Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and collaborations enhance revenue growth potential by expanding asset bases, optimizing real estate, and introducing new service offerings.

- Favorable market conditions and industry engagement boost fuel margins and suggest improved future earnings and shareholder value.

- Increasing interest expenses and high acquisition valuations could pressure net margins and profitability despite cautious EV strategy and rising operating costs.

Catalysts

About Global Partners- Engages in the purchasing, selling, gathering, blending, storing, and logistics of transporting gasoline and gasoline blendstocks, distillates, residual oil, renewable fuels, crude oil, and propane to wholesalers, retailers, and commercial customers.

- Global Partners' acquisition of liquid energy terminals from Motiva Enterprises and Gulf Oil enhances their asset base, providing a platform for strategic projects and expanded product offerings, which can drive increased revenue through improved operational efficiency and market reach.

- The acquisition of the 730-acre liquid energy terminal in East Providence offers potential for diversification and strategic real estate expansion, positively impacting future revenue and net margins by optimizing asset utilization.

- In collaboration with the Massachusetts Department of Transportation, Global Partners will deploy funds from the NEVI program to accelerate the installation of DC fast EV charging stations, potentially boosting revenue and margins through new service offerings and increased foot traffic at retail locations.

- Increased fuel margins in the Gasoline Distribution and Station Operations segment, due to favorable market conditions and strategic acquisitions, suggest potential for sustained or improved net margins and earnings in the future.

- The company's participation in high-profile energy and financial conferences could signal potential for strategic partnerships or investments, further fueling revenue growth and enhancing shareholder value through improved investor relations.

Global Partners Future Earnings and Revenue Growth

Assumptions

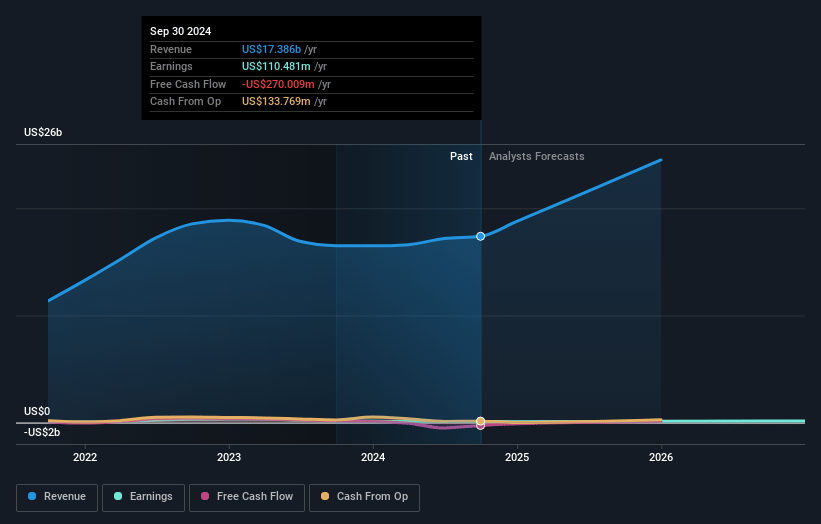

How have these above catalysts been quantified?- Analysts are assuming Global Partners's revenue will grow by 29.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 0.6% today to 0.5% in 3 years time.

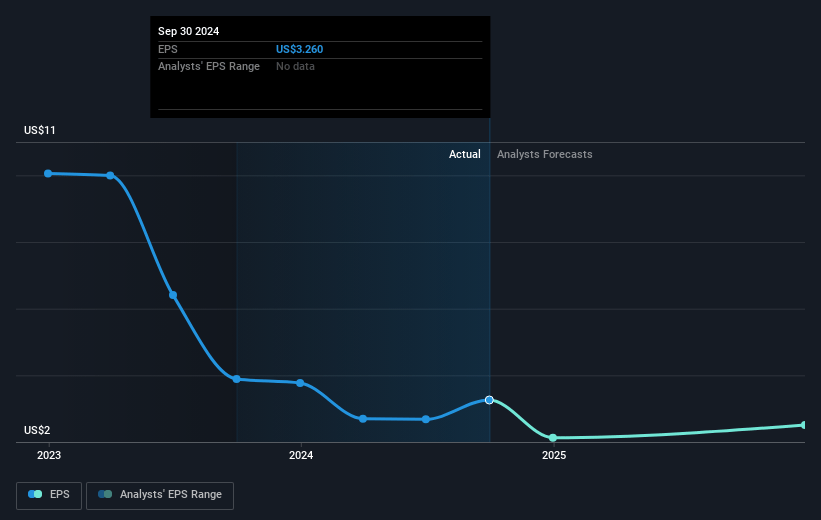

- Analysts expect earnings to reach $174.1 million (and earnings per share of $1.87) by about November 2027, up from $110.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.2x on those 2027 earnings, up from 14.9x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to grow by 39.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.77%, as per the Simply Wall St company report.

Global Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's financial projections and future performance are subject to a wide range of business risks and uncertainties, which could cause actual results to differ materially. (Revenue, earnings)

- The interest expense increased significantly due to the issuance of 8.25% senior notes and higher average balances on the credit facility resulting from recent acquisitions. This might affect net margins and profitability. (Net margins, earnings)

- The company's strategy involves continued acquisitions, but valuations remain relatively high, suggesting a risk in maintaining the strategy's accretive nature without overpaying. (Earnings)

- The deployment of EV charging stations is described as being in the early stages, with a cautious approach to financial risk, which could limit short-term growth potential in this segment. (Revenue, net margins)

- Increases in SG&A expenses, partially due to long-term incentive compensation and wages, may continue to place pressure on operating expenses, potentially affecting net margins. (Net margins)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.0 for Global Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $37.9 billion, earnings will come to $174.1 million, and it would be trading on a PE ratio of 38.2x, assuming you use a discount rate of 9.8%.

- Given the current share price of $48.61, the analyst's price target of $54.0 is 10.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives