Key Takeaways

- Significant debt reduction improves cash flow and earnings, setting a strong financial base for future growth.

- Focus on fleet modernization and new revenue streams positions the company for enhanced profitability and stable growth.

- Geopolitical instability and regulatory changes could negatively impact StealthGas's revenue, costs, and profitability amid reliance on volatile maritime trade and period charters.

Catalysts

About StealthGas- Provides seaborne transportation services to liquefied petroleum gas (LPG) producers and users worldwide.

- The company has been significantly deleveraging, reducing its debt to just $50 million and becoming essentially net debt free. This reduction in debt allows for faster cash flow accumulation and reduced interest expenses, positively impacting future earnings.

- StealthGas has secured over $200 million in future revenues with high period coverage for 2025, ensuring a stable and predictable revenue stream that can support future growth in earnings and profitability.

- The potential growth in ammonia trades, using handysize and medium gas carriers (MGCs), suggests a new revenue stream that could drive high margins due to increased demand for alternative fuels and cleaner energy solutions, enhancing future net margins.

- The company's strategic focus on fleet modernization, including the incorporation of two new medium gas carriers with higher earnings capacity, positions it well for increased revenue and net profitability as demand grows for larger and more efficient vessels.

- The renewed share repurchase program with authorization to buy back up to $10.5 million in shares is likely to increase earnings per share (EPS) by reducing the share float, making the stock more attractive and potentially increasing its valuation.

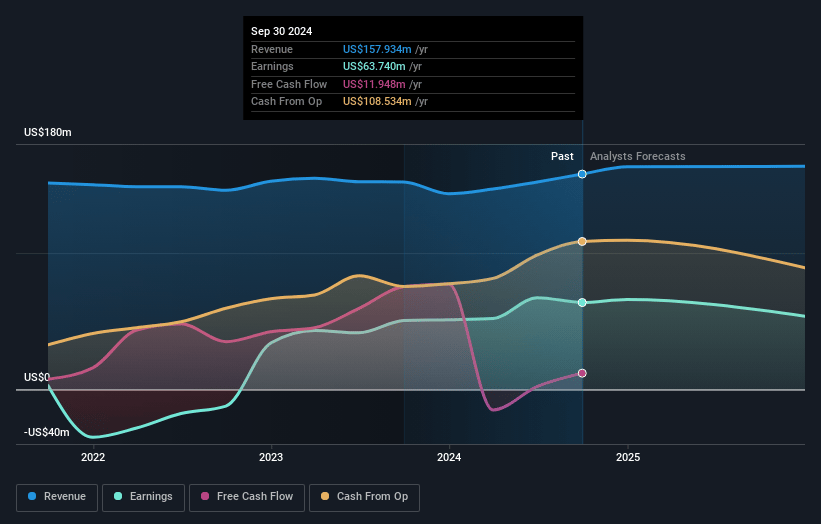

StealthGas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming StealthGas's revenue will decrease by 0.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 41.8% today to 29.6% in 3 years time.

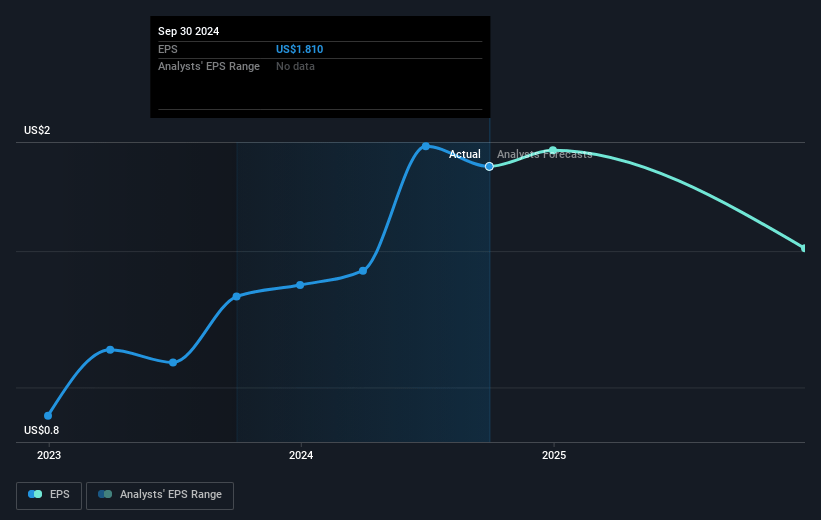

- Analysts expect earnings to reach $50.3 million (and earnings per share of $1.38) by about April 2028, down from $69.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, up from 2.7x today. This future PE is lower than the current PE for the US Oil and Gas industry at 11.4x.

- Analysts expect the number of shares outstanding to grow by 0.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.76%, as per the Simply Wall St company report.

StealthGas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The geopolitical situation in the Middle East and the ongoing Russia-Ukraine conflict could affect the safety and efficiency of maritime routes, impacting revenue stability and potentially increasing costs.

- Regulatory changes in Europe regarding carbon emissions and fuel consumption could lead to increased operational expenses, negatively impacting net margins.

- While the company heavily relies on period charters, the volatility and unpredictability of the spot market can affect revenue generation, especially if there are fewer long-term contracts during economic downturns.

- The high order book ratio of medium gas carriers (MGC) could lead to overcapacity issues if the demand does not keep pace, potentially reducing earnings in the future.

- Potential U.S.-China trade tensions may disrupt U.S. LPG exports, impacting revenues and overall profitability for shipping companies reliant on stable transpacific LPG trade.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.0 for StealthGas based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $170.3 million, earnings will come to $50.3 million, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 10.8%.

- Given the current share price of $5.09, the analyst price target of $10.0 is 49.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.