Key Takeaways

- Strategic expansions and acquisitions bolster logistical operations, enhance capacity, and drive revenue growth amid a growing customer base.

- Stable cash flows and robust operations support continuous dividend increases, reflecting financial strength and positively affecting investor returns.

- Significant capital expenditures and rising interest expenses could pressure cash flow and profitability amid declining adjusted EBITDA and tariff-induced supply cost uncertainties.

Catalysts

About Global Partners- Engages in the purchasing, selling, gathering, blending, storing, and logistics of transporting gasoline and gasoline blendstocks, distillates, residual oil, renewable fuels, crude oil, and propane to wholesalers, retailers, and commercial customers.

- The integration of 30 new terminals across various regions, more than doubling storage capacity, is expected to increase Global Partners' ability to serve a growing customer base and drive revenue growth.

- A significant 25-year take-or-pay contract with Motiva Enterprises is anticipated to provide stable, long-term cash flow, positively impacting earnings.

- The strategic acquisition of a terminal in East Providence with infrastructure for long-range vessels enhances logistical capabilities, potentially improving operational efficiency and net margins.

- The expected implementation of tariffs on oil and gas imports creates uncertainty, but Global Partners' flexible source system allows them to adapt and optimize costs, potentially maintaining stable or increased net margins.

- Continuous dividend increases, supported by a strong balance sheet and cash flow, reflect financial robustness and may enhance investor returns, impacting overall earnings per share (EPS).

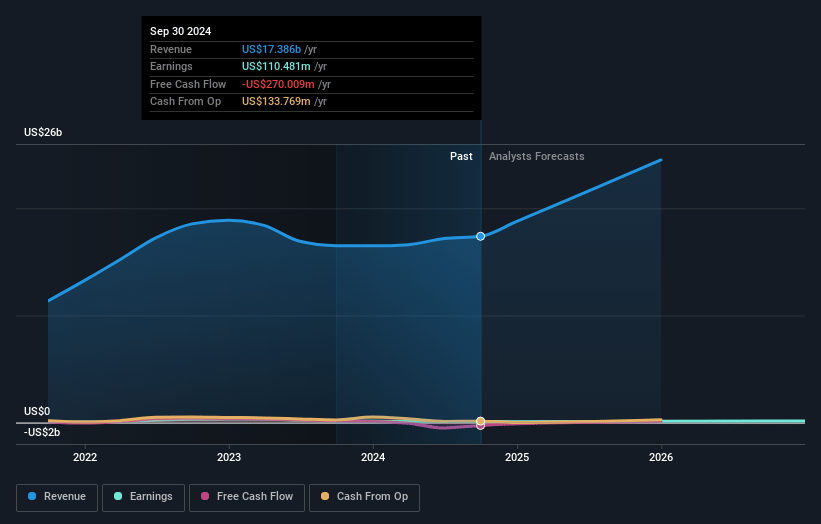

Global Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Global Partners's revenue will grow by 19.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 0.5% today to 0.3% in 3 years time.

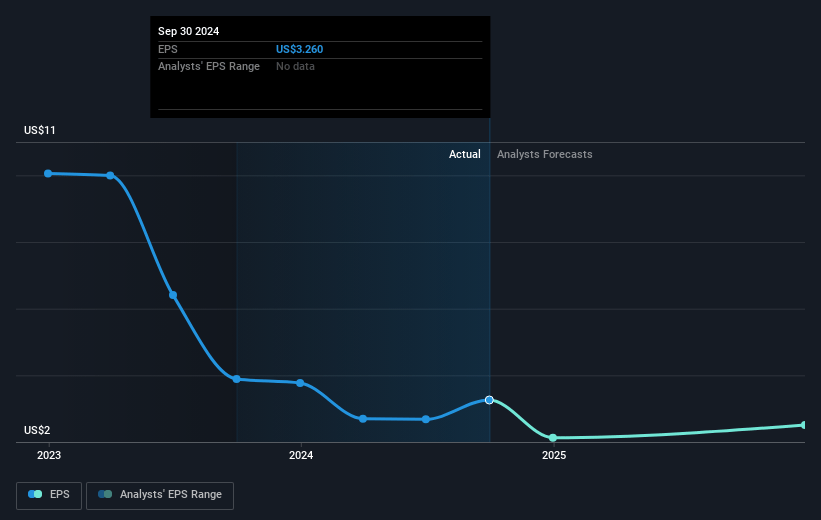

- Analysts expect earnings to reach $94.9 million (and earnings per share of $2.67) by about April 2028, up from $82.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.2x on those 2028 earnings, up from 20.7x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.4x.

- Analysts expect the number of shares outstanding to decline by 0.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.68%, as per the Simply Wall St company report.

Global Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is planning significant capital expenditures for the next year, with maintenance and expansion CapEx projections between $135 million and $155 million, which could pressure free cash flow if projects do not generate expected returns. [Financial Impact: Earnings/Free Cash Flow]

- Global Partners’ adjusted EBITDA and DCF figures for Q4 2024 decreased compared to the same period in 2023, which could signal declining profitability if these trends continue. [Financial Impact: Profitability]

- The implementation of tariffs on oil and gas imports, particularly from Canada and Europe, introduces uncertainty and could increase supply costs, potentially squeezing margins if cost increases cannot be passed on to consumers. [Financial Impact: Net Margins]

- Interest expenses have increased significantly, primarily due to recent acquisitions funded by debt, which could impact net income and financial leverage ratios if interest rates rise or cash flow does not meet expectations. [Financial Impact: Net Income/Leverage]

- Volatility in fuel prices has already led to a decrease in fuel margins in the GDSO segment, and continued price fluctuations could further impact the profitability of gasoline distribution and related retail operations. [Financial Impact: Revenue/Margins]

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $56.0 for Global Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $29.0 billion, earnings will come to $94.9 million, and it would be trading on a PE ratio of 24.2x, assuming you use a discount rate of 8.7%.

- Given the current share price of $50.81, the analyst price target of $56.0 is 9.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.