Narratives are currently in beta

Key Takeaways

- Acquisition of KCA Deutag bolsters global presence and diversifies revenue, enhancing Helmerich & Payne's international growth potential.

- Emphasis on customer-centric strategies and digital adoption drives U.S. market share growth and operational efficiency, boosting profitability.

- Integration challenges and market dynamics could affect revenue, earnings stability, and cash flow, while dividend maintenance may be pressured by leverage reduction needs post-acquisition.

Catalysts

About Helmerich & Payne- Provides drilling services and solutions for exploration and production companies.

- Helmerich & Payne's acquisition of KCA Deutag is expected to transform the company into a global drilling leader, enhancing its presence in the Middle East and expanding its international footprint. This could lead to increased revenue and diversification of cash flow sources.

- The company's strategic focus on customer-centric approaches and performance-based contracts is driving market share gains in the U.S., which could lead to sustained revenue growth and improved margins by delivering value and efficiency to customers.

- Helmerich & Payne's expansion in Saudi Arabia, with the deployment of FlexRigs in unconventional fields, is expected to strengthen its International Solutions segment, potentially boosting revenues and long-term growth prospects.

- The company's emphasis on digital technology adoption and automation could lead to efficiency improvements and cost reductions, possibly enhancing net margins and profitability.

- Reduction in capital expenditures for fiscal 2025 by $190 million, alongside strategic deleveraging and maintaining dividend commitments, suggests improved free cash flow generation and financial stability, positively impacting earnings.

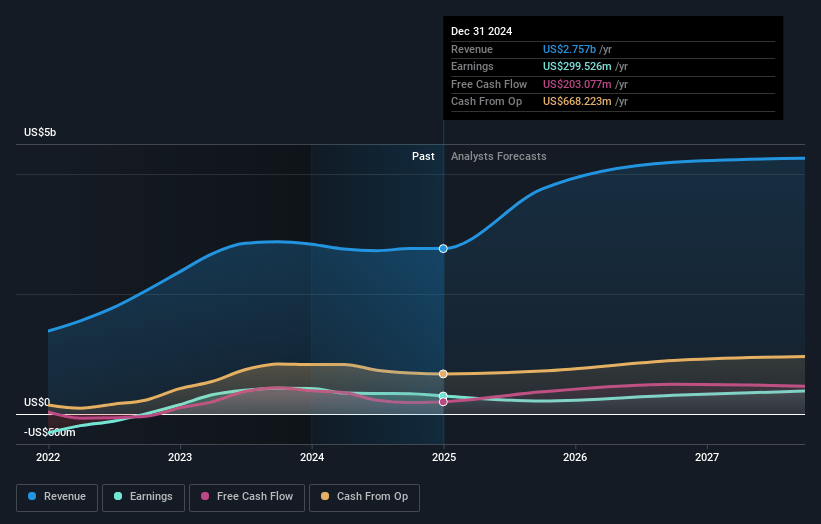

Helmerich & Payne Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Helmerich & Payne's revenue will grow by 8.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.3% today to 9.7% in 3 years time.

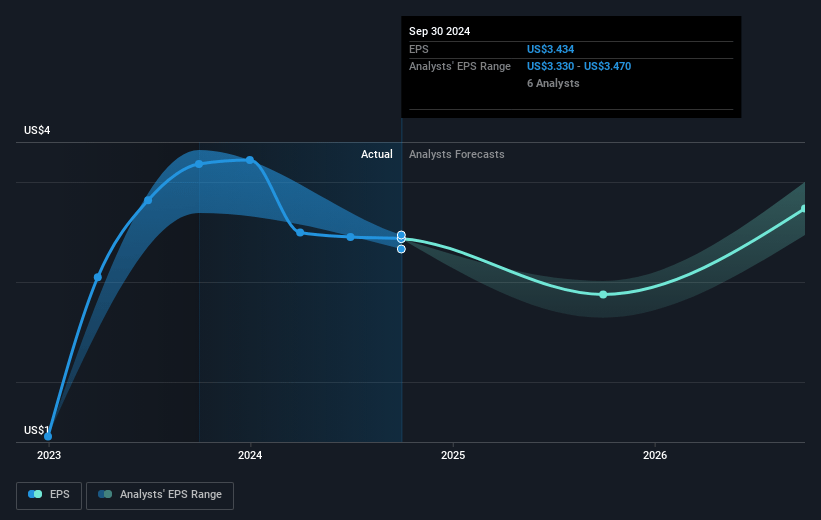

- Analysts expect earnings to reach $337.9 million (and earnings per share of $3.58) by about November 2027, down from $339.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.9x on those 2027 earnings, up from 9.7x today. This future PE is lower than the current PE for the US Energy Services industry at 16.6x.

- Analysts expect the number of shares outstanding to decline by 1.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.3%, as per the Simply Wall St company report.

Helmerich & Payne Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential suspension of rigs in the Saudi Arabian market, specifically mentioning contract suspensions of up to 12 months for some KCA Deutag rigs, could impact the company's revenue and cash flow negatively.

- The choppy U.S. rig count driven by factors such as customer consolidation and low natural gas prices, leading to projections of flat rig counts going forward, may constrain growth in North American revenues and margins.

- The company's ability to maintain its peer-leading base dividend may be challenged by the need to significantly reduce leverage following the acquisition of KCA Deutag, possibly impacting available free cash flow.

- Expected challenges in the KCA Deutag acquisition integration, amidst regulatory scrutiny and industry cyclicality in international markets, could affect earnings stability and operational efficiency in the short to medium term.

- Commodity price volatility remains a risk, as shifts in natural gas prices can negatively affect rig demand, further impacting revenue projections and profit margins across North American operations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $41.0 for Helmerich & Payne based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $33.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.5 billion, earnings will come to $337.9 million, and it would be trading on a PE ratio of 14.9x, assuming you use a discount rate of 9.3%.

- Given the current share price of $33.4, the analyst's price target of $41.0 is 18.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives