Narratives are currently in beta

Key Takeaways

- Heavy reliance on FSRUs and capital expenditure may delay revenue and compress margins due to high operational costs.

- Exposure to geopolitical risks and emerging market uncertainties could destabilize earnings and complicate profitability through joint ventures.

- Strategic long-term agreements and robust contract portfolio ensure financial stability, while disciplined capital allocation boosts shareholder value and overall financial position.

Catalysts

About Excelerate Energy- Provides flexible liquefied natural gas (LNG) solutions worldwide.

- The company's future growth relies heavily on the deployment of newly built and converted FSRUs, with long project timelines that may delay revenue realization, potentially impacting future revenue projections negatively if demand shifts.

- Excelerate is planning significant capital expenditure, including new build milestones and dry docks, which could increase operational costs and compress net margins during the ramp-up phase before these assets become revenue-generating.

- The reliance on stable long-term supply deals, such as the Petrobangla contract, exposes the company to geopolitical and market risks that could affect the stability of future earnings.

- The strategic focus on entering emerging markets like Vietnam and Alaska involves uncertainties and developmental risks that may not yield the expected returns, impacting earnings visibility in the medium term.

- Continued reliance on joint ventures and partnerships, as seen with PetroVietnam Technical Services Corporation, may lead to complexity in project execution and potential dilution of net margins, affecting profitability forecasts.

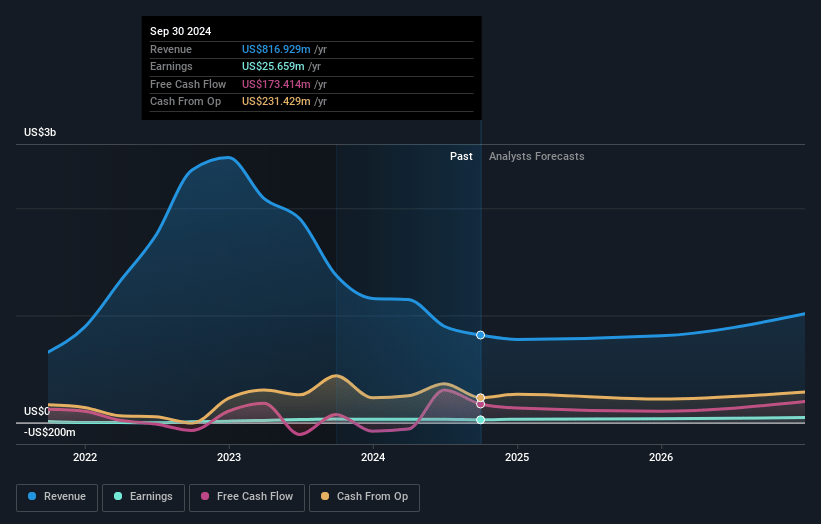

Excelerate Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Excelerate Energy's revenue will grow by 8.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 5.2% in 3 years time.

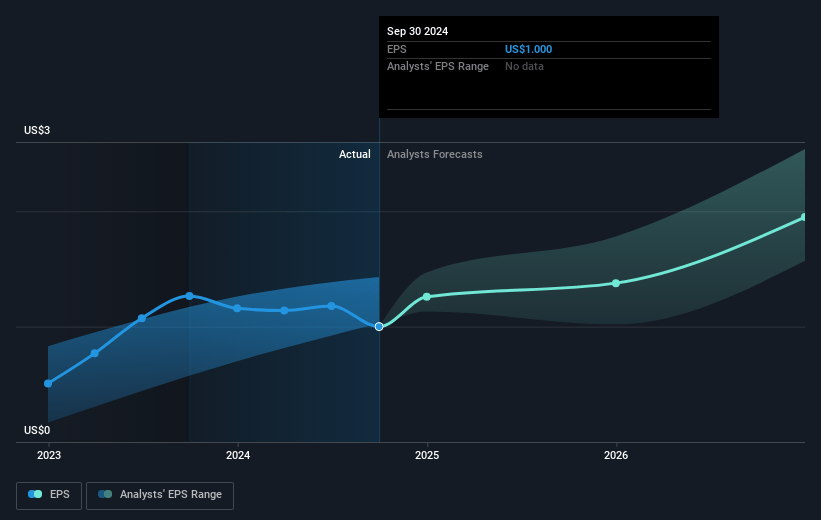

- Analysts expect earnings to reach $54.4 million (and earnings per share of $3.22) by about November 2027, up from $25.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.6x on those 2027 earnings, down from 28.2x today. This future PE is lower than the current PE for the US Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to decline by 45.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.47%, as per the Simply Wall St company report.

Excelerate Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Excelerate Energy has a robust contract portfolio worth about $4 billion in future revenue with a weighted average remaining term of 7 years, which underpins its financial stability and ensures future revenue streams.

- The company's regasification business is supported by its strong operational performance and reliability, reflected in the impressive 99.8% reliability rate, indicating an ability to maintain high levels of efficiency and low operational disruptions, thus sustaining strong earnings.

- Excelerate has strategic international agreements and initiatives, such as the 15-year LPG deal with Petrobangla in Bangladesh and the 20-year contract with Venture Global, which can generate consistent EBITDA, potentially stabilizing or increasing net margins over the long-term.

- The company’s ability to leverage a diversified LNG supply portfolio for sales and purchase agreements across major markets enhances its revenue and helps derisk investments, thus strengthening its overall financial position.

- Excelerate’s disciplined capital allocation strategy, including the use of share repurchase programs and dividend increases, demonstrates confidence in its cash generation capability and liquidity, which could positively impact net margins and shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.3 for Excelerate Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $31.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.0 billion, earnings will come to $54.4 million, and it would be trading on a PE ratio of 9.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of $29.85, the analyst's price target of $26.3 is 13.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives