Key Takeaways

- Strong contract backlog and long-term charters ensure stable revenue, enhancing earnings predictability and cushioning against market cycles.

- Recent refinancing reduces interest costs, extends debt maturities, and frees cash for operations or shareholder returns, boosting net margins.

- Overreliance on spot markets and low freight rates could threaten earnings, while geopolitical tensions and oversupply risks may hinder revenue growth and stability.

Catalysts

About FLEX LNG- Engages in the seaborne transportation of liquefied natural gas (LNG) worldwide.

- Extension of existing ship charters with options into the 2030s signifies strong contract backlog, securing steady and predictable revenue streams, which can bolster future earnings.

- The commencement of a new 15-year time charter for the Flex Constellation starting in 2026 ensures long-term revenue visibility, helping to stabilize revenue through market cycles and improve future earnings predictability.

- Recent refinancing efforts have led to lower interest costs and extended debt maturities, enhancing net margins and freeing up $97 million in cash, which can be used for operational improvements or shareholder returns.

- Despite a downturn in freight rates, the company’s strategic backlog provides stability, allowing it to maintain firm revenue guidance for future years, thereby supporting stable adjusted EBITDA projections.

- The anticipated scrapping of older steam ships and high demand for efficient vessels could help balance the market by 2027, potentially leading to higher future rates and increased revenues as Flex LNG's modern fleet remains in demand.

FLEX LNG Future Earnings and Revenue Growth

Assumptions

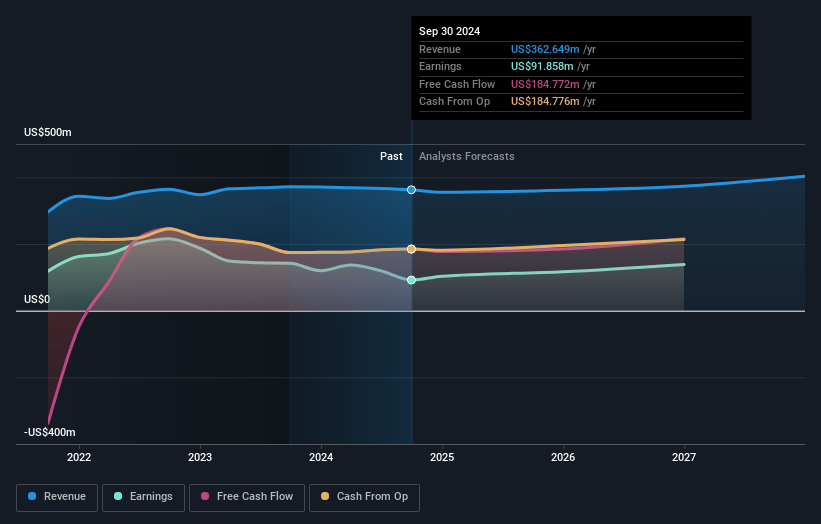

How have these above catalysts been quantified?- Analysts are assuming FLEX LNG's revenue will grow by 1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 29.1% today to 37.6% in 3 years time.

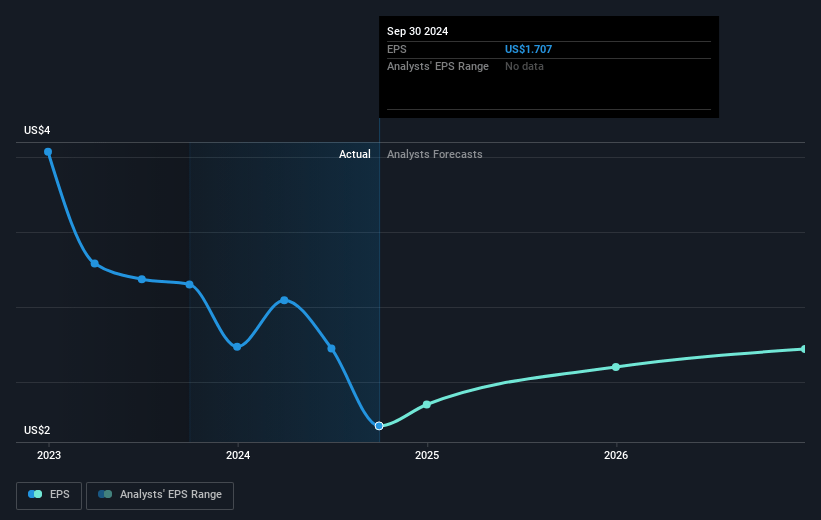

- Analysts expect earnings to reach $137.7 million (and earnings per share of $2.27) by about July 2028, up from $103.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $170.1 million in earnings, and the most bearish expecting $117 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, which is the same as it is today today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.41%, as per the Simply Wall St company report.

FLEX LNG Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The LNG market experienced record low growth in export volumes in 2024, indicating potential weaknesses in demand that could impact future revenue growth.

- Slumping freight rates, currently at rock-bottom levels, suggest potential difficulties in maintaining high net margins if the market does not recover quickly.

- Dependence on spot markets due to uncertainty in long-term contracts might lead to fluctuations and reduced stability in earnings.

- The geopolitical landscape, especially U.S.-China trade disputes and potential tariffs, poses risks to market access and could disrupt revenue streams.

- A large influx of new ships anticipated in the market could create oversupply, leading to further pressure on freight rates and potentially reducing future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.0 for FLEX LNG based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $366.0 million, earnings will come to $137.7 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 8.4%.

- Given the current share price of $22.95, the analyst price target of $24.0 is 4.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.