Last Update01 May 25

Key Takeaways

- Strategic partnerships and supportive policies are expected to significantly enhance Clean Energy's revenue growth through increased RNG adoption and fuel volumes.

- Upcoming RNG production projects and energy credit approvals could strengthen Clean Energy's financial position and earnings from 2026 onwards.

- Expiration of tax credits, declining RIN prices, and regulatory uncertainties harm revenue outlook, while facility exits could exacerbate financial losses and hurt investor confidence.

Catalysts

About Clean Energy Fuels- Offers natural gas as alternative fuels for vehicle fleets and related fueling solutions in the United States and Canada.

- The anticipated adoption of the X15N Cummins engine in 2025 is expected to catalyze growth for Clean Energy Fuels by attracting heavy-duty trucking fleets to switch to RNG, potentially increasing fuel volumes and revenue.

- The federal and state policies are expected to become more supportive of RNG solutions, which could enhance the business environment and drive revenue growth through broader RNG adoption.

- There are significant RNG production projects underway, including expansions with Maas Energy and new projects at dairy farms, expected to increase RNG supply and revenue as they come online, mainly impacting earnings from 2026 onwards.

- Clarifications and final approvals of energy credits like the 45Z and potential reinstatement of the AFTC could significantly enhance Clean Energy's financial position by unlocking additional revenue streams related to RNG production.

- Strategic partnerships with large trucking and transportation companies like FedEx and agreements for future RNG adoption in varied sectors could bolster long-term revenue growth, driving higher earnings over time.

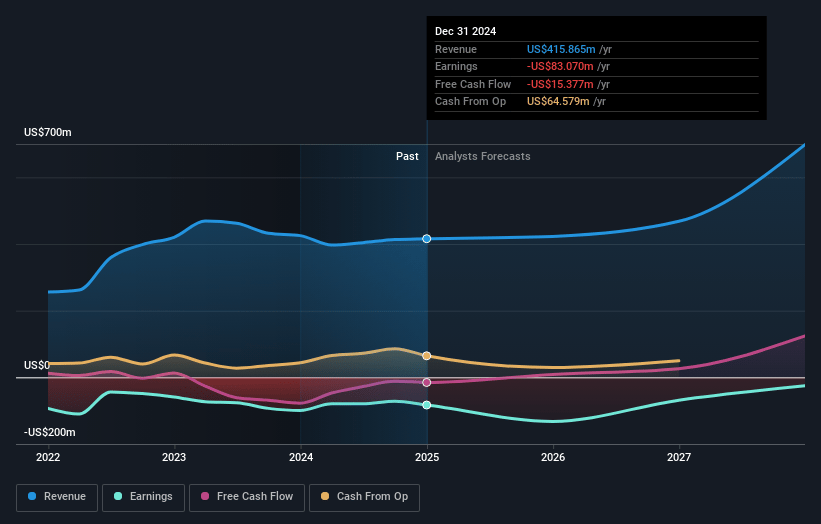

Clean Energy Fuels Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Clean Energy Fuels's revenue will grow by 8.6% annually over the next 3 years.

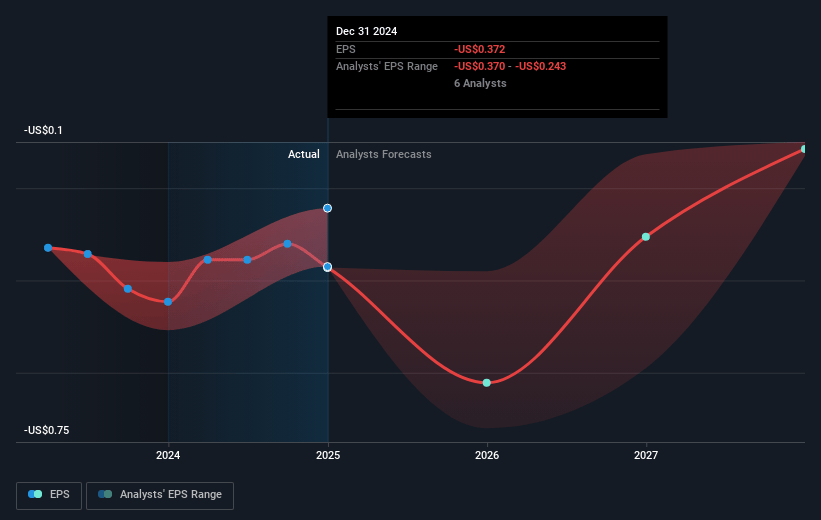

- Analysts are not forecasting that Clean Energy Fuels will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Clean Energy Fuels's profit margin will increase from -20.0% to the average US Oil and Gas industry of 14.7% in 3 years.

- If Clean Energy Fuels's profit margin were to converge on the industry average, you could expect earnings to reach $78.2 million (and earnings per share of $0.35) by about May 2028, up from $-83.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.5x on those 2028 earnings, up from -3.9x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.54%, as per the Simply Wall St company report.

Clean Energy Fuels Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The expiration of the alternative fuel tax credit (AFTC) at the end of last year, which contributed nearly $24 million to 2024 results, is not included in the 2025 financial outlook, potentially impacting future revenues and earnings.

- RIN prices are projected to decline by 30% compared to higher values in 2024, which, along with volatility in the renewable fuel credits market, can reduce revenues by approximately $10 million in 2025.

- The regulatory and policy uncertainties surrounding the 45Z Clean Fuel Production Credit, which is still pending finalization, contribute to revenue uncertainty, as the rules could significantly affect potential earnings from low-carbon fuel production.

- The potential exit from 55 Pilot Flying J locations, where mainly LNG equipment is housed, is predicted to result in non-cash write-downs and operational savings, affecting net margins and earnings negatively due to increased depreciation expenses.

- The company reported a GAAP net loss of $83.1 million in 2024, including significant noncash expenses. This weak financial performance, coupled with a conservative 2025 outlook lacking in environmental credits like AFTC and 45Z, risks impacting investor confidence in future financial health and earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.144 for Clean Energy Fuels based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $532.5 million, earnings will come to $78.2 million, and it would be trading on a PE ratio of 22.5x, assuming you use a discount rate of 8.5%.

- Given the current share price of $1.45, the analyst price target of $6.14 is 76.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.