Key Takeaways

- Elevated global energy demand and underinvestment in oil infrastructure position Halliburton for stable, long-term revenue growth through high-margin projects and robust contract backlogs.

- Strategic international expansion and advanced technology adoption drive higher operating margins, enhanced cash flow generation, and increasing shareholder returns.

- Reliance on traditional oilfield services, rising ESG pressures, and lack of diversification threaten Halliburton’s long-term profitability and sustainability amid the global energy transition.

Catalysts

About Halliburton- Provides products and services to the energy industry worldwide.

- The ongoing underinvestment in global oil and gas infrastructure is expected to drive a supply and demand imbalance, supporting elevated commodity prices and increasing upstream capital expenditures. This trend directly benefits Halliburton by expanding its opportunity set for high-margin projects, which is poised to accelerate revenue and earnings growth as industry CAPEX cycles turn up.

- Rapid global energy demand growth, fueled by population expansion and urbanization, is likely to result in structurally elevated oil and gas consumption for decades. Halliburton, already securing multi-year, integrated offshore contracts with major producers, stands to benefit from long-term project backlogs and recurring revenues that enhance top-line stability and visibility.

- Halliburton’s strategic investments in advanced digitalization, automation, and AI-enabled oilfield technologies—such as ZEUS IQ and remote drilling systems—are unlocking significant productivity gains for customers. These efficiency improvements are expected to drive higher operating margins and support net margin expansion as more premium services are adopted across its international and North America portfolios.

- Expansion into international growth engines—particularly in unconventional oil and gas, artificial lift, and offshore interventions—is accelerating, as evidenced by recent major contract wins in regions like Brazil, Suriname, West Africa, the Middle East, and Norway. This international growth trajectory supports above-industry-average revenue growth and a higher earnings base, partially derisking geographic exposure and dampening margin volatility.

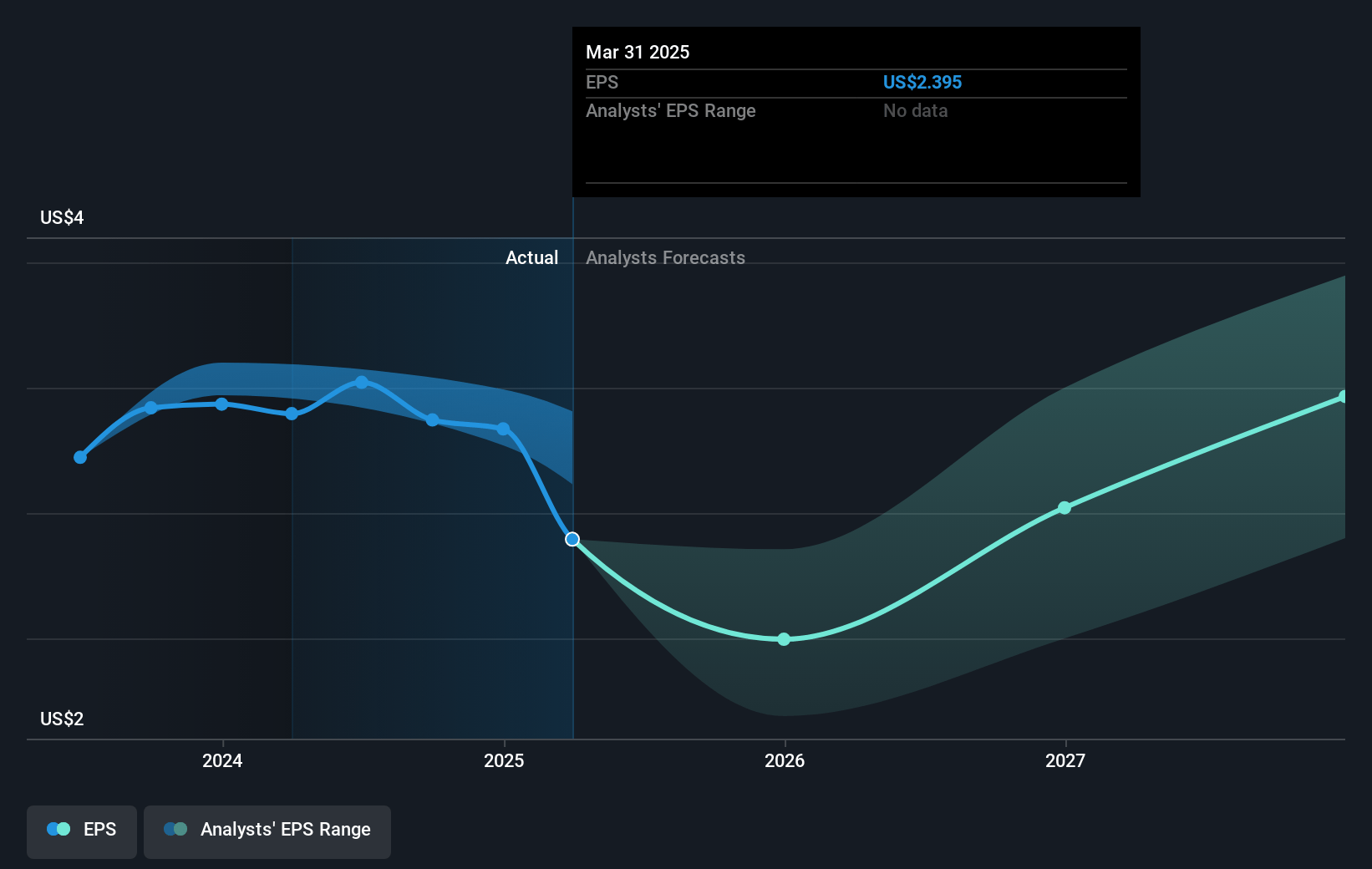

- Halliburton’s continued focus on capital discipline, an asset-light operating strategy, and a commitment to shareholder returns through buybacks and dividends is projected to grow free cash flow generation. This improved cash conversion profile is paving the way for ongoing dividend growth and further share repurchases, supporting long-term earnings per share expansion and potentially higher stock multiples.

