Last Update 11 Nov 25

Fair value Decreased 1.28%BJ: Membership Gains And Defensive Positioning Will Drive Further Market Share Advances

BJ's Wholesale Club Holdings' analyst price target has decreased slightly from $115.63 to $114.15 per share. Analysts point to mixed second-quarter performance and rising competitive pressures, which are offset by continued membership growth and earnings resilience.

Analyst Commentary

Analyst reactions to BJ's Wholesale Club Holdings' latest results reflect a blend of optimism about resilient fundamentals and caution about emerging challenges. The following summarizes the main bullish and bearish viewpoints highlighted by recent Street research:

Bullish Takeaways- Bullish analysts point to ongoing membership growth, with the company achieving a record membership above 8 million and increasing engagement in premium tiers.

- Several view BJ's as attractively valued and defensive, citing a clear path to mid-single digit revenue growth and earnings per share growth in the high-single to low-double digits.

- The company remains well-positioned to gain grocery market share, supported by robust digital and membership trends despite broader macroeconomic pressures.

- Some note that the market's post-earnings reaction may be overdone. They maintain that the overall business trajectory continues to move in a positive direction.

- Bearish analysts highlight that the 2.3% comparable sales growth in Q2 lagged the industry, raising concerns about BJ's ability to maintain topline momentum amid tougher second half comparisons.

- There is increased caution regarding the retail landscape, with concerns about slowing topline growth and elevated valuations after a period of strong share price performance.

- Several have lowered price targets, pointing to macroeconomic uncertainty, weaker sales tied to factors like weather, and questions about the achievability of out-year earnings estimates.

- Underperformance on key sales metrics, including missing consensus and internal store sales projections, has fueled some calls for a more measured outlook as the stock consolidates recent gains.

What's in the News

- The new Sevierville, Tennessee location is scheduled to open on November 14, marking BJ's fifth club in the state. The gas station will open on October 29, and the company is expanding charitable giving to local food banks (Key Developments).

- The Warner Robins, Georgia club will open on September 12, expanding BJ's presence in Georgia with a focus on competitive value and partnerships with community food banks (Key Developments).

- BJ's repurchased 375,000 shares for $41.14 million, completing a buyback tranche totaling 430,000 shares for $47.44 million under the program announced in November 2024 (Key Developments).

- BJ's has issued new corporate guidance for the fiscal year ending January 31, 2026, projecting comparable club sales (excluding gasoline) to increase by 2.0% to 3.5% year-over-year (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has decreased slightly from $115.63 to $114.15 per share.

- Discount Rate has risen modestly from 7.08% to 7.25%.

- Revenue Growth projections have edged down from 6.47% to 6.43% year over year.

- Net Profit Margin estimate has increased marginally from 2.71% to 2.72%.

- Future P/E Ratio has ticked down from 26.81x to 26.69x.

Key Takeaways

- Accelerated membership and footprint expansion