Narratives are currently in beta

Key Takeaways

- Strategic fleet investments and aging global MR fleet could enhance trading flexibility and improve earnings, positively impacting revenue and net margins.

- Effective cost management and focus on regulatory adaptation aim to sustain revenue growth and improve financial resilience.

- Reliance on seasonal markets and an aging fleet, combined with geopolitical instability and high interest rates, pose significant risks to Ardmore Shipping's revenue and margins.

Catalysts

About Ardmore Shipping- Engages in the seaborne transportation of petroleum products and chemicals worldwide.

- Ardmore Shipping's strategic fleet investments, such as specialized tank coatings during regular drydockings in 2025, are expected to enhance trading flexibility and boost earnings, impacting revenue positively.

- The company benefits from an aging global MR fleet, with 50% set to scrap in the next 5 years, combined with a low order book, potentially leading to higher TCE rates and improved net margins.

- Entering the seasonally stronger winter market with 99% fleet on-hire availability positions Ardmore to capitalize on increased charter rates, potentially boosting earnings and free cash flow.

- The company's effective cost management, reducing cash breakeven levels to $11,500 per day, enhances financial resilience, potentially improving net margins and overall profitability.

- Ardmore's focus on leveraging supply-demand dynamics in the tanker market and adapting to evolving regulatory contexts, such as the Fuel EU Maritime regulation, aims to sustain revenue growth and financial performance.

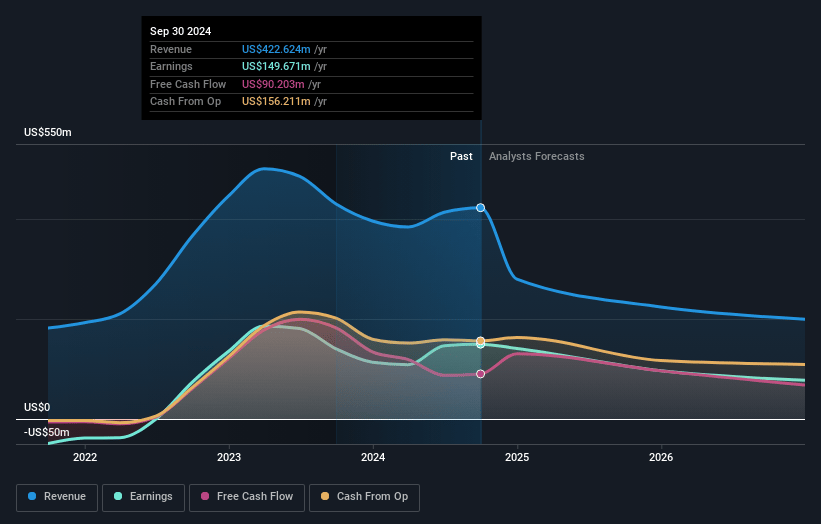

Ardmore Shipping Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ardmore Shipping's revenue will decrease by -22.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 35.4% today to 37.8% in 3 years time.

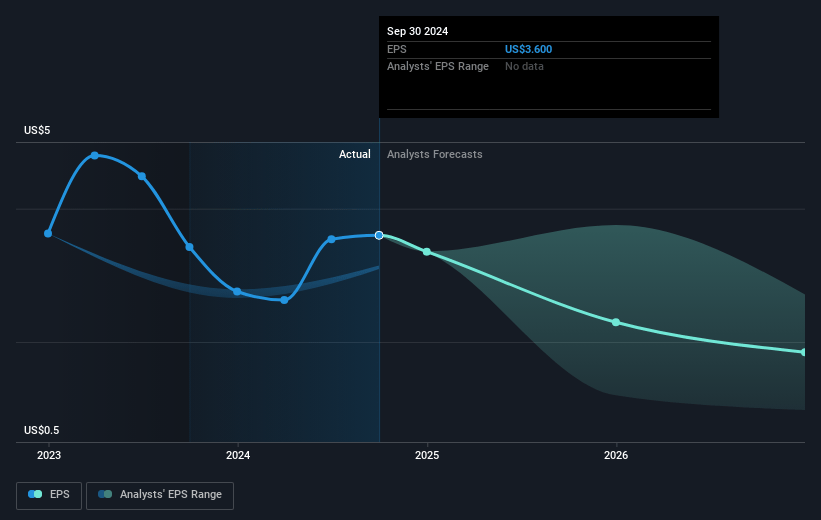

- Analysts expect earnings to reach $74.4 million (and earnings per share of $1.78) by about November 2027, down from $149.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $112.7 million in earnings, and the most bearish expecting $42 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.0x on those 2027 earnings, up from 3.4x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to decline by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

Ardmore Shipping Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on seasonal market trends, such as the stronger winter market, introduces volatility that could negatively impact day rates and revenue if the expected seasonal patterns do not materialize as forecasted.

- An aging fleet presents a risk, as over 50% of the global MR fleet will be over 20 years old and entering the scrapping window within the next five years, which could necessitate significant capital expenditure in fleet renewal, affecting net margins and cash flow.

- The geopolitical instability, such as the ongoing conflict between Russia and Ukraine and the EU embargo on refined products, while currently advantageous, could also introduce risk if geopolitical dynamics shift, potentially disrupting current shipping routes and impacting revenue and earnings.

- The high interest rate environment presents a financial burden that, if it persists, could strain profitability and cash flow, especially when considering the company’s need to balance debt reduction with capital investments.

- Investment in fleet enhancements and compliance with new regulations like Fuel EU Maritime involve significant capital expenditure, potentially impacting net margins if the expected return on these investments does not materialize or if operational costs exceed forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.2 for Ardmore Shipping based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $196.5 million, earnings will come to $74.4 million, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 7.1%.

- Given the current share price of $11.94, the analyst's price target of $19.2 is 37.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives