Narratives are currently in beta

Key Takeaways

- Increased investments in new technologies and areas might pressure margins and earnings due to rising operational costs and debt.

- Expanded share repurchases and dividends suggest confidence, but without matching revenue growth, they could signal potential overvaluation concerns.

- EOG Resources' focus on capital efficiency, sustainability, and strategic financial management is expected to enhance net margins and support stable revenue growth.

Catalysts

About EOG Resources- Explores for, develops, produces, and markets crude oil, natural gas liquids, and natural gas primarily in producing basins in the United States, the Republic of Trinidad and Tobago and internationally.

- The company is investing in longer lateral drilling and in-house motor technology, which might not lead to immediate revenue increases, but incurs higher operational costs that can compress margins in the short term.

- EOG is increasing capital allocation to emerging plays like the Utica, focusing on volatile oil windows. While this could present future growth, there is a risk of these investments not performing to expectation, potentially impacting earnings.

- The company anticipates refinancing upcoming debt and increasing overall debt levels to $5-6 billion. This shift may lead to increased interest expenses, impacting net margins and earnings.

- With an increase in share repurchase authorization, there's potential concern that this cash allocation may not translate into proportionate earnings growth, thus putting pressure on EPS if financial performance doesn't align with buybacks.

- The steady increase in dividend payouts and share buybacks reflects a confidence in current operations, but sustained high shareholder returns without equivalent growth in revenue or net income could indicate an overvaluation.

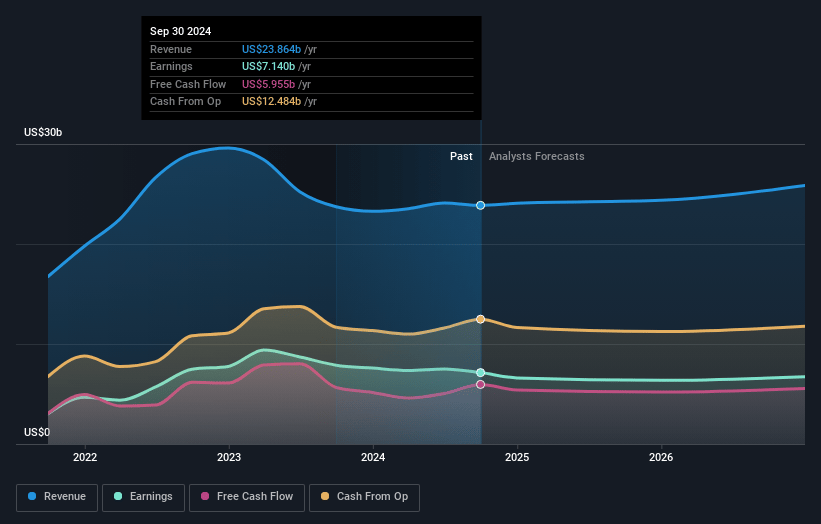

EOG Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EOG Resources's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 29.9% today to 23.5% in 3 years time.

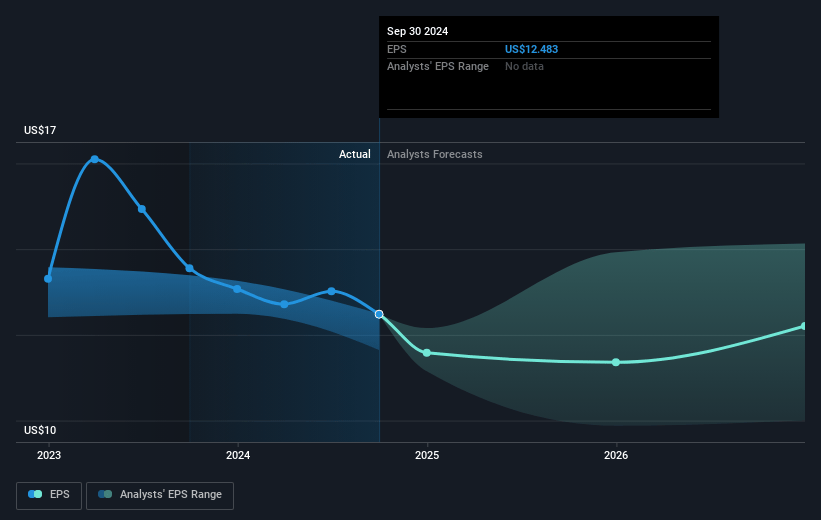

- Analysts expect earnings to reach $6.2 billion (and earnings per share of $10.66) by about November 2027, down from $7.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $7.8 billion in earnings, and the most bearish expecting $5.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.3x on those 2027 earnings, up from 10.5x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to grow by 0.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

EOG Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- EOG Resources has demonstrated confidence in its ability to generate strong free cash flow, which could positively impact revenue and earnings by increasing dividends and share repurchase authorizations.

- The company has effectively improved its capital efficiency by leveraging technology and innovation, potentially enhancing net margins through operational performance gains in multiple basins.

- EOG has shown a robust marketing strategy with peer-leading U.S. price realizations, which could lead to increased revenue from higher oil and gas prices.

- EOG's strategic planning around reduced debt and strong financial performance, including maintaining a pristine balance sheet and optimizing its capital structure, could result in better earnings and net margins.

- The company's investments in sustainability and leading environmental performance showcase a long-term commitment to cost efficiency and risk management, potentially improving net margins and supporting revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $142.1 for EOG Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $164.0, and the most bearish reporting a price target of just $126.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $26.2 billion, earnings will come to $6.2 billion, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 7.1%.

- Given the current share price of $133.13, the analyst's price target of $142.1 is 6.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives