Narratives are currently in beta

Key Takeaways

- Strategic investments in international markets and new technologies are set to drive revenue growth and increase margins in North America and offshore segments.

- Focused capital allocation and a share buyback program reflect confidence in earnings growth and improved free cash flow, boosting shareholder value.

- Operational risks from cybersecurity events, project delays, and competition pressures could impact Halliburton's revenue, margins, and future earnings stability.

Catalysts

About Halliburton- Provides products and services to the energy industry worldwide.

- Halliburton's significant investment in emerging international markets, especially in unconventional developments, artificial lift, and intervention services, is expected to drive future revenue growth as these technologies demonstrate increased market share and profitability internationally.

- The company's advanced technological solutions, such as the Zeus platform and new drilling technologies, are positioned to enhance operational efficiencies and improve recovery rates. This is likely to increase Halliburton's completions business margins and create a demand-driven growth in North America.

- Expansion in international offshore opportunities, with a focus on well intervention and new alliances, positions Halliburton for above-market growth, potentially enhancing revenue and net margins as these strategic technologies are adopted at scale.

- Focused capital allocation towards high-return opportunities such as electric fracturing fleets and drilling services technology improvements, while ensuring steady capital discipline, is projected to boost earnings and free cash flow generation.

- Halliburton's strategic share buyback program indicates management's confidence in the company’s stock valuation, further supported by expectations of sustained free cash flow improvements, which should drive meaningful earnings per share growth in the coming quarters.

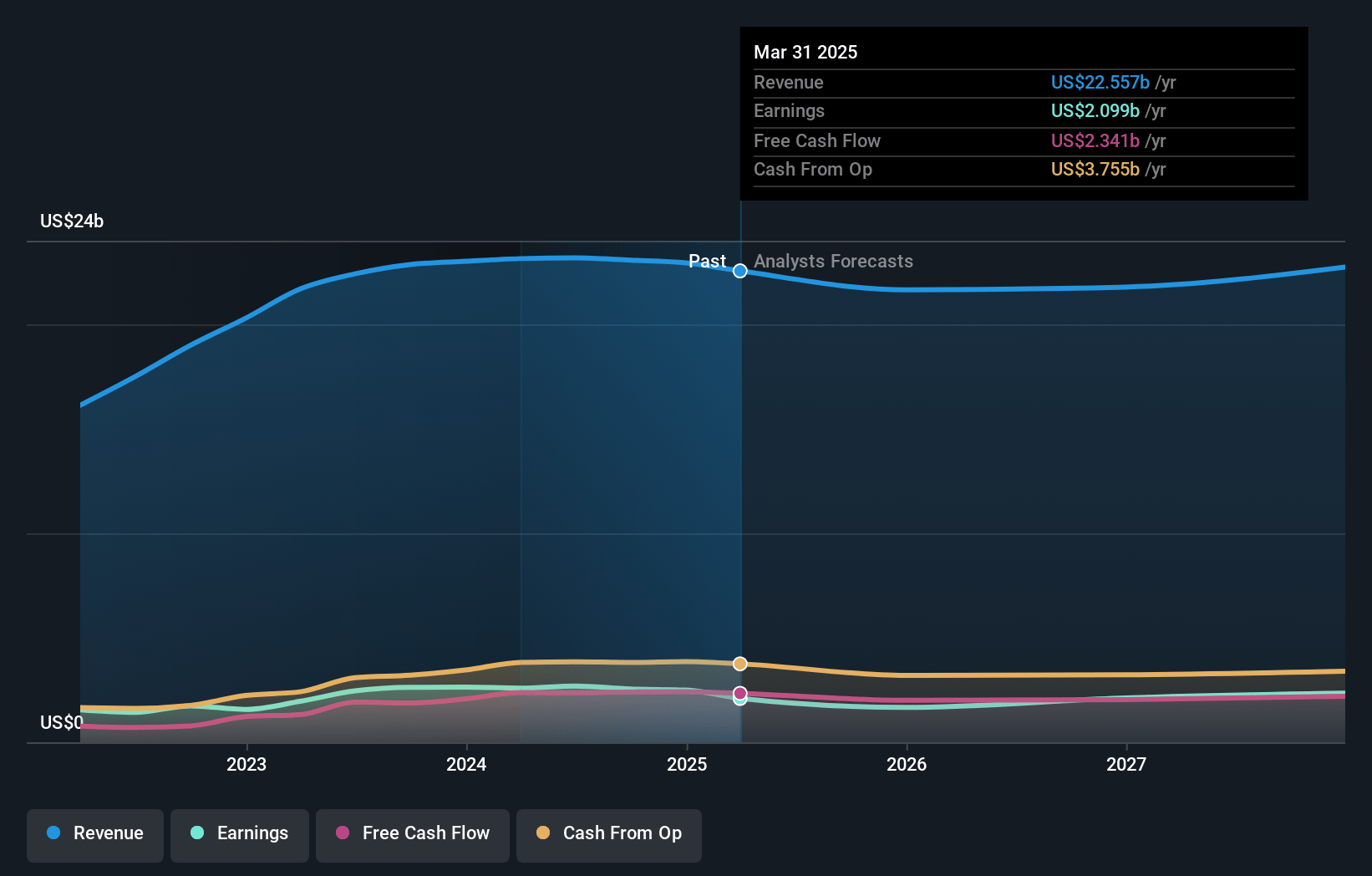

Halliburton Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Halliburton's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.0% today to 12.6% in 3 years time.

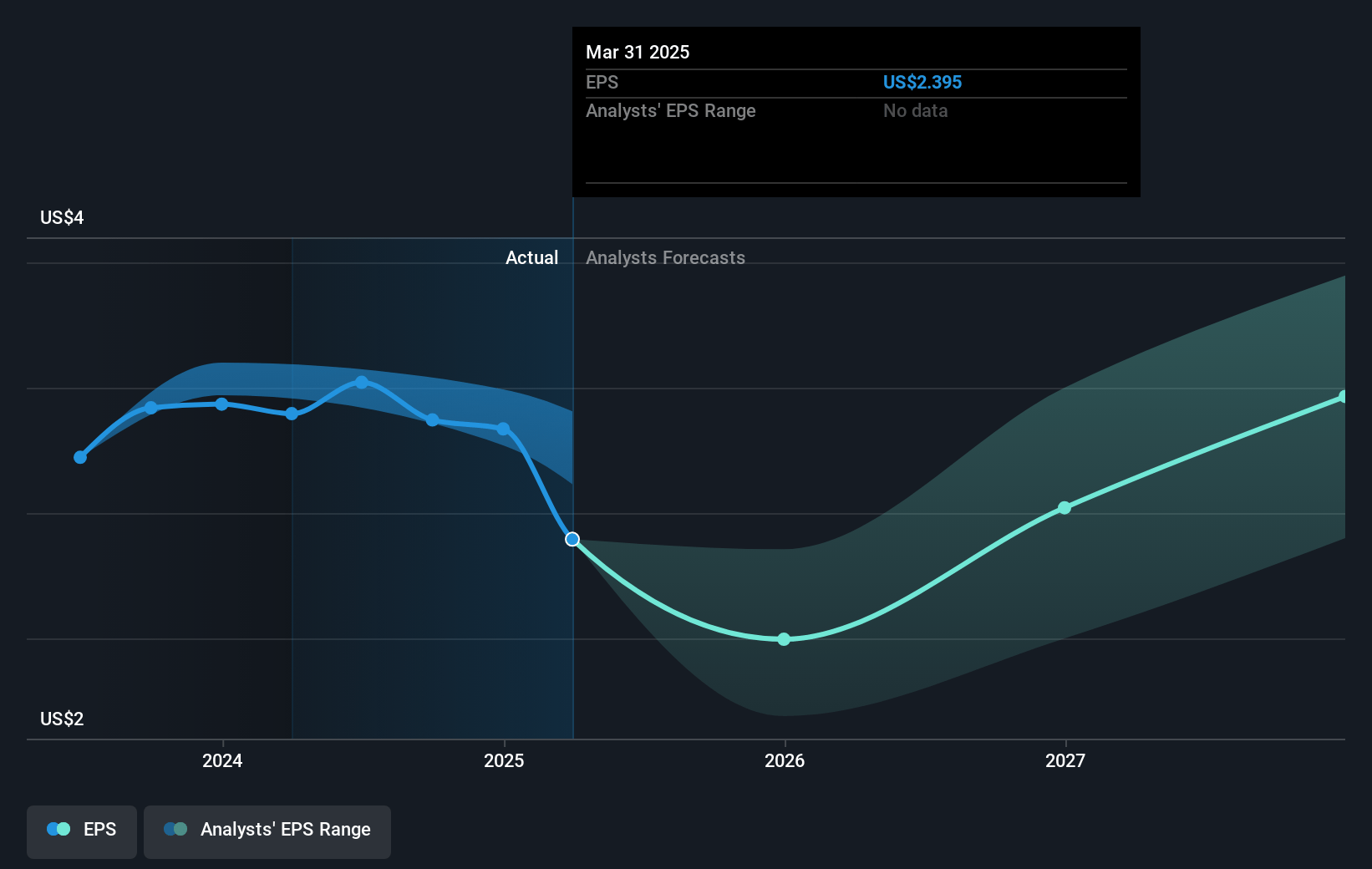

- Analysts expect earnings to reach $3.1 billion (and earnings per share of $3.73) by about November 2027, up from $2.5 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $3.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.4x on those 2027 earnings, up from 10.4x today. This future PE is lower than the current PE for the US Energy Services industry at 16.5x.

- Analysts expect the number of shares outstanding to decline by 1.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.66%, as per the Simply Wall St company report.

Halliburton Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The August cybersecurity event, although claimed to not have materially affected financial conditions, did lead to reduced earnings per share and disrupted cash flow owing to delayed billing and collections, thus presenting a risk to future earnings disruption from similar events.

- North American revenue faced a year-over-year decline of 9%; with expectations of full-year revenue decline due to seasonality and budget exhaustion, which could adversely affect revenue generation if these trends continue or exacerbate.

- Project delays in the North Sea and greater-than-anticipated rig count reductions in the Middle East, two of Halliburton's largest well-construction markets, suggest a risk to timely revenue and margin realization due to external factors beyond company control.

- Despite growth in certain regions, competition from new technologies and methods leading to greater efficiency (e.g., using fewer frac fleets for the same output) could compress margins and reduce revenue if Halliburton cannot capitalize on its technology investments.

- The cost overruns and delays in the SAP ERP system rollout, partly due to the cybersecurity issues, introduce operational risks and potential increased costs, which could impact net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $39.01 for Halliburton based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $35.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $24.9 billion, earnings will come to $3.1 billion, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 8.7%.

- Given the current share price of $30.19, the analyst's price target of $39.01 is 22.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives