Narratives are currently in beta

Key Takeaways

- Acquisition of Equitrans Midstream boosts EQT's revenue potential and net margins through vertical integration and operational efficiencies.

- EQT's achievement of net zero emissions enhances ESG valuation, while strategic positioning supports future revenue via increased natural gas demand.

- Integration challenges, reliance on efficiency targets, volatile gas prices, regulatory setbacks, and asset divestitures may affect EQT's margins, cash flow, and revenue.

Catalysts

About EQT- Operates as a natural gas production company in the United States.

- EQT's acquisition of Equitrans Midstream has created a unique vertically integrated natural gas business, positioning EQT as the lowest cost producer. This not only provides protection during low commodity cycles but also allows EQT to capitalize on high prices, potentially impacting revenue growth positively.

- The accelerated integration of Equitrans and subsequent realization of synergies, which have already surpassed initial forecasts, is expected to continue yielding financial benefits, potentially boosting net margins by reducing operating costs more quickly than anticipated.

- Significant operational efficiency gains, such as improved water delivery systems, have reduced well costs and increased completion efficiency. These efficiencies could decrease capital expenditures and improve net margins through cost savings.

- The achievement of net zero Scope 1 and 2 greenhouse gas emissions places EQT favorably within ESG investment criteria, potentially enhancing valuation and revenue as EQT becomes a preferred partner for utilities seeking sustainable gas suppliers.

- EQT's strategic positioning to meet increased natural gas demand from anticipated power market shifts, driven by factors like AI-related data centers and coal plant retirements, supports future revenue growth and underpins earnings potential through increased sales volumes.

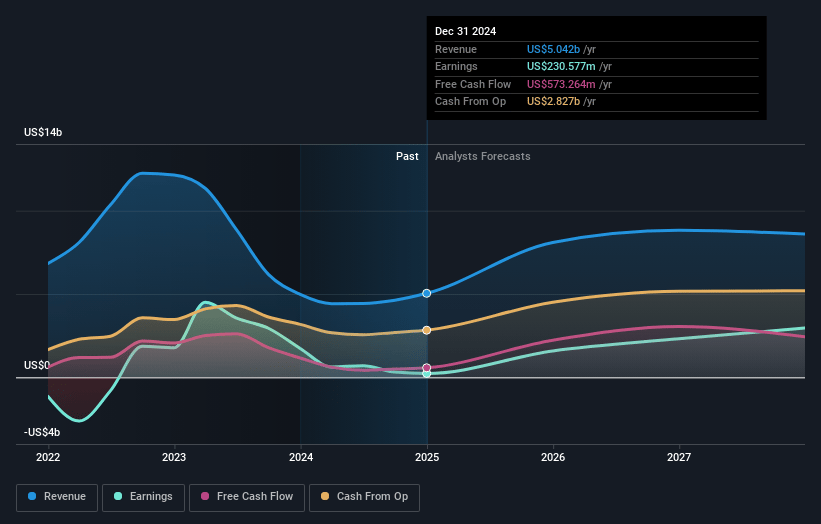

EQT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EQT's revenue will grow by 17.4% annually over the next 3 years.

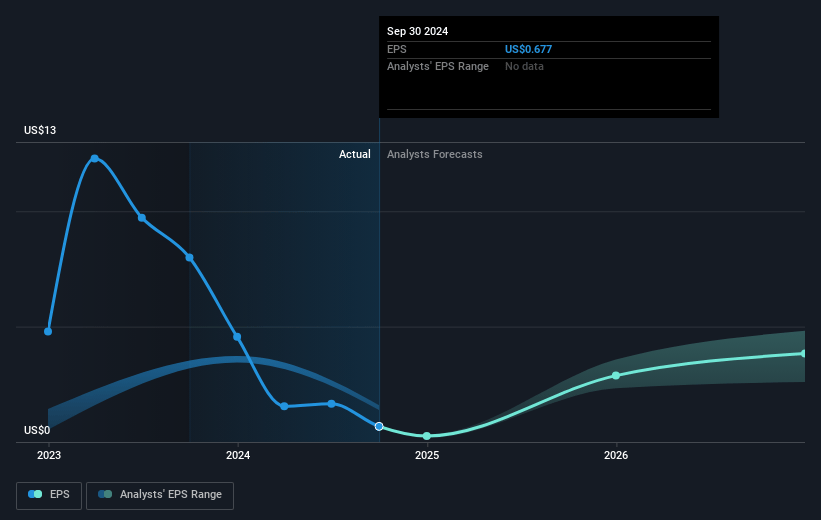

- Analysts assume that profit margins will increase from 6.8% today to 14.9% in 3 years time.

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $1.96) by about November 2027, up from $314.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.2x on those 2027 earnings, down from 83.7x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to decline by 1.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.17%, as per the Simply Wall St company report.

EQT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The integration of Equitrans Midstream into EQT's operations, while progressing rapidly, may face challenges that could result in unexpected costs or delays in achieving operational synergies, potentially impacting net margins.

- The reliance on achieving high levels of completion efficiency and synergy targets for cost savings might not materialize as expected, which could negatively affect the capital budget and free cash flow.

- The tactical approach of curtailing gas production due to volatile gas prices may reduce revenue if prices remain below the levels necessary to profitably sustain production.

- Regulatory or operational setbacks in increasing natural gas demand, such as potential delays in LNG export capacity expansions, could adversely impact revenue expectations based on anticipated demand growth.

- The divestiture of non-core assets and debt-focused financial strategy could constrain operational flexibility and limit potential revenue from future production capabilities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $42.25 for EQT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $7.5 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 27.2x, assuming you use a discount rate of 8.2%.

- Given the current share price of $44.08, the analyst's price target of $42.25 is 4.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives