Key Takeaways

- Strategic expansion in industrial gas, focusing on CO2 and helium, and transition to manufacturing phase aim to boost revenue and margin growth.

- Strong financial discipline with asset monetization and share buybacks support a stable and profitable growth trajectory, enhancing market competitiveness.

- Delays and challenges in projects, regulatory approvals, and market volatility could affect U.S. Energy's revenue, profits, and financial stability.

Catalysts

About U.S. Energy- An independent energy company, focuses on the acquisition, exploration, and development of industrial gas, and oil and natural gas properties in the continental United States.

- U.S. Energy's strategic focus on the Montana industrial gas project, particularly the CO2 dominant pay zones and significant helium concentrations, is expected to drive future revenue growth. The expansion of its land holdings and the plan to drill and complete multiple wells in 2025 are aimed at substantial resource development that will underpin this growth.

- The anticipated move to a manufacturing phase of the gas processing plant once well operations provide sufficient data indicates potential for increased processing capacity. This initiative is likely to enhance net margins due to efficient gas production and processing operations, benefiting from economies of scale.

- The development of carbon sequestration capabilities aligned with federal incentives could position U.S. Energy as a leader in industrial gas production with an environmental edge, supporting a stronger market position and driving sustainable revenue streams.

- The strategic monetization of legacy oil and gas assets, enabling debt elimination and funding of core projects, indicates a strong financial management approach that can positively impact earnings. This capital discipline allows investments in high-return opportunities without diluting shareholder value.

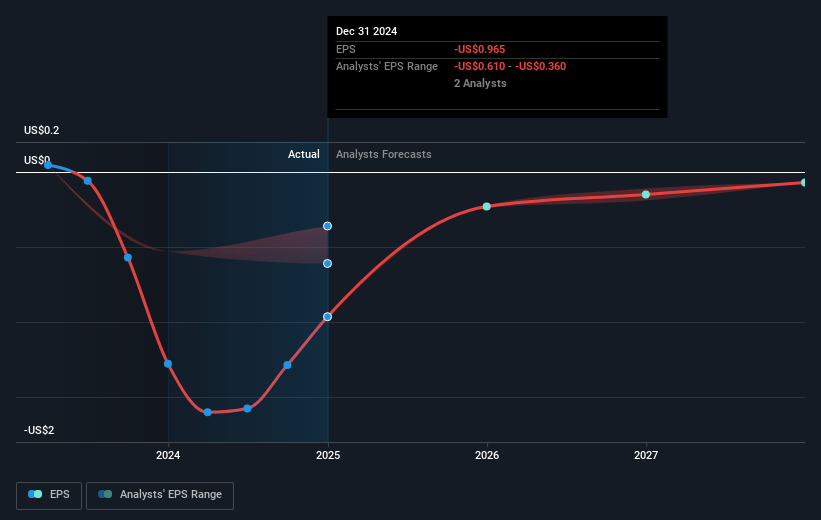

- Share repurchase programs and insider stock accumulations suggest confidence in undervaluation, enhancing earnings per share (EPS) potential as these buybacks reduce the overall share count, amplifying the effect of future earnings on a per-share basis.

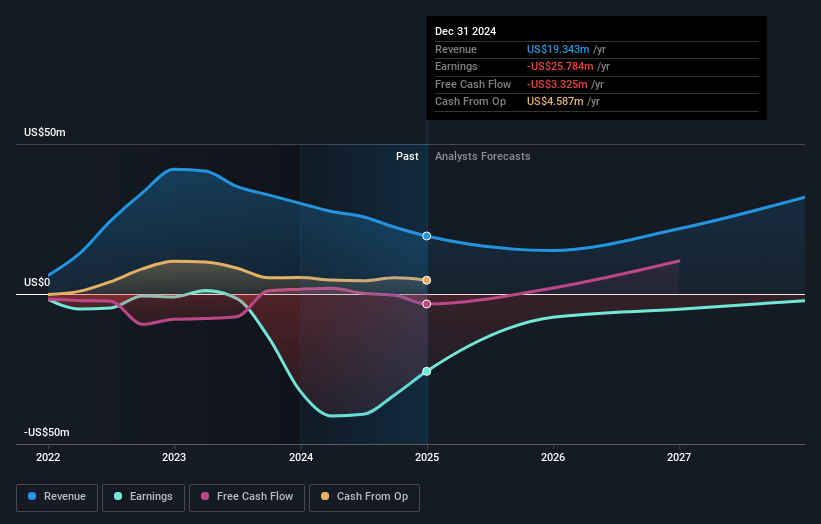

U.S. Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming U.S. Energy's revenue will grow by 18.6% annually over the next 3 years.

- Analysts are not forecasting that U.S. Energy will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate U.S. Energy's profit margin will increase from -133.3% to the average US Oil and Gas industry of 14.7% in 3 years.

- If U.S. Energy's profit margin were to converge on the industry average, you could expect earnings to reach $4.7 million (and earnings per share of $0.12) by about May 2028, up from $-25.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.5x on those 2028 earnings, up from -1.5x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.54%, as per the Simply Wall St company report.

U.S. Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The harsh winter conditions in Montana delayed operational efforts, which might continue affecting project timelines, potentially impacting U.S. Energy's revenue and earnings expectations.

- Decline in total oil and gas sales from $7.3 million to $4.2 million year-over-year, due in part to divestitures; this could result in lower overall revenue while transitioning into new projects.

- Significant reliance on a single project (Montana industrial gas) could expose the company to high operational and financial risks if projections are not met, which can impact future earnings and net margins.

- Current market volatility and helium price fluctuations could affect the offtake agreements and revenue generated from the industrial gas segment.

- The necessity to secure Class II injection permits and federal MRV approvals could present regulatory challenges or delays, affecting the company's ability to leverage federal incentives, impacting cash flow and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.917 for U.S. Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.5, and the most bearish reporting a price target of just $2.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $32.3 million, earnings will come to $4.7 million, and it would be trading on a PE ratio of 30.5x, assuming you use a discount rate of 6.5%.

- Given the current share price of $1.12, the analyst price target of $2.92 is 61.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.