Narratives are currently in beta

Key Takeaways

- Contract extensions and strategic acquisitions could drive stable revenue growth and improve asset quality, enhancing net margins.

- Disciplined capital allocation balances growth and stability, potentially boosting shareholder value and earnings stability.

- Heavy investment in new projects and dependence on debt could strain resources, affecting short-term earnings and future growth if market conditions or project timelines falter.

Catalysts

About Delek Logistics Partners- Provides gathering, pipeline, transportation, and other services for crude oil, intermediates, refined products, natural gas, storage, wholesale marketing, terminalling water disposal and recycling customers in the United States.

- The extension of contracts between DKL and DK for a period of 7 years could lead to stable and potentially increased revenue streams, given the long-term security and business continuity that these contracts provide.

- The acquisition of the Wink to Webster Pipeline, supported by investment-grade counterparties, enhances asset quality and strengthens DKL’s position, potentially driving future revenue growth and improving net margins.

- Progress on the new gas processing plant, which includes opportunities for sour gas treatment, is anticipated to increase throughput capacity and revenue, while maintaining efficient cost management, thus potentially boosting net margins.

- Growth in organic and inorganic opportunities, such as the acquisition of H2O Midstream and new acreage dedications in the Midland Basin, could lead to increased volumes and revenue, along with better utilization of existing assets.

- The focus on maintaining a disciplined approach to capital allocation, balancing distribution growth with leverage and liquidity management, may contribute to enhanced earnings stability and long-term shareholder value.

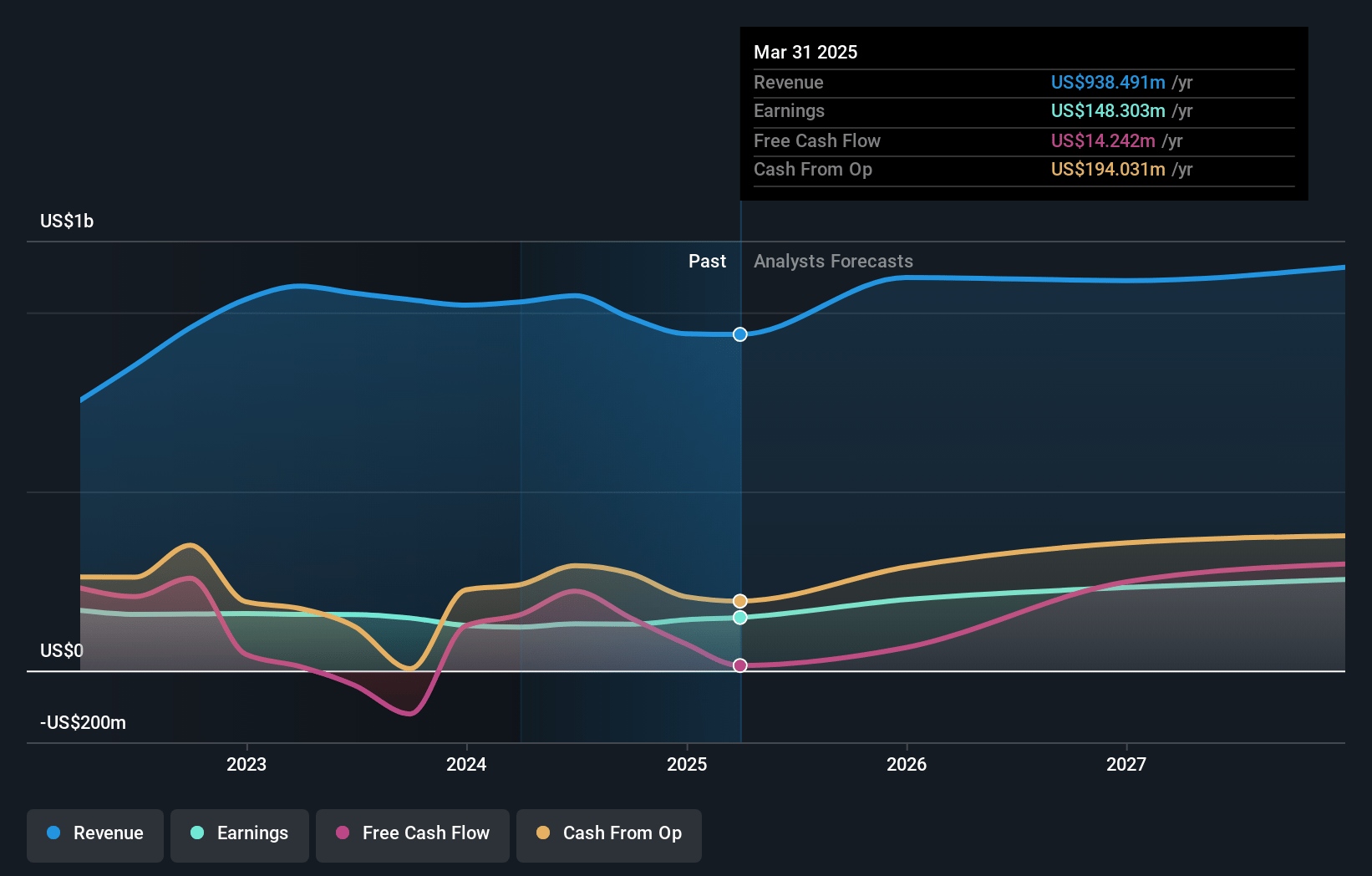

Delek Logistics Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Delek Logistics Partners's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.2% today to 22.3% in 3 years time.

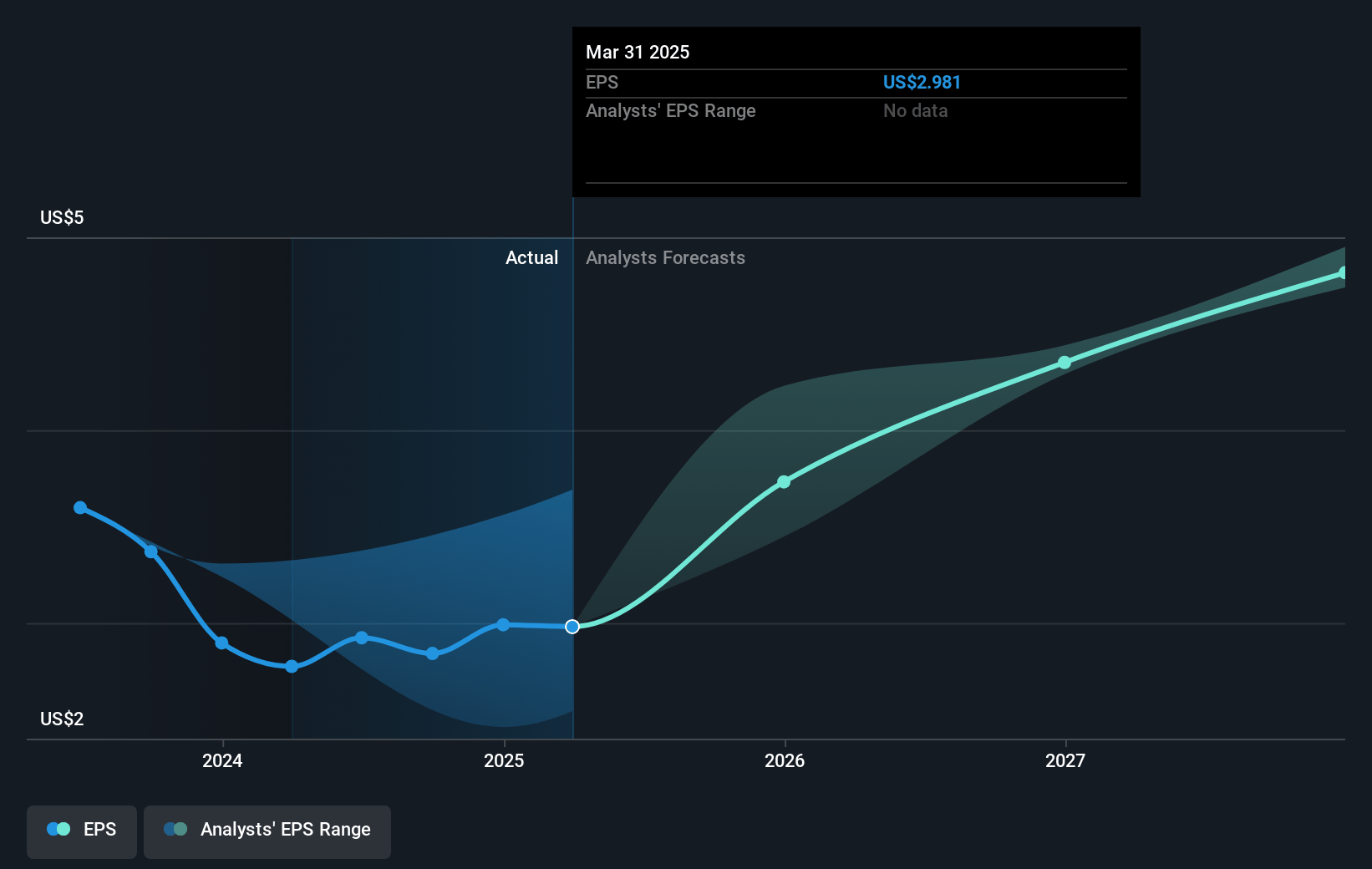

- Analysts expect earnings to reach $241.9 million (and earnings per share of $4.81) by about November 2027, up from $129.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.6x on those 2027 earnings, down from 15.4x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to decline by 0.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.18%, as per the Simply Wall St company report.

Delek Logistics Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delek Logistics Partners is heavily investing in new projects like a gas processing plant, which could strain their capital resources and impact their short-term earnings and leverage ratios, especially if these projects experience delays or cost overruns.

- The company’s Wholesale Marketing and Terminalling segment experienced a decrease in adjusted EBITDA due to lower wholesale margins, which could impact overall revenue growth if this trend continues.

- The company's reliance on debt and equity markets to manage liquidity and leverage could expose it to risk if market conditions become unfavorable, potentially affecting its ability to fund operations and new projects, thereby impacting future earnings.

- The current DCF coverage ratio sits at approximately 1.1x, lower than the long-term objective of 1.3x, indicating a potential risk to sustaining distribution growth, which could ultimately affect investor confidence and share price.

- The integration of newly acquired assets, such as H2 Midstream, may not deliver the anticipated synergies and efficiencies, potentially leading to unexpected costs or operational challenges that could impact net margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $43.0 for Delek Logistics Partners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $46.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.1 billion, earnings will come to $241.9 million, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 9.2%.

- Given the current share price of $38.82, the analyst's price target of $43.0 is 9.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives