Narratives are currently in beta

Key Takeaways

- Strategic asset restructuring and modernization in key regions could boost revenue, earnings, and cash flow through increased production and efficiency.

- Future projects and cost reductions aim to improve margins and cash flow, supporting stronger financial performance and growth potential.

- Ceasing North Sea production, declining oil volumes, and capital investment freeze may pressure APA's revenue and long-term cash flow generation.

Catalysts

About APA- An independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids.

- APA's substantial acquisition and divestiture activities have transformed its asset base, resulting in a more focused, unconventional pure-play Permian operation, doubling unconventional production and extending inventory duration, which could potentially boost revenue and earnings.

- The modernization and extension of Egypt PSC terms, alongside new gas price agreements, enhances capital allocation efficiency and operational flexibility, potentially increasing future free cash flow and net margins.

- The final investment decision (FID) for the GranMorgu project in Suriname positions APA for strong future oil production growth with attractive economics; this project can be funded through operating cash flow, potentially enhancing future revenues and earnings.

- The integration of Callon, reduction of Permian rig count, and achievement of cost synergies contribute to improved cash flow resilience and lower per unit costs, supporting higher net margins in the foreseeable future.

- APA's 2025 outlook targets a reduction in per-unit LOE, G&A, GPT, and interest costs by 10-15%, alongside running a consistent rig program, potentially translating to improved margins and cash flow generation.

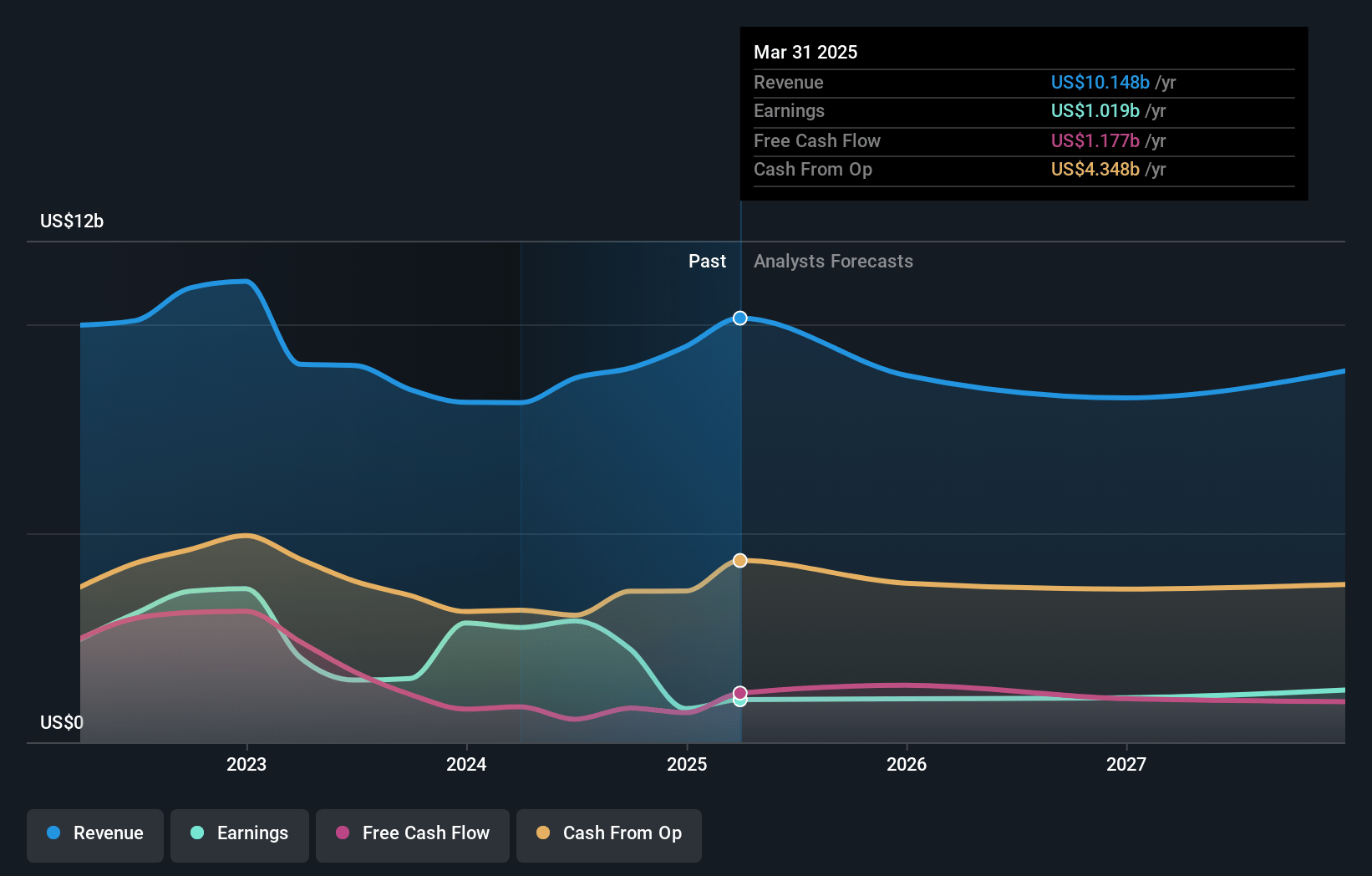

APA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming APA's revenue will decrease by -2.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 24.8% today to 14.1% in 3 years time.

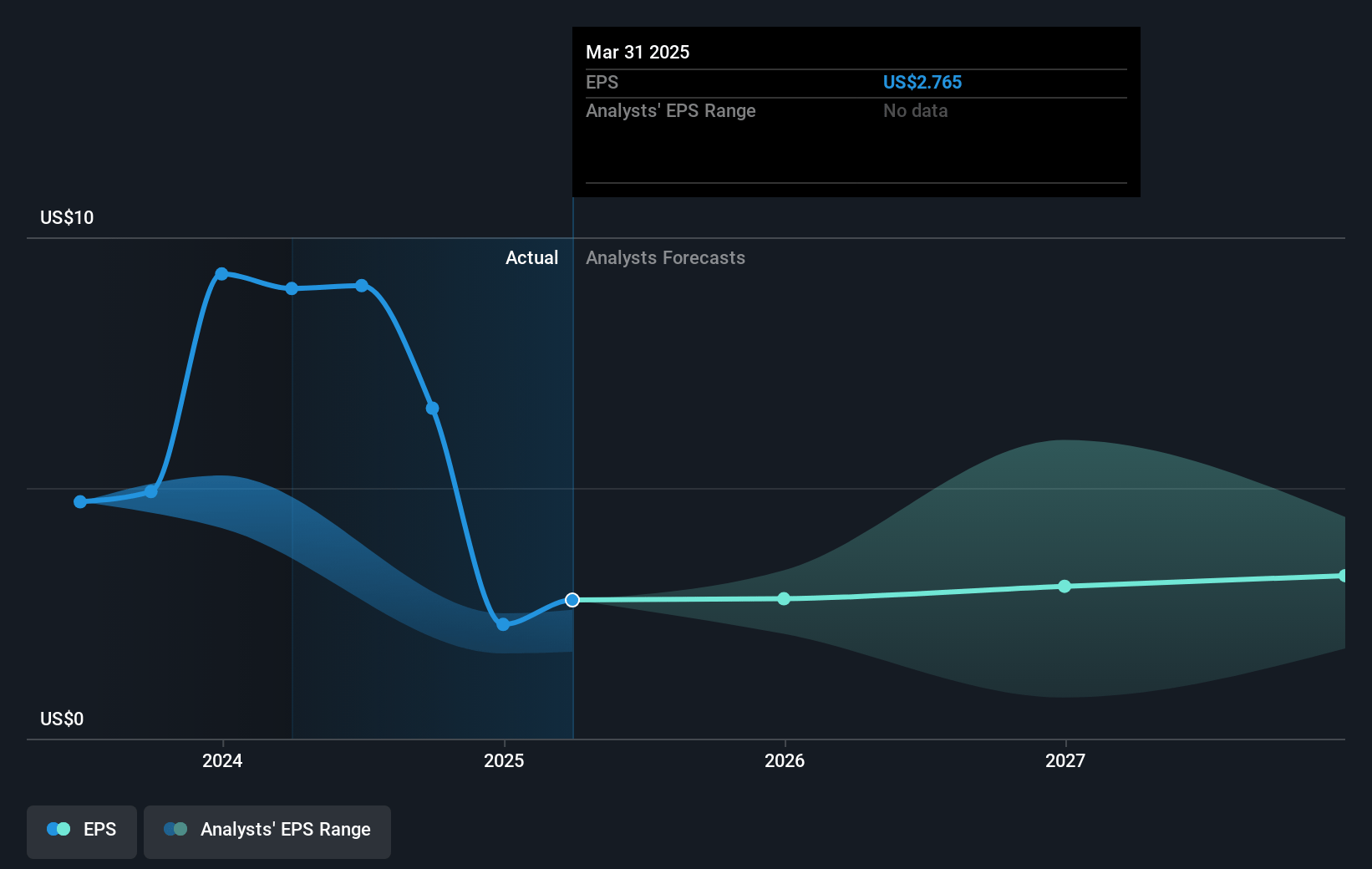

- Analysts expect earnings to reach $1.2 billion (and earnings per share of $3.32) by about November 2027, down from $2.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.9 billion in earnings, and the most bearish expecting $498 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.2x on those 2027 earnings, up from 3.6x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to decline by 1.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.78%, as per the Simply Wall St company report.

APA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decision to cease all production in the North Sea by December 31, 2029, due to regulatory requirements and financial impacts, could result in asset impairments and increased abandonment obligations, affecting depreciation, depletion, and amortization expenses.

- The decline in gross oil volumes in Egypt and the slight decline in North Sea production could put pressure on overall production levels, potentially impacting revenue and cash flow.

- The curtailment of high-volume, high GOR oil wells and weaker-than-expected regional gas prices may affect short-term revenue generation, especially in the Permian Basin.

- Challenges in the Egyptian gas market, including reliance on new gas-focused exploration to offset existing declines, introduce uncertainty into future production and cash flow predictions.

- The planned freeze on capital investment in the North Sea, focusing solely on free cash flow, could see reduced long-term production and revenues from these assets, posing a risk to sustained cash flow generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $34.04 for APA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $49.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $8.3 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 8.8%.

- Given the current share price of $21.87, the analyst's price target of $34.04 is 35.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives