Key Takeaways

- Integration of operations and improved performance are expected to achieve significant synergies, improving margins and reducing expenses to boost earnings.

- Strategic investments and infrastructure enhancements position the company to capitalize on LNG demand, optimizing revenue from premium markets and improving free cash flow.

- The strategy's dependence on natural gas market conditions and expansions presents risks to cash flow, margins, and earnings amid potential volatility and infrastructure challenges.

Catalysts

About Expand Energy- Operates as an independent natural gas production company in the United States.

- The company aims to expand its productive capacity by investing in additional infrastructure, allowing it to deliver 7.5 Bcf per day in 2026 if market conditions are favorable. This strategy positions the company to optimize free cash flow at mid-cycle prices.

- By integrating operations and enhancing drilling performance, Expand Energy expects to achieve significant annual synergies, reaching $400 million in 2025 and the full $500 million target by 2026. These efficiencies are expected to improve net margins and reduce capital expenses, boosting earnings.

- The company has a strong financial foundation, with plans to reduce net debt to less than $4.5 billion by the end of 2025 through strategic use of free cash flow for debt reduction, while also maintaining a focus on returning cash to shareholders. This could enhance net income and stabilize earnings through reduced interest expenses.

- Expand Energy is strategically positioned to capitalize on increasing demand for LNG, with 2.5 Bcf per day of transportation capacity directly connected to the growing LNG corridor. This could lead to higher revenue from premium markets and diversified sales channels.

- The company aims to optimize marketing strategies and transportation efficiencies, potentially increasing revenue streams and further enhancing free cash flow. The development of a robust marketing and trading program under new leadership could create additional earnings opportunities.

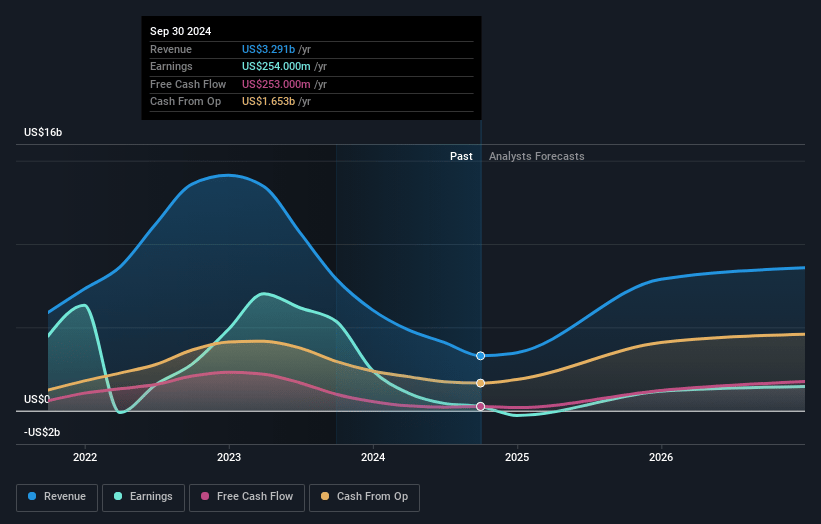

Expand Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Expand Energy's revenue will grow by 31.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -16.8% today to 20.6% in 3 years time.

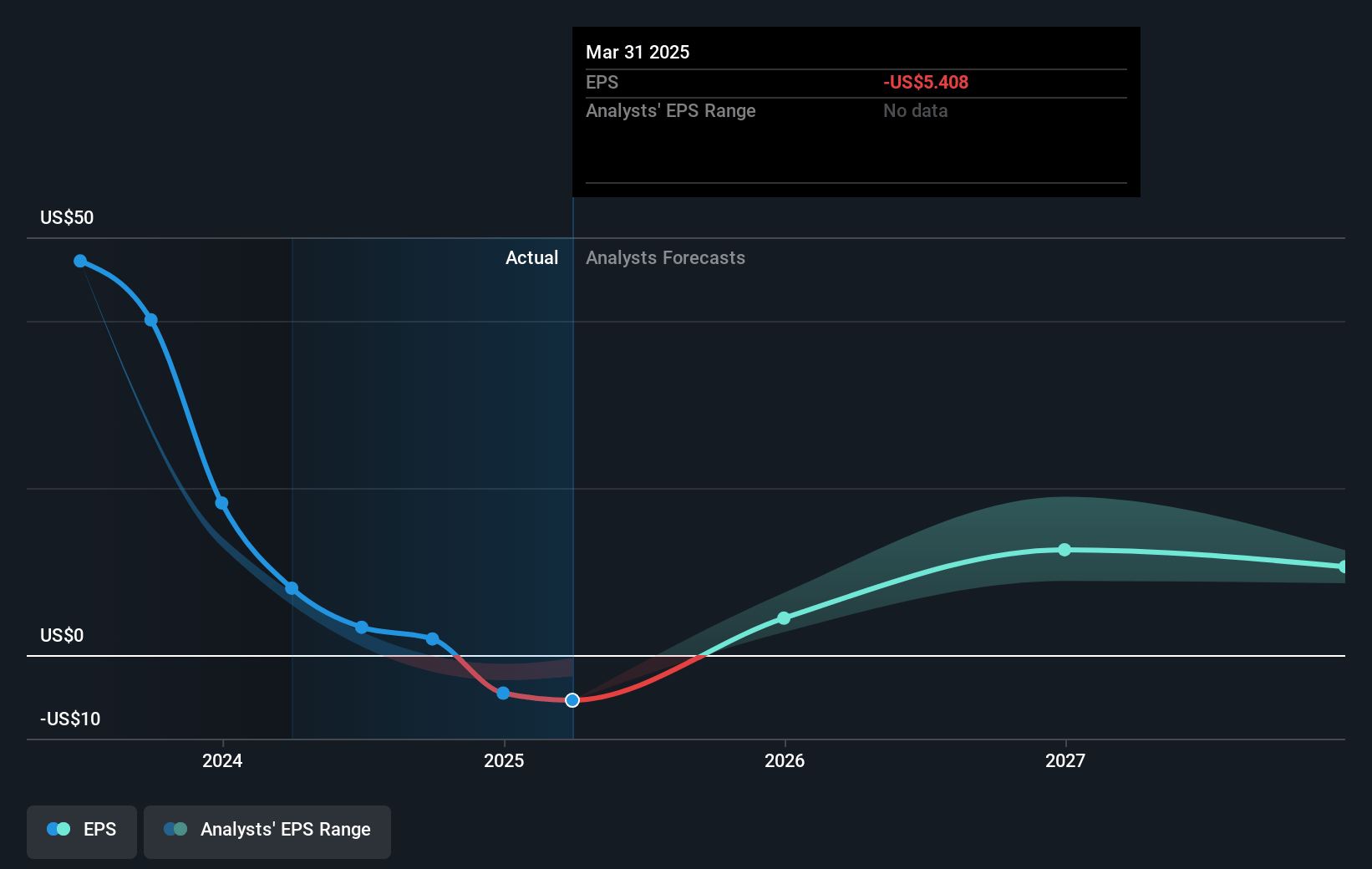

- Analysts expect earnings to reach $2.0 billion (and earnings per share of $8.98) by about April 2028, up from $-714.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.8 billion in earnings, and the most bearish expecting $1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.5x on those 2028 earnings, up from -33.6x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.92%, as per the Simply Wall St company report.

Expand Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Incremental capital investments hinge on assumptions for natural gas market conditions, and should these assumptions not materialize as expected, this could lead to inefficiencies or overcapacity, negatively impacting free cash flow and net margins.

- While targeting synergies, the anticipated cost reductions of $500 million by 2026 involve execution risks that, if not realized, could affect the company’s operating costs and future earnings.

- The marketing strategy depends significantly on LNG export growth and domestic power demand, which, if less robust than predicted, could lead to lower than expected revenues and free cash flow.

- Despite strong capital efficiency, the company's strategy remains heavily exposed to natural gas prices, and the risk of price volatility could lead to fluctuations in earnings and cash flow.

- Expanding production capacity in both Haynesville and Appalachia carries infrastructure and takeaway risks, especially in Appalachia, which could limit the ability to optimize production levels and affect revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $123.63 for Expand Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $170.0, and the most bearish reporting a price target of just $100.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.7 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 21.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $103.01, the analyst price target of $123.63 is 16.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.