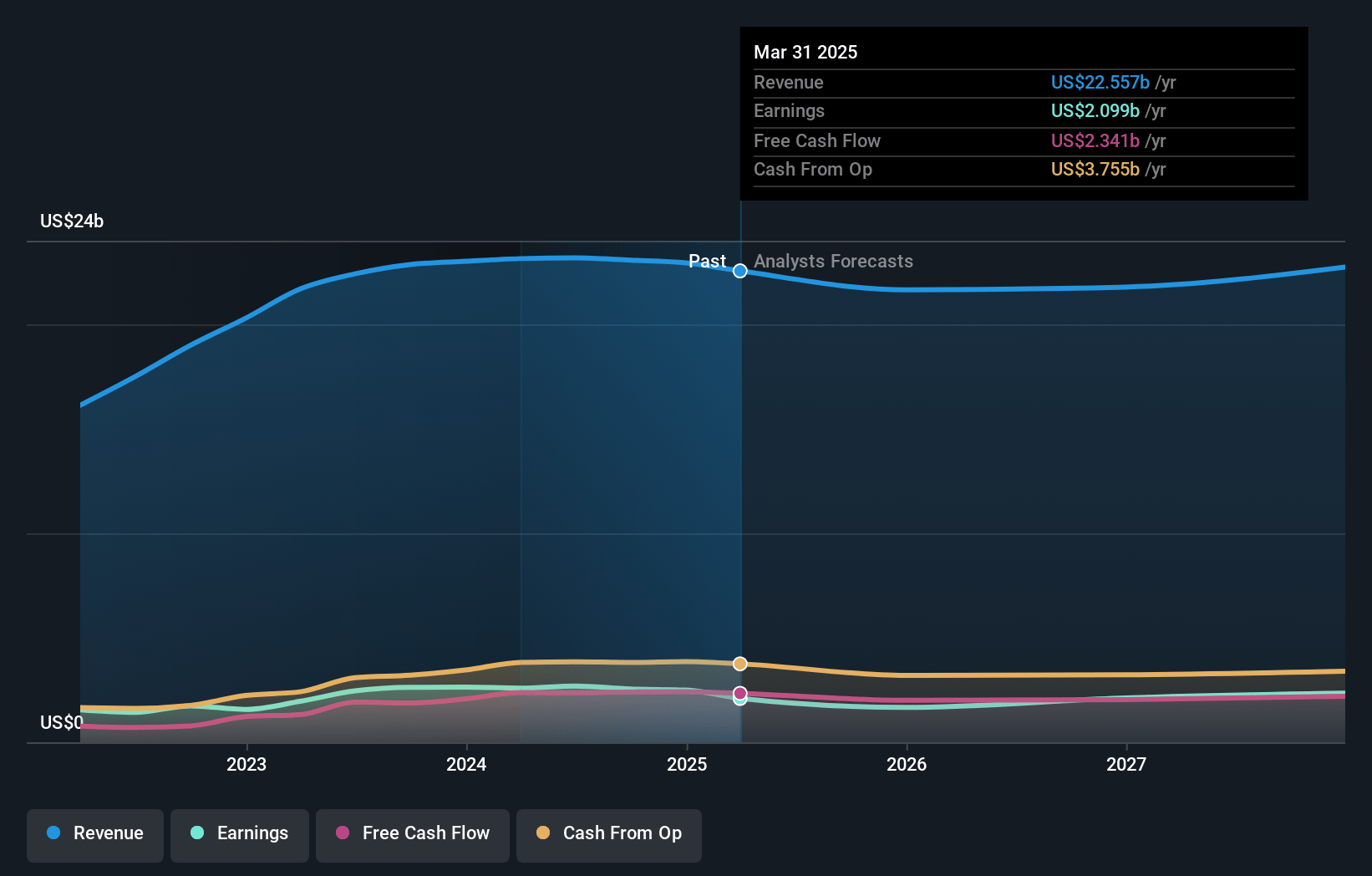

Halliburton Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Halliburton compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Halliburton's revenue will grow by 3.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.3% today to 10.8% in 3 years time.

- The bullish analysts expect earnings to reach $2.7 billion (and earnings per share of $3.45) by about May 2028, up from $2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, up from 8.0x today. This future PE is greater than the current PE for the US Energy Services industry at 10.6x.

- Analysts expect the number of shares outstanding to decline by 2.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.78%, as per the Simply Wall St company report.

Halliburton Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global transition away from fossil fuels toward renewables, coupled with increased decarbonization efforts by governments and investors, poses a structural threat to Halliburton’s long-term addressable market, risking sustained declines in future revenue and cash flows.

- Heightened environmental and ESG scrutiny on oilfield service providers like Halliburton is likely to increase compliance costs and could limit access to capital, putting pressure on net margins over time.

- Halliburton’s heavy dependence on upstream oil and gas exploration and drilling subjects its revenues and earnings to the cyclical nature of commodity prices and industry downturns, as evidenced by recent declines in both North America and Mexico.

- Intense competition and ongoing commoditization in oilfield services, particularly in North America, are likely to erode Halliburton’s pricing power and squeeze net margins, even as it invests in technology like the ZEUS platform.

- Persistent underinvestment in diversification beyond traditional oilfield services, along with exposure to legacy environmental liabilities and associated impairment charges, will negatively impact the company’s long-term cost structure and limit the sustainability of earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Halliburton is $36.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Halliburton's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $36.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $24.9 billion, earnings will come to $2.7 billion, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 7.8%.

- Given the current share price of $19.44, the bullish analyst price target of $36.0 is 46.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.