Key Takeaways

- Strong investment in digital platforms, delivery, and private label brands positions Kroger to capture growth from online shopping and premium health trends.

- Enhanced cost controls, automation, and store expansion are expected to drive higher efficiency, profit margins, and market reach in evolving consumer landscapes.

- Unprofitable e-commerce, store rebalancing, rising labor costs, intense competition, and heavy investment needs could pressure margins, cash flow, and future earnings growth.

Catalysts

About Kroger- Operates as a food and drug retailer in the United States.

- The rapid growth in Kroger's e-commerce business-highlighted by a 15% YoY increase and strong improvements in delivery-suggests significant upside potential as more consumers shift to online grocery shopping; ongoing investment in unified digital platforms and fulfillment operations is expected to drive future revenue growth and accelerate profit improvement as the business scales.

- Kroger's continued focus on fresh and health-oriented offerings, including expansion of its Simple Truth and Private Selection lines (with 80 new protein products targeting current consumer trends), positions it to benefit from heightened consumer emphasis on health and premiumization-supporting larger basket sizes, higher gross margins, and improved earnings quality over time.

- Planned acceleration in new store openings and major remodeling projects, especially in high-growth geographies, should extend Kroger's urban and local market reach, capitalizing on demographic shifts like urbanization and an aging population-fueling same-store sales and total company revenue.

- Aggressive cost optimization efforts-including further supply chain automation, adoption of AI and data analytics for shrink reduction, and a comprehensive review of store performance-are expected to enhance operational efficiency, reduce costs, and support margin expansion, bolstering long-term profitability.

- Expansion and outperformance of Kroger's private label brands are increasing mix toward higher-margin offerings, providing resilience against inflation and private label growth industry-wide, thus supporting gross margin stability and stronger net earnings even as price competition intensifies.

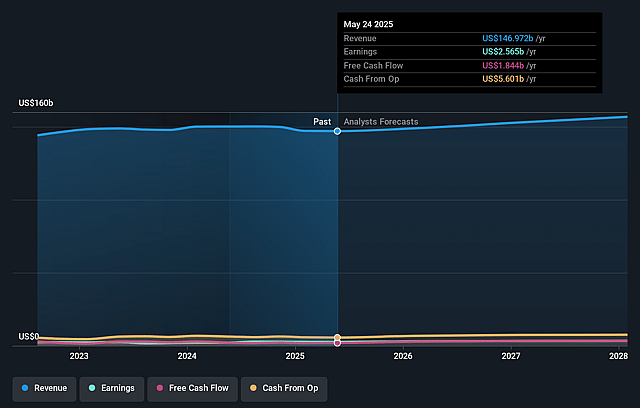

Kroger Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kroger's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.7% today to 2.1% in 3 years time.

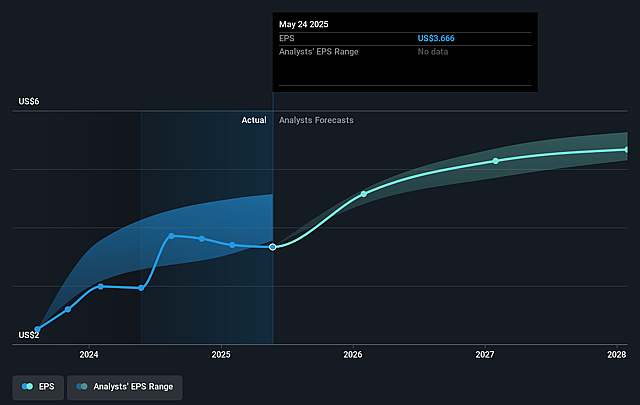

- Analysts expect earnings to reach $3.3 billion (and earnings per share of $5.38) by about September 2028, up from $2.6 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $3.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, down from 17.4x today. This future PE is lower than the current PE for the US Consumer Retailing industry at 21.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.69%, as per the Simply Wall St company report.

Kroger Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite recent strong growth in e-commerce sales, Kroger's e-commerce segment remains unprofitable, and management acknowledged "a lot of work to do" before reaching profitability; if the shift to digital grocery continues and profitability lags, this could create a long-term drag on net margins and overall earnings.

- The company is accelerating new store openings but simultaneously closing around 60 underperforming stores; this shift in physical store footprint, especially amid changing demographics and consumer preferences, indicates risk of declining revenue from certain large-format stores and potential underutilization of assets in non-growth geographies.

- Intensifying competition from discounters, big-box retailers, and smaller local brands, combined with ongoing consumer demand for value and increased use of promotions, could constrain Kroger's pricing power and put continued pressure on gross margins and net revenues.

- Persistent wage inflation, contractual increases in labor and benefit costs, and union activity (including a recent strike in Colorado) point to rising OG&A expenses, which may outpace productivity or cost optimization initiatives and compress net margins over the long term.

- Heavy investment requirements for digital transformation, supply chain modernization, and store remodeling, combined with uncertainties over the returns from these capex projects (especially partnerships like Ocado), could create pressure on free cash flow and increase debt, impacting Kroger's future earnings and financial flexibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $75.727 for Kroger based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $63.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $158.1 billion, earnings will come to $3.3 billion, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 7.7%.

- Given the current share price of $67.63, the analyst price target of $75.73 is 10.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.