Key Takeaways

- Acquisition in Vaca Muerta and new exploration pads enhance reserves and production, boosting revenue and future earnings potential.

- Focus on advanced flooding techniques aims to improve productivity and net margins, enhancing revenue and cash flow.

- Declines in production, regulatory delays, and rising operational costs could hurt GeoPark's revenue and introduce uncertainty in earnings forecasts amidst heavy M&A reliance.

Catalysts

About GeoPark- Operates as an oil and natural gas exploration and production company primarily in Chile, Colombia, Brazil, Argentina, Ecuador, and other Latin American countries.

- The acquisition in Vaca Muerta has significantly extended GeoPark's reserves life, with newly acquired assets boosting production by nearly 50% since the transaction announcement. This is expected to enhance future revenue growth.

- The company has completed its first exploration pad in the Confluencia block, which could unlock approximately 90 million barrels of contingent resources, potentially increasing future earnings.

- GeoPark plans to drill a second exploration pad in the Confluencia Sur block by the second half of 2025, which can further increase production, potentially boosting future revenues and earnings.

- A focus on optimizing water flooding and polymer flooding projects in the Llanos 34 Block in Colombia is aimed at enhancing field productivity, which may improve net margins and increase revenue.

- The introduction of a second drilling rig in Vaca Muerta by early 2026 aims to reach a gross production plateau of 40,000 barrels a day, significantly enhancing production capacity and potentially increasing future revenue and cash flow.

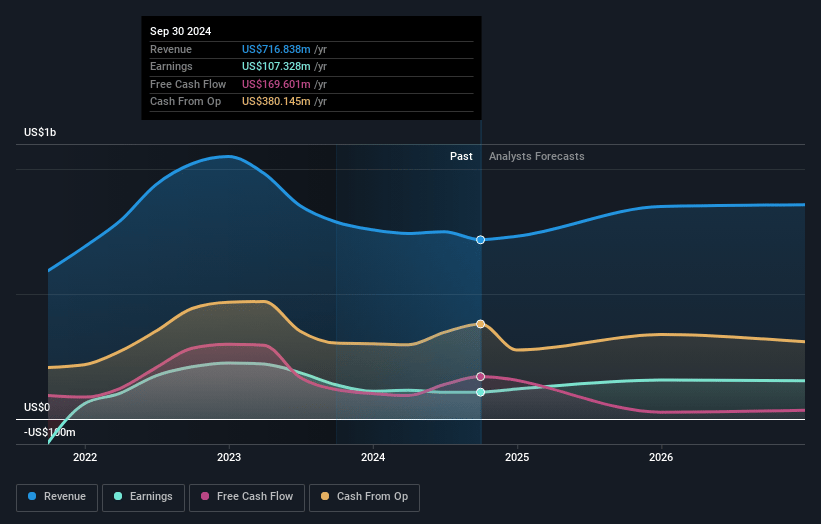

GeoPark Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GeoPark's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.6% today to 10.0% in 3 years time.

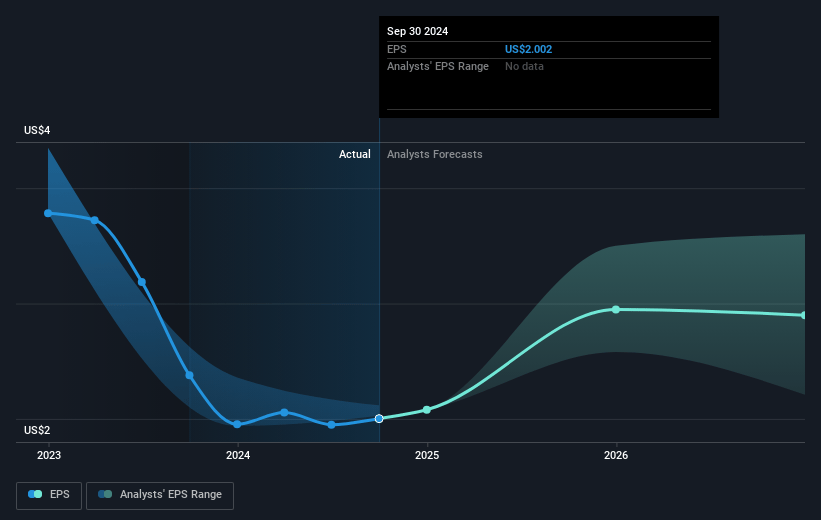

- Analysts expect earnings to reach $77.3 million (and earnings per share of $1.52) by about April 2028, down from $96.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.2x on those 2028 earnings, up from 3.5x today. This future PE is lower than the current PE for the US Oil and Gas industry at 11.4x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.65%, as per the Simply Wall St company report.

GeoPark Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in GeoPark's total oil and gas production by 7% from 2023 due to temporary disruptions and natural decline in Colombian fields could negatively impact its revenues and earnings.

- The delay in regulatory approval for the Vaca Muerta acquisition means the production volumes and financials are not yet reflected in the consolidated figures, which could affect short-term revenue and earnings forecasts.

- The decrease in adjusted EBITDA by 8% and net income by $13 million compared to 2023 suggests challenges in maintaining profit margins and revenue amidst lower production and increased financial expenses.

- Challenges like well cost pressures and the parent-child effect in the Vaca Muerta basin could increase operational costs, impacting net margins and overall profitability.

- The company's heavy reliance on M&A for growth, alongside the risk of not receiving timely regulatory clearance for transactions like the one in Argentina, can introduce uncertainty in revenue and earnings projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.2 for GeoPark based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $770.7 million, earnings will come to $77.3 million, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 9.6%.

- Given the current share price of $6.53, the analyst price target of $13.2 is 50.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.