Key Takeaways

- Frontline's younger, ECO-compliant fleet is well-positioned to capitalize on increased demand from geopolitical developments, potentially boosting net margins via lower operational costs.

- With strong liquidity and no major debt maturity until later years, Frontline could enhance earnings and shareholder returns amidst geopolitical trade shifts.

- Geopolitical tensions and regulatory changes threaten global trade efficiency, impacting Frontline's revenue, operational costs, and fleet utilization amid an aging tanker fleet.

Catalysts

About Frontline- A shipping company, engages in the seaborne transportation of crude oil and oil products worldwide.

- Frontline expects its modern, spot-exposed fleet to capture increased demand for compliant tonnage, driven by geopolitical developments affecting trade patterns, which could enhance revenue opportunities.

- The aging global tanker fleet, with a significant portion over 15 to 20 years old, contrasted with Frontline's younger, ECO-compliant fleet, positions them well to take advantage of high-demand periods, potentially improving net margins due to lower operational costs.

- Frontline benefits from a robust balance sheet with strong liquidity and no major debt maturities until 2028, providing financial stability that could lead to increased earnings and potential shareholder returns.

- Anticipated inefficiencies in trade lanes due to geopolitical tensions and sanctions enforcement could result in longer voyages for compliant ships, potentially increasing revenue per day for Frontline's fleet.

- Potential resolution of geopolitical tensions, such as lifting Russian or Iranian sanctions, could realign trade patterns favorably for compliant tanker operations, enhancing Frontline's revenue growth prospects by capturing market share previously served by non-compliant vessels.

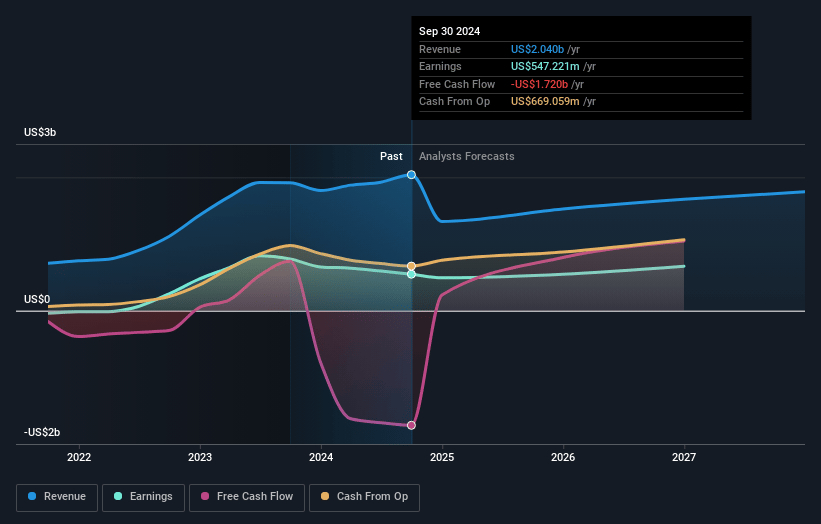

Frontline Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Frontline's revenue will decrease by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 24.2% today to 44.9% in 3 years time.

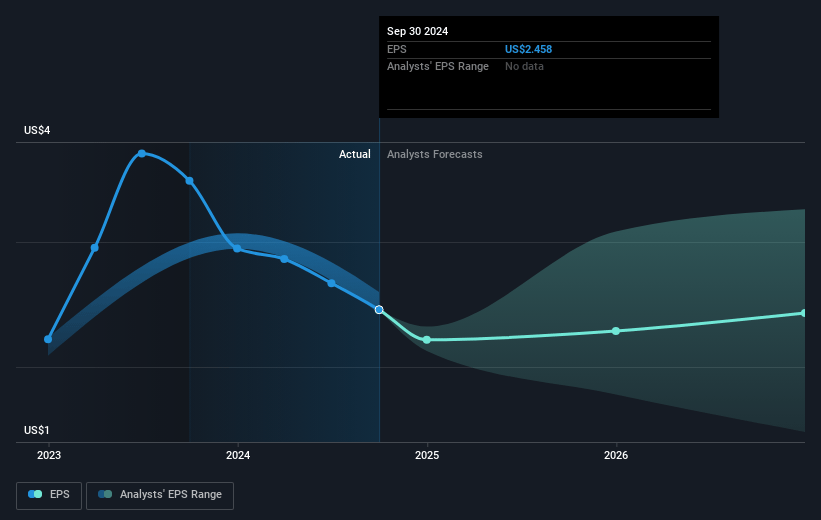

- Analysts expect earnings to reach $757.5 million (and earnings per share of $3.28) by about March 2028, up from $495.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, up from 7.2x today. This future PE is lower than the current PE for the US Oil and Gas industry at 13.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.44%, as per the Simply Wall St company report.

Frontline Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical uncertainty and potential sanctions or tariffs can create volatility in oil supply routes, impacting Frontline's revenue and earnings by affecting demand for compliant tankers.

- A decrease in global oil exports, particularly from regions key to Frontline's operations, could lead to reduced demand for tankers, negatively impacting revenue.

- The aging of the global tanker fleet without significant newbuilds may lead to increased operational costs and pressure on net margins if older vessels require more maintenance or face reduced market demand.

- Regulatory changes or increased geopolitical tensions could limit global trade efficiency, affecting the routing and utilization rates of Frontline's tanker fleet, thus impacting earnings.

- Increased sanctions-related complexities, such as vessel blacklisting, could reduce the operational flexibility of Frontline's fleet, potentially increasing costs or decreasing market opportunities, thereby affecting net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.405 for Frontline based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $757.5 million, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 12.4%.

- Given the current share price of $16.09, the analyst price target of $26.4 is 39.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.