Key Takeaways

- Expansion in key basins, operational efficiencies, and capital reallocation position Civitas for sustained growth and resilience as global energy demand rises.

- Disciplined cost management, emissions focus, and balance sheet strength enhance margins, earnings consistency, and flexibility for growth or shareholder returns.

- Exposure to regulatory, ESG, and cost pressures threatens profitability, while reliance on capital-intensive drilling and lack of scale increases risks to earnings and long-term growth.

Catalysts

About Civitas Resources- An exploration and production company, focuses on the acquisition, development, and production of crude oil and associated liquids-rich natural gas.

- Civitas Resources has significantly expanded its asset base in the Permian Basin and DJ Basin, adding nearly two years of future high-return, low-cost drilling locations; this expanded inventory and diversified production can drive higher revenues and support sustained production growth, especially as global energy demand continues to rise from emerging economies.

- Ongoing operational improvements—including a 15% reduction in well costs, extended lateral lengths by 5%, and embracing simulfrac technology and longer laterals—enhance capital efficiency and allow the company to sustain or grow net margins, making Civitas more competitive and resilient even in volatile commodity markets.

- By shifting capital allocation towards the high-return Delaware Basin and optimizing Permian development (with about 40% of 2025 activity moving to Delaware), Civitas is positioned to benefit from persistent global energy supply constraints, supporting future revenue stability and potentially leading to premium pricing for its output.

- Civitas’ leading cost structure, driven by disciplined cost management, workforce reductions, and focus on emissions reductions, is expected to keep the company at the low end of the industry cost curve; this should bolster both net margins and earnings consistency, especially as regulatory and investor preferences increasingly reward lower-emission oil and gas producers.

- The company’s strong and flexible balance sheet strategy, prioritizing substantial debt reduction and opportunistic asset divestitures, lowers interest expense and provides capacity to deploy capital for future growth or shareholder returns as energy prices rise, which can significantly enhance free cash flow and boost overall earnings.

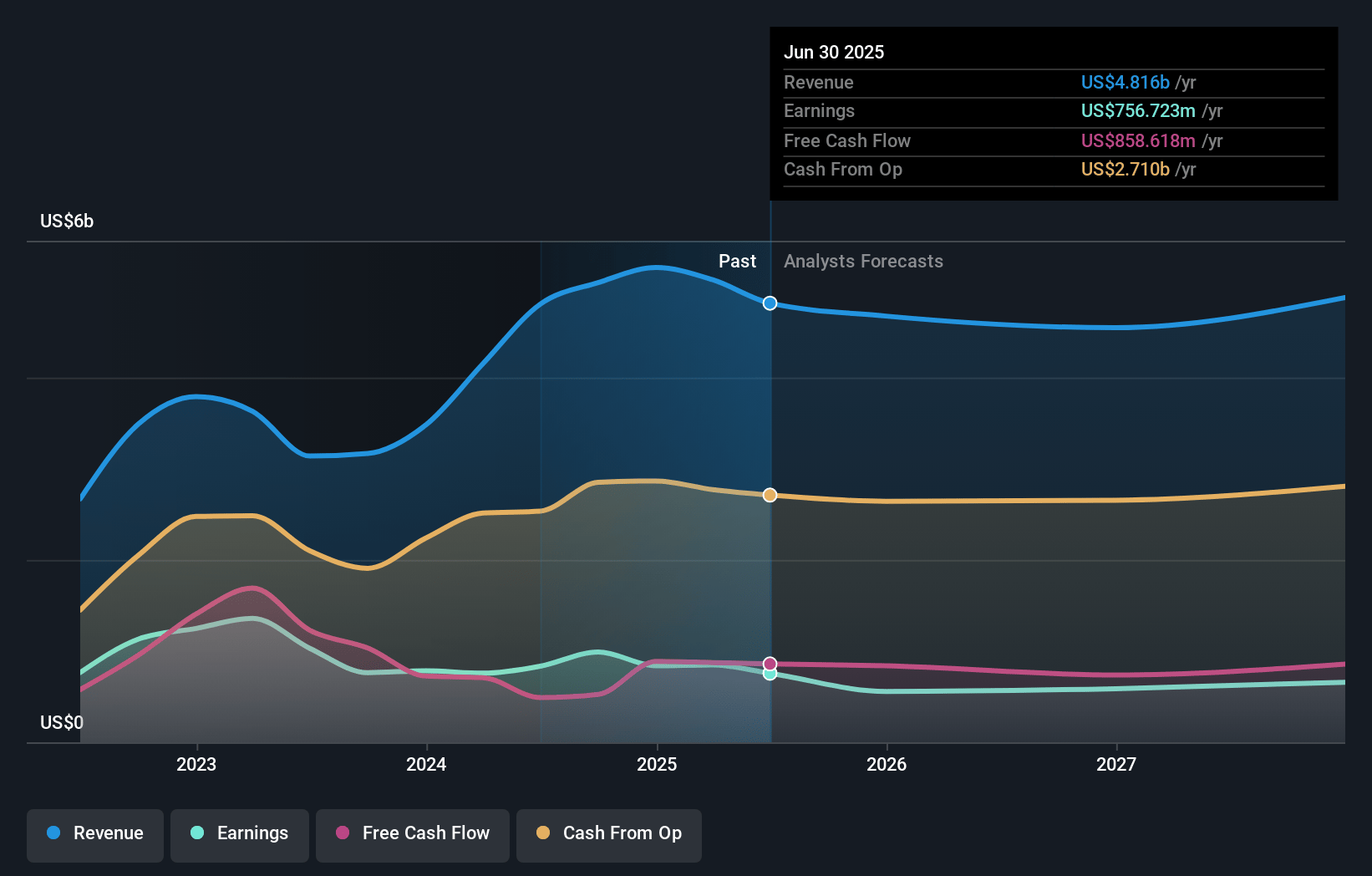

Civitas Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Civitas Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Civitas Resources's revenue will decrease by 0.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 16.1% today to 13.7% in 3 years time.

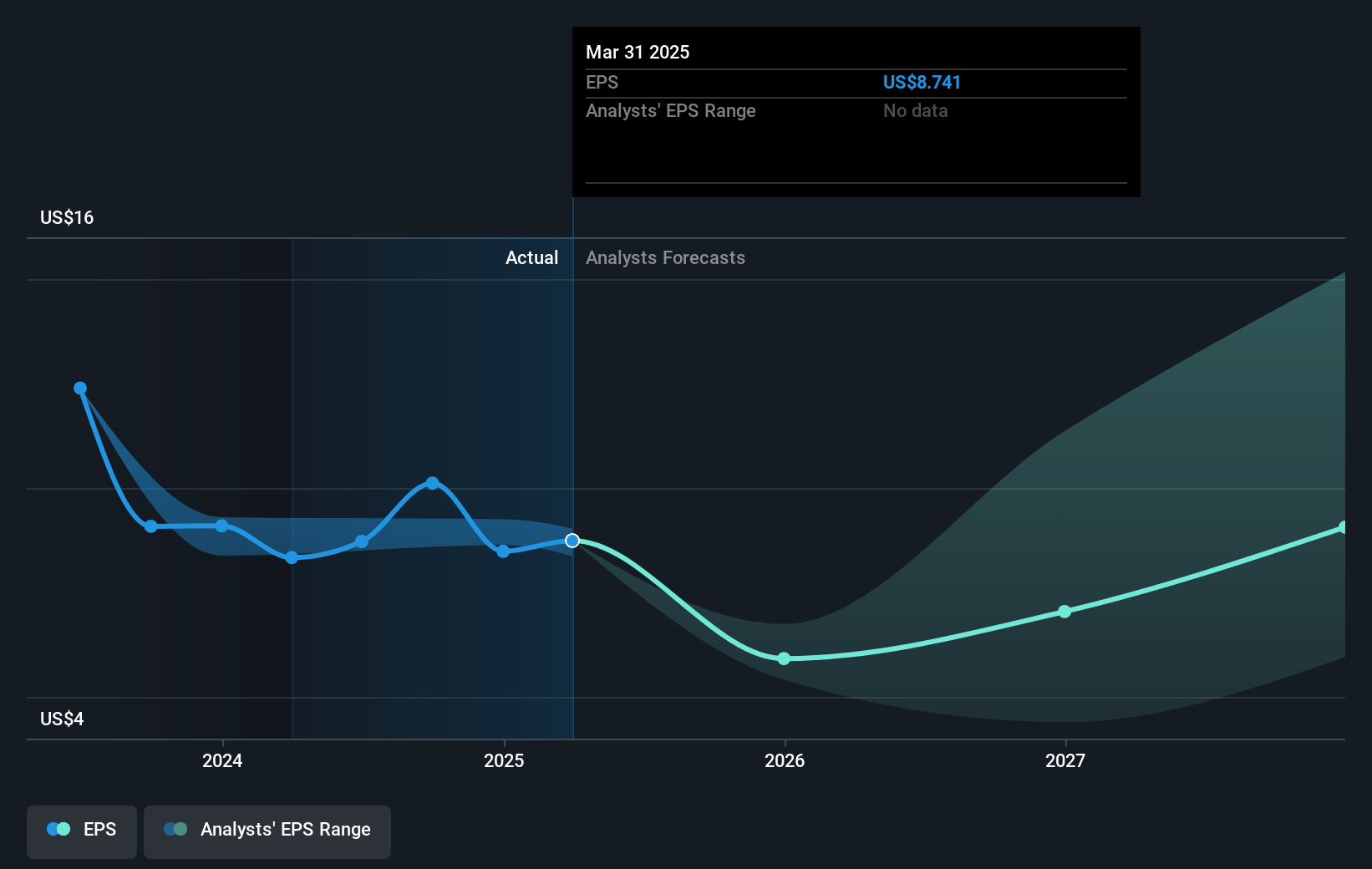

- The bullish analysts expect earnings to reach $722.0 million (and earnings per share of $22.01) by about April 2028, down from $838.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, up from 3.2x today. This future PE is lower than the current PE for the US Oil and Gas industry at 11.4x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.57%, as per the Simply Wall St company report.

Civitas Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Long-term global energy transition away from fossil fuels, combined with growing ESG investment constraints and regulatory pressure, threatens to structurally decrease oil and gas demand, which could lead to lower realized commodity prices and reduced revenue over time for Civitas Resources.

- Despite recent moves to diversify into the Permian Basin, Civitas Resources remains heavily exposed to regulatory and permitting risks in Colorado and the DJ Basin, increasing the threat of local opposition and stricter environmental policy, which could drive up operating costs and compress net margins.

- High base decline rates in the company’s shale assets require ongoing, capital-intensive drilling just to maintain production levels; if access to capital becomes more challenging due to industry consolidation trends or ESG divestment, production volumes and top-line revenue could decline.

- Structural cost inflation across labor, oilfield services, and winterization efforts—highlighted by recent LOE increases in the Permian—could erode the company’s low-cost structure advantage, resulting in pressured profit margins and weaker net earnings.

- Heightened industry consolidation could leave Civitas at a competitive disadvantage if forced to pursue acquisitions at high valuations or if limited scale curtails negotiating power, potentially resulting in shareholder dilution or reduced long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Civitas Resources is $73.55, which represents two standard deviations above the consensus price target of $48.0. This valuation is based on what can be assumed as the expectations of Civitas Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $77.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.3 billion, earnings will come to $722.0 million, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 9.6%.

- Given the current share price of $28.69, the bullish analyst price target of $73.55 is 61.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:CIVI. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.