Key Takeaways

- Expansion into integrated LNG and power infrastructure leverages rising regional energy demand and transition to natural gas, driving long-term revenue growth and improved margins.

- Focus on high-quality contracts and flexible LNG solutions enhances earnings stability, supports higher margin offerings, and positions the company for sustainable, recurring growth.

- Reliance on FSRU and LNG import terminals, regulatory risks, aggressive acquisition strategy, and emerging market exposure threaten long-term revenue, margins, and financial stability.

Catalysts

About Excelerate Energy- Provides liquefied natural gas (LNG) solutions worldwide.

- Excelerate’s expansion into Jamaica via the acquisition of integrated LNG and power infrastructure, coupled with the region’s rising energy demand and ongoing shift from coal/oil to natural gas, positions the company to capture long-term contract revenue growth and enhanced net margins.

- The global emphasis on energy security and diversification is fueling increased demand for LNG import solutions and flexible FSRU assets, driving greater utilization of Excelerate’s fleet and supporting growth in recurring revenues.

- The completion and deployment of the newbuild FSRU (Hull 3407) in 2026—in the context of growing LNG supply and strong interest from multiple counterparties—creates a clear catalyst for future EBITDA and earnings growth once the vessel is contracted.

- Excelerate’s ability to secure high-quality, long-term take-or-pay contracts, especially with investment-grade counterparties, increases earnings visibility and cash flow stability, which should support a re-rating of the stock as investors gain confidence in forward results.

- The company’s development of integrated and small-scale LNG value chain solutions, along with its operational excellence and robust project pipeline in emerging markets, is likely to translate into higher-margin service offerings, improved net margins, and sustainable, long-term revenue growth.

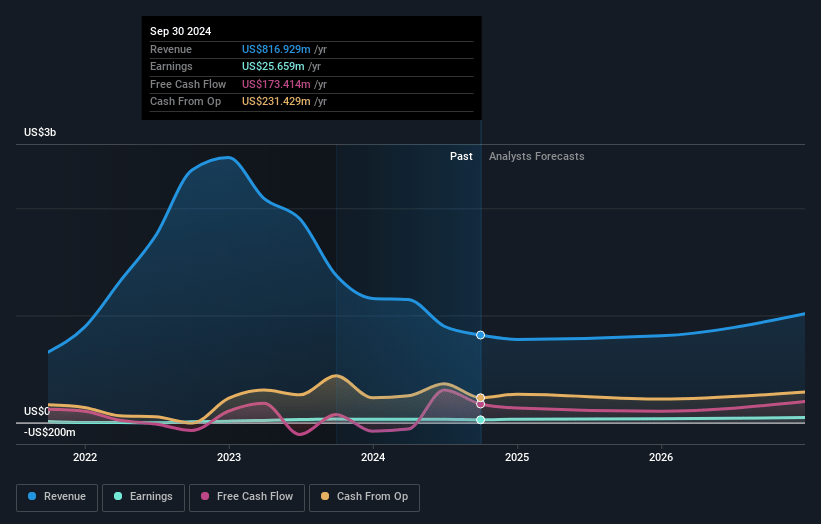

Excelerate Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Excelerate Energy's revenue will grow by 26.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.9% today to 3.4% in 3 years time.

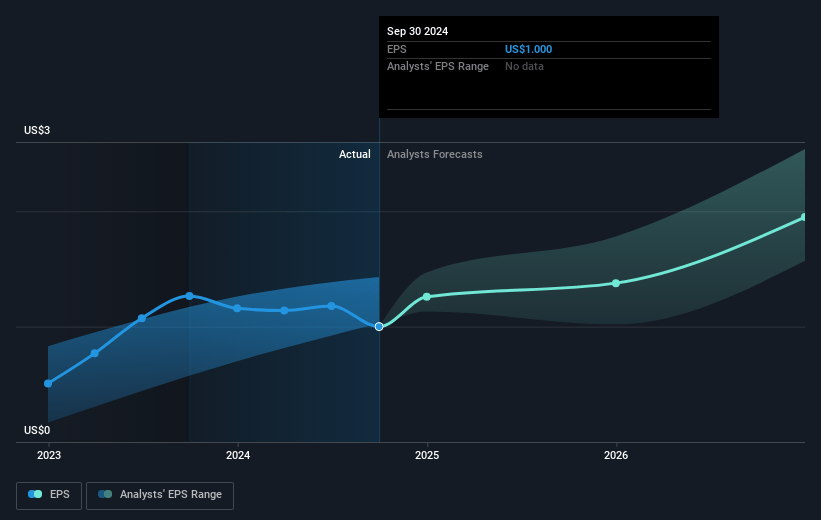

- Analysts expect earnings to reach $65.7 million (and earnings per share of $1.82) by about May 2028, up from $37.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $72.8 million in earnings, and the most bearish expecting $43.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 87.5x on those 2028 earnings, up from 30.9x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.31%, as per the Simply Wall St company report.

Excelerate Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s heavy concentration in FSRU (Floating Storage and Regasification Units) and LNG import terminals exposes it to long-term technological disruption or shifts in market preference toward onshore, smaller-scale, or alternative energy solutions, which could reduce contract wins and pressure long-term revenue and asset utilization.

- Strong secular trends toward renewables and global policy action on climate change, including potential future carbon taxes or stricter regulations, may reduce the long-term competitiveness of LNG and lead to declining demand for Excelerate’s services, negatively impacting revenue growth and margins.

- The company’s increasing exposure to emerging markets—such as Jamaica and Vietnam—entails heightened geopolitical and credit risks, including the potential for contract renegotiations, delays, or payment defaults, which could destabilize predictable earnings and cash flows.

- The acquisition-driven growth strategy, highlighted by the $1 billion Jamaica deal financed by new equity and high-interest debt (8% senior notes), raises Excelerate’s capital intensity and leverage, increasing vulnerability to rising financing costs and potential earnings dilution if future acquisitions underperform.

- Industry risks of volatile global LNG prices and the potential for long-term overcapacity in LNG shipping and regasification infrastructure, as large new supply comes online and more competitors enter the market, could weaken Excelerate’s pricing power, lower asset utilization rates, and compress profit margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $32.1 for Excelerate Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $65.7 million, and it would be trading on a PE ratio of 87.5x, assuming you use a discount rate of 6.3%.

- Given the current share price of $29.34, the analyst price target of $32.1 is 8.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.