Last Update 11 Dec 25

Fair value Decreased 0.73%DHT: Winter Tanker Market Strength Will Support Margins And Share Upside

Analysts have nudged their price target on DHT Holdings slightly lower to $15.32 from $15.43 per share, while highlighting a promising winter tanker market backdrop and stronger projected profit margins as key supports for the updated valuation.

Analyst Commentary

Bullish analysts frame the modest reduction in the consolidated price target as a fine tuning of assumptions rather than a shift in conviction, underscoring that the current valuation still implies meaningful upside if winter market dynamics unfold as expected.

They point to the recent upward adjustment in some individual targets as evidence that tanker fundamentals are improving faster than previously modeled, potentially supporting stronger earnings power and cash generation through the coming quarters.

Bullish Takeaways

- Bullish analysts emphasize that the winter tanker market setup looks promising, with seasonal strength in freight rates expected to support higher utilization and margin expansion versus prior forecasts.

- The revised price targets reflect increased confidence in DHT Holdings' cash flow visibility, supporting the potential for sustained dividends and disciplined fleet renewal that could enhance long term equity value.

- Improving rate dynamics are seen as offering leverage to earnings growth, with even modest upside to spot and time charter rates translating into outsized gains in profitability relative to the current share price.

- Stronger projected profit margins, combined with a constructive supply and demand backdrop, are viewed as improving execution risk and narrowing the gap between DHT Holdings' trading levels and intrinsic value estimates.

Bearish Takeaways

- Bearish analysts caution that the overall price target trim signals limited room for multiple expansion if the winter rate environment underwhelms, leaving the shares more dependent on near term earnings delivery.

- There is concern that tanker market strength could prove shorter lived than anticipated, particularly if global trade flows or refinery runs soften, which would pressure both utilization and margin assumptions embedded in current valuations.

- Some see risk that elevated expectations for winter seasonality raise the bar for execution, meaning any operational hiccups or weaker than forecast chartering performance could prompt further estimate revisions.

- Uncertainty around the longevity of the rate upcycle, including potential fleet growth and changes in regulatory or geopolitical conditions, is cited as a constraint on more aggressive upside scenarios for the stock.

Valuation Changes

- The fair value estimate has edged down slightly to $15.32 from $15.43 per share, reflecting minor model adjustments rather than a major reassessment of fundamentals.

- The discount rate is effectively unchanged at about 6.96 percent, indicating a stable view of risk and required return.

- Revenue growth assumptions have fallen significantly, shifting from a modestly positive 1.63 percent to a slightly negative 0.21 percent outlook.

- Net profit margin expectations have risen meaningfully, increasing from approximately 52.18 percent to 55.11 percent on stronger projected operating efficiency and pricing.

- The future P/E multiple has slipped slightly to around 10.23x from 10.31x, implying a marginally more conservative valuation on forward earnings.

Key Takeaways

- Modern fleet renewal and disciplined capital strategy strengthen earnings stability, operational efficiency, and resilience through market cycles.

- Geopolitical shifts and tightening vessel supply create favorable conditions for higher utilization, stable cash flows, and improved profitability.

- Intensifying regulatory and market pressures threaten long-term revenue stability, with aggressive dividend policy and earnings volatility limiting financial flexibility and investment in fleet renewal.

Catalysts

About DHT Holdings- Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, Norway, and India.

- Persistent growth in energy demand from emerging markets, notably in Asia, and evolving global refinery patterns are driving longer trade routes and increased ton-mile demand, supporting sustained high vessel utilization and, therefore, improved revenue visibility for DHT Holdings.

- DHT's active fleet renewal-selling older vessels and acquiring modern, fuel-efficient VLCCs-positions the company to capture premium charter rates and reduce operating expenses, likely supporting higher net margins and more stable long-term earnings.

- Attractive new time-charter fixtures and continued high-level customer interest, fueled by geopolitical shifts such as Indian sourcing changes and OPEC production decisions, are creating more predictable and resilient cash flows, positively impacting future revenue and earnings stability.

- Current limited global newbuild VLCC supply, shipyard constraints, and regulatory favor for newer, eco-efficient ships provide a supportive industry backdrop; DHT's modern fleet is well-positioned to benefit from tightening supply and potentially rising vessel day rates, aiding future profitability.

- Strong balance sheet, low leverage, competitive financing, and a disciplined capital allocation strategy (including dividend payouts and buybacks) enhance DHT's ability to invest in growth and navigate market cycles, supporting long-term EPS and shareholder returns.

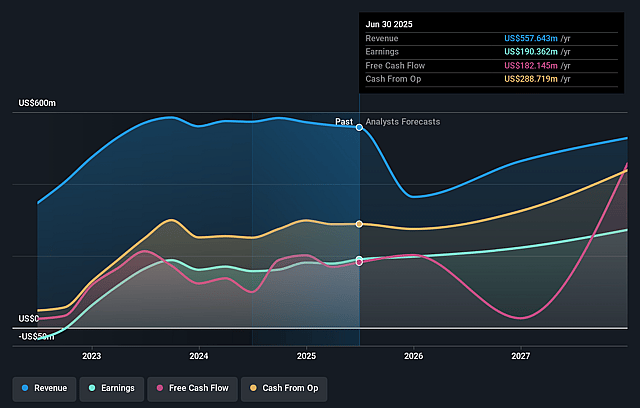

DHT Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming DHT Holdings's revenue will decrease by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 34.1% today to 56.5% in 3 years time.

- Analysts expect earnings to reach $281.4 million (and earnings per share of $1.69) by about September 2028, up from $190.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $328.1 million in earnings, and the most bearish expecting $189.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, down from 10.3x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.05%, as per the Simply Wall St company report.

DHT Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing global momentum toward renewable energy and decarbonization could erode long-term demand for crude oil transportation, creating structural headwinds for VLCC utilization and DHT's future revenue streams.

- The company's aggressive policy of allocating 100% of ordinary net income as quarterly dividends may constrain retained earnings and reduce flexibility for fleet renewal or adoption of costly new technologies, thereby potentially impacting future earnings resilience.

- Persistent lack of scrapping in the sector due to high demand for older vessels in sanctioned trades could extend oversupply, pressuring freight rates industry-wide and negatively affecting DHT's revenues and net margins.

- Elevated acquisition and newbuilding capital expenditures to maintain fleet competitiveness, combined with potential increases in regulation-driven costs (e.g., compliance with environmental standards), could pressure net margins and require ongoing financing-especially if vessel earnings soften.

- Continued reliance on spot market exposure for a portion of the fleet results in earnings volatility during periods of weak rates or unfavorable macroeconomic conditions, with potential for prolonged periods of depressed cash flows and negative impact on net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.317 for DHT Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $12.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $497.7 million, earnings will come to $281.4 million, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 7.0%.

- Given the current share price of $12.17, the analyst price target of $14.32 is 15.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on DHT Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.