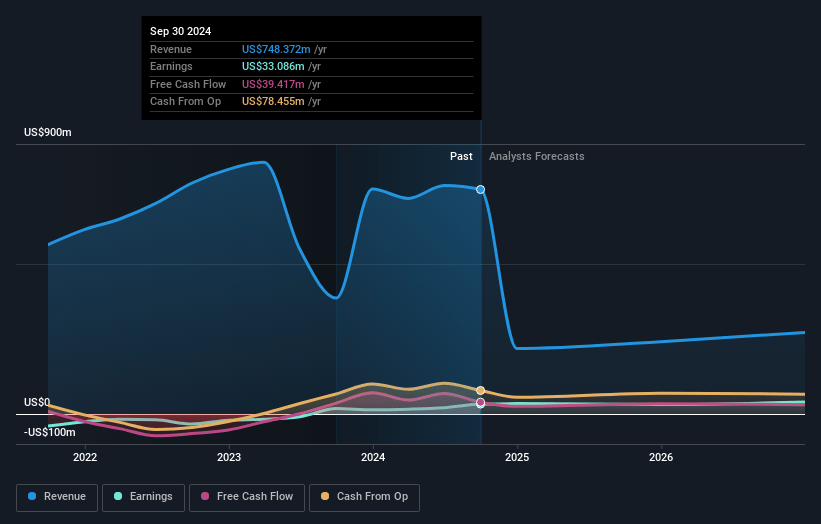

Newpark Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NPK International's revenue will decrease by -42.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 28.7% in 3 years time.

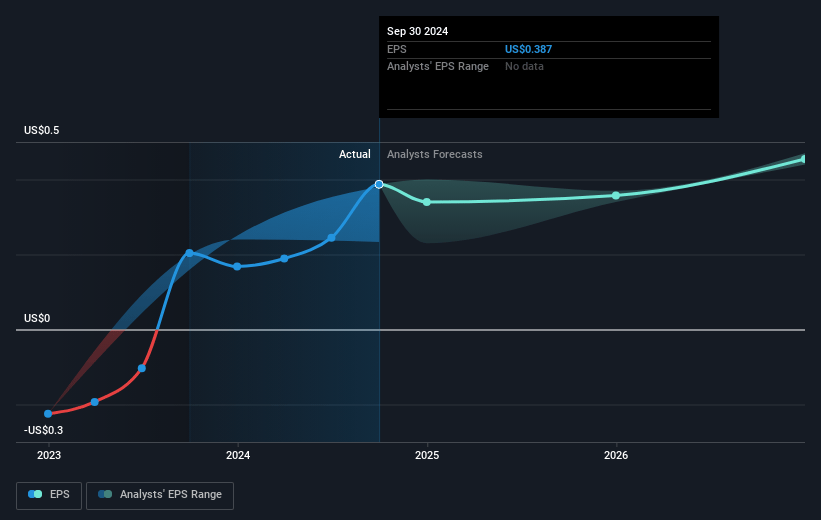

- Analysts expect earnings to reach $40.2 million (and earnings per share of $0.46) by about December 2027, up from $33.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.5x on those 2027 earnings, up from 19.9x today. This future PE is greater than the current PE for the US Energy Services industry at 15.6x.

- Analysts expect the number of shares outstanding to grow by 0.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.74%, as per the Simply Wall St company report.

Newpark Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift in customer priorities from transmission to renewable generation projects and unpredictable project timelines can impact revenue predictability and growth.

- Unplanned maintenance events and facility downtime, such as those that occurred at the Louisiana manufacturing facility, can negatively affect operating income due to unabsorbed fixed costs and additional maintenance expenses.

- Dependency on favorable weather conditions and seasonal demand trends introduces uncertainty in revenue generation, particularly for matting rentals, which could affect overall earnings.

- Changes in political landscapes and potential policy shifts might influence market demand for renewable versus traditional energy projects, impacting Newpark's revenue distribution.

- The company's capital allocation strategy, which involves significant investment in rental fleet expansion and potential acquisitions, might strain cash reserves and affect net margins if projected growth in rental demand does not materialize.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.25 for NPK International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $140.0 million, earnings will come to $40.2 million, and it would be trading on a PE ratio of 30.5x, assuming you use a discount rate of 7.7%.

- Given the current share price of $7.62, the analyst's price target of $11.25 is 32.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

Consensus Narrative from 3 Analysts

Investment In Sales Force And Expansion Into Key Regions Will Strengthen Future Market Position

Key Takeaways Strategic shift to high-margin site access solutions aims to improve profitability and net margins, focusing on a more profitable business model. Selling Fluids business and optimizing costs are expected to boost earnings and efficiency, supporting organic growth and market position.

View narrativeUS$11.33

FV

50.2% undervalued intrinsic discount-42.07%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

0users have followed this narrative

10 days ago author updated this narrative