Key Takeaways

- Expansion into Suriname and Egypt positions APA for diversified, resilient earnings growth as global energy demand shifts and natural gas rises in prominence.

- Portfolio optimization, cost discipline, and improved credit rating enable higher margins, better capital returns, and long-term share price support.

- APA faces long-term revenue risks from declining oil and gas demand, regulatory pressures, geopolitical instability, high debt, and growing ESG-driven divestment trends.

Catalysts

About APA- An independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids.

- The ramp-up of Suriname offshore oil production will add a major new growth engine with first oil expected in 2028, which is set to underpin a significant step-change in free cash flow and earnings as production volumes rise and risk is de-risked, directly supporting bullish long-term revenue projections.

- APA’s increased investment in natural gas exploration and production in Egypt—now supported by improved gas pricing agreements—positions the company to capture the rising role of natural gas in global energy demand, benefitting from macro trends like energy security needs and the transition from coal to gas, resulting in a more resilient and diversified earnings base.

- Sustained global demand for reliable oil and gas, fueled by population growth and industrialization in developing markets, provides a long runway for APA’s core production assets in the Permian Basin and Egypt; these dynamics point to steady or rising revenues as oil, gas, and related product consumption remain essential to world markets.

- Company-wide portfolio optimization, disciplined capital allocation, and aggressive cost reduction initiatives—including at least $350 million in annualized cost savings targeted by 2027—are expected to drive meaningfully higher net margins and free cash flow per share, especially as these efforts are coupled with technology-driven productivity gains.

- Industry consolidation and APA’s newly achieved investment-grade credit rating enhance capital discipline and improve access to funding; together, these strengthen the company’s ability to return capital to shareholders through growing dividends and substantial buybacks, fueling higher EPS and supporting long-term share price appreciation.

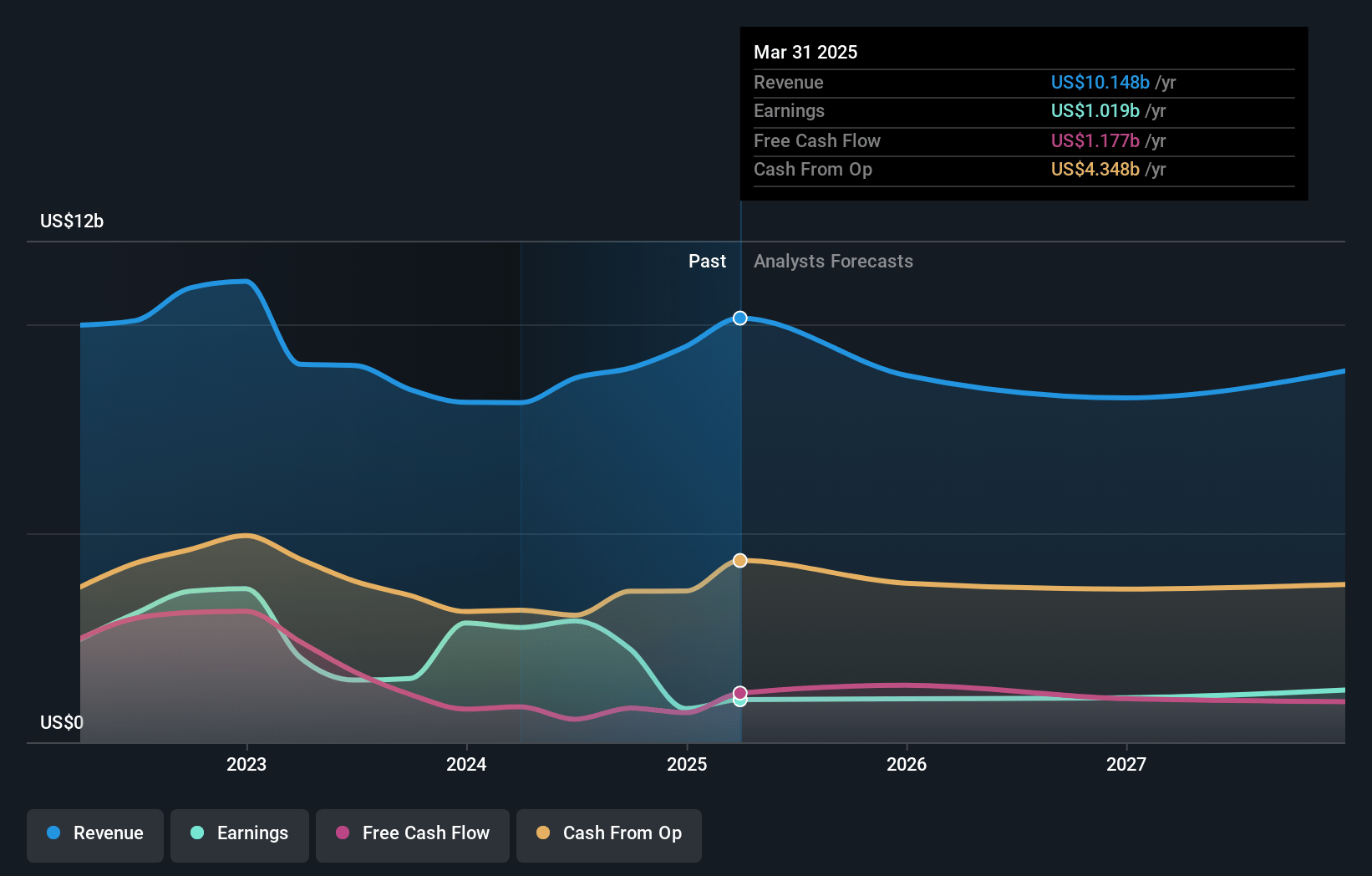

APA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on APA compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming APA's revenue will decrease by 0.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.5% today to 14.8% in 3 years time.

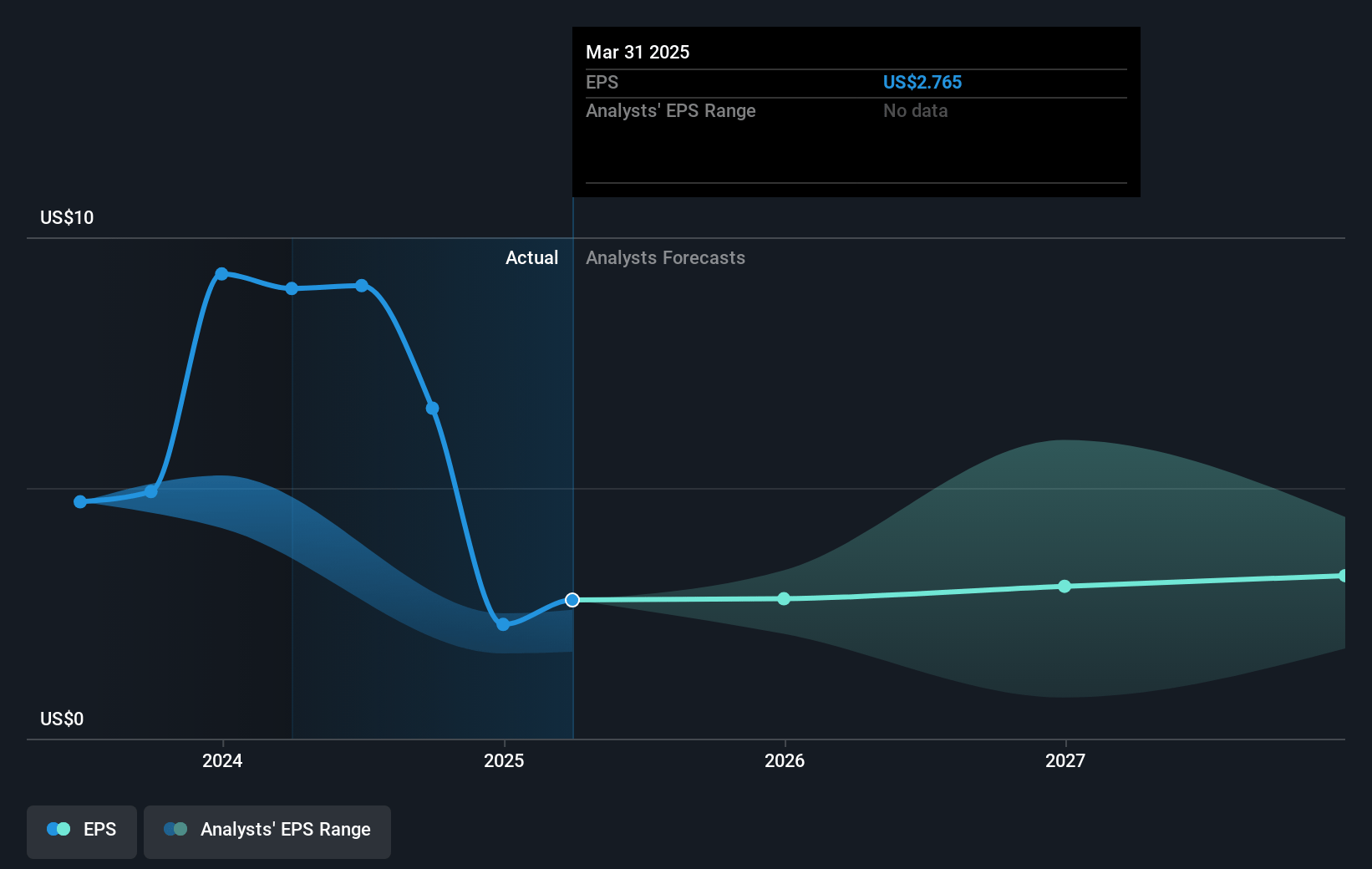

- The bullish analysts expect earnings to reach $1.4 billion (and earnings per share of $3.9) by about April 2028, up from $804.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.6x on those 2028 earnings, up from 7.2x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.4x.

- Analysts expect the number of shares outstanding to decline by 1.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.55%, as per the Simply Wall St company report.

APA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- APA remains highly exposed to long-term declines in global oil and gas demand due to the accelerating energy transition toward renewables and electrification, which could significantly weaken future revenues and impair the value of its core assets in the Permian, Egypt, and Suriname.

- The company faces increasing regulatory and policy risks from expanding international climate action, including carbon taxes and emission restrictions, particularly in Europe and the United States, which may drive up operational costs and compress net margins over the long term.

- APA’s heavy concentration of production and reserves in Egypt and Suriname means it is vulnerable to political instability and regional disruptions, posing ongoing risks to output consistency and leading to potential revenue volatility or unexpected cost escalations.

- Persistent high leverage and sizable long-term debt, despite recent balance sheet improvements, continue to limit APA's investment flexibility and could result in higher interest expenses and refinancing risks, directly weighing on long-term earnings and cash flow generation.

- Industry-wide ESG pressures and the global divestment trend from hydrocarbons threaten APA’s access to capital markets and may lead to downward pressure on its stock valuation and credit ratings, undermining shareholder value and the company’s ability to fund operations and future growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for APA is $36.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of APA's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $36.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $9.2 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 8.5%.

- Given the current share price of $15.86, the bullish analyst price target of $36.0 is 55.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:APA. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

Suriname Development And Cost Savings To Improve Production Outlook