Narratives are currently in beta

Key Takeaways

- Sysco's initiatives, like Total Team Selling and strategic sourcing, aim to enhance revenue, gross margins, and improve operational efficiency.

- International growth and facility investments are key strategies to boost market presence, operational capacity, and long-term profitability.

- Declining restaurant traffic and compensation challenges, coupled with unfavorable customer mix, may hinder Sysco's revenue and earnings growth amidst uncertain economic conditions.

Catalysts

About Sysco- Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

- Sysco's leadership expects an acceleration in Total Team Selling, which integrates specialty products with existing Broadline customers, increasing revenue potential significantly as these customers typically spend more with Sysco when they purchase across different categories. This is likely to impact revenue positively.

- Strategic sourcing efforts are expected to contribute significantly to gross margins, especially in the second half of the fiscal year, by improving supplier negotiations and leveraging Sysco's purchasing scale more effectively. This will likely improve gross profit margins.

- The introduction of a new sales consultant compensation model is expected to motivate increased performance and customer acquisition, thus driving higher volume and revenue growth in the local sales business. Enhanced sales effectiveness could support revenue and improve net margins due to higher operational efficiency.

- Sysco's international segment shows promise, with strong top-line growth and a robust plan to introduce higher-margin categories and enhance operational efficiencies, expected to bolster international earnings growth and drive positive operating leverage.

- Investment in new facilities like those in Allentown, Pennsylvania, and Los Angeles for Sysco Broadline and Greco businesses, respectively, is expected to provide the capacity needed to attract new customers and support long-term revenue growth. Enhanced operational capabilities could improve earnings by allowing Sysco to serve more customers efficiently.

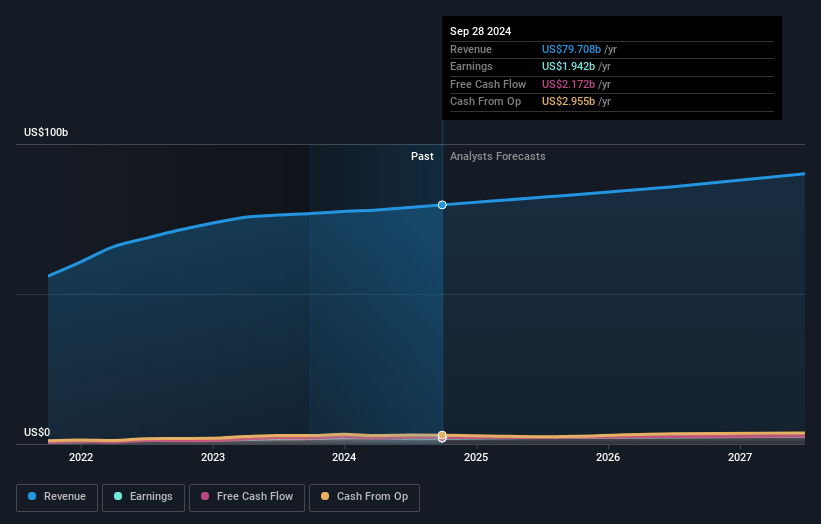

Sysco Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sysco's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.4% today to 2.9% in 3 years time.

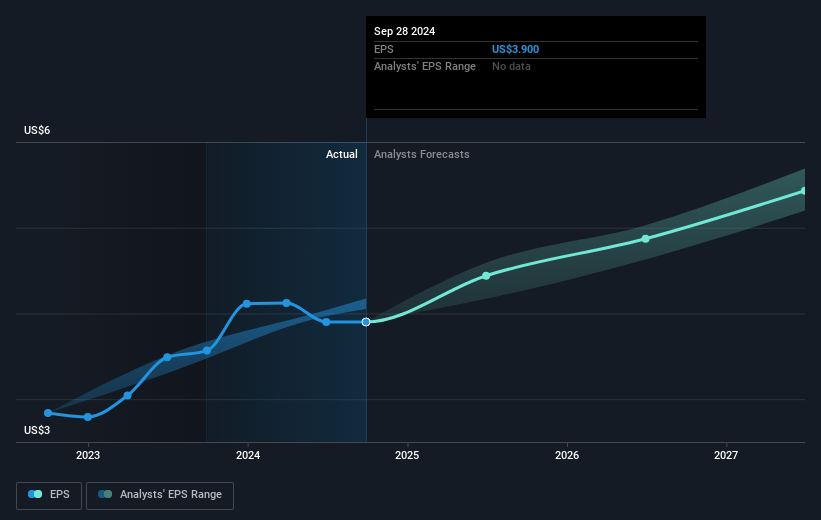

- Analysts expect earnings to reach $2.6 billion (and earnings per share of $5.52) by about November 2027, up from $1.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2027 earnings, down from 19.4x today. This future PE is lower than the current PE for the US Consumer Retailing industry at 22.0x.

- Analysts expect the number of shares outstanding to decline by 1.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.17%, as per the Simply Wall St company report.

Sysco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A decline in food traffic to restaurants, which was down 3.6% for the first quarter, could negatively impact Sysco's revenue from the food-away-from-home sector.

- Challenges in increasing local sales volume, which only grew 0.2%, may hinder overall revenue growth if not addressed, especially compared to stronger national sales that could compress margins.

- A decrease in gross profit margin by 27 basis points compared to 2024, driven by unfavorable customer mix and timing of strategic sourcing benefits, may impact net margins if not improved.

- Transition issues related to changes in sales consultant compensation and turnover could temporarily disrupt sales efforts and slow revenue growth.

- Uncertainty in macroeconomic conditions and industry dynamics, such as potential further decline in restaurant foot traffic, could pose risks to projected volume and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $84.08 for Sysco based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $91.0 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 6.2%.

- Given the current share price of $76.66, the analyst's price target of $84.08 is 8.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives