Narratives are currently in beta

Key Takeaways

- Expansion of processing plants and facilities aims to boost cash flow and NGL value chain, potentially increasing future revenues and earnings.

- Strategic acquisitions, demand-driven natural gas revenue, and expansion into European markets are expected to enhance operational efficiency and expand revenue streams.

- The company's reliance on volatile natural gas price spreads and execution of complex projects could impact earnings and revenue amid evolving energy trends and regulations.

Catalysts

About Enterprise Products Partners- Provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products.

- The completion of two additional natural gas processing plants, the Bahia pipeline, Frac 14, the Neches River NGL export terminal, and the Morgan's Point Terminal expansion in 2025, along with another processing plant in 2026, are set to improve future cash flow and expand the NGL value chain, potentially boosting revenue.

- The acquisition of Piñon Midstream is expected to enhance their Permian processing footprint and attract more acreage in the Delaware Basin, facilitating operational efficiency and potentially increasing earnings.

- The increased demand for natural gas from data centers and new gas-fired power plants in Texas is anticipated to significantly impact future natural gas revenues as Enterprise is well-positioned with its pipeline and storage assets.

- Implementation of big data and data science for predictive maintenance, market analytics, and asset optimization aims to improve operational efficiency and reduce costs, thereby enhancing net margins.

- The planned CO2 pipeline with Oxy and new market opportunities in Europe for petrochemicals, such as ethylene exports to Europe, provide potential for expanding revenue streams in the coming years.

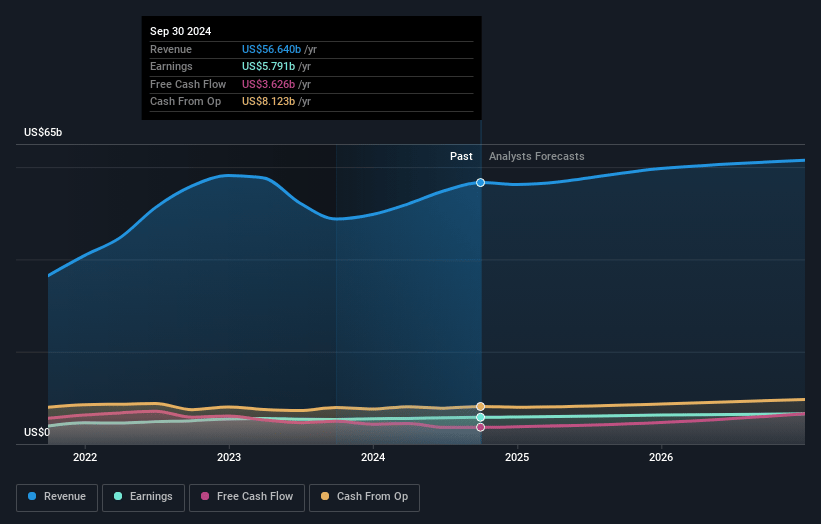

Enterprise Products Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Enterprise Products Partners's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 11.0% in 3 years time.

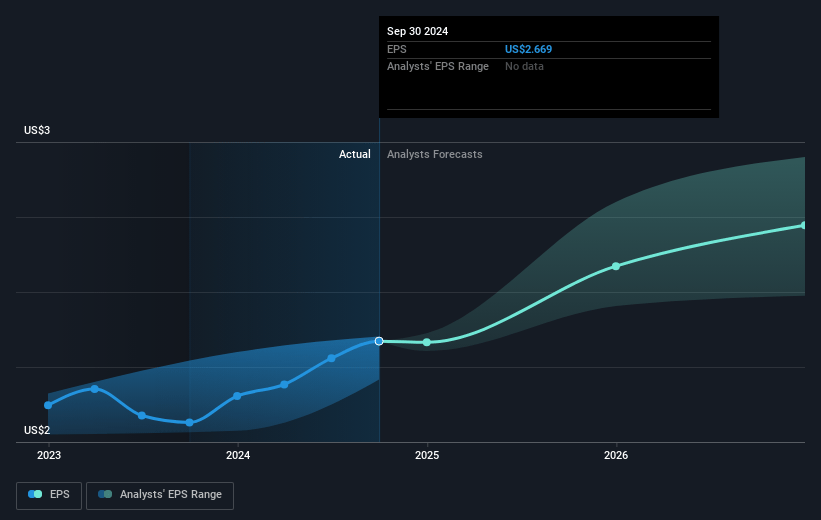

- Analysts expect earnings to reach $6.6 billion (and earnings per share of $3.02) by about November 2027, up from $5.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.2x on those 2027 earnings, up from 11.4x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to grow by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.07%, as per the Simply Wall St company report.

Enterprise Products Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on volatile natural gas price spreads for revenue growth could negatively impact earnings if these spreads narrow unexpectedly. (Revenue, Earnings)

- Increased capital expenditures for growth projects might strain financial resources and limit short-term net margins, especially given higher sustained capital expenditures than initially estimated. (Net Margins)

- Operational risks from complex turnaround projects like those of the PDH facilities could impact earnings if not executed as planned, especially given higher sustaining capital expenditures. (Net Margins, Earnings)

- The dependency on new projects becoming operational on schedule to meet growing demand, such as the Bahia pipeline and expansion projects, might impact revenue and cash flow if there are delays or unmet demand projections. (Revenue, Cash Flow)

- The transition in energy trends and potential policy changes, such as setbacks in New Mexico or stricter environmental regulations, might alter operational strategy and profitability, impacting long-term revenue stability. (Revenue, Net Margins)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $34.12 for Enterprise Products Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $59.8 billion, earnings will come to $6.6 billion, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 8.1%.

- Given the current share price of $30.39, the analyst's price target of $34.12 is 10.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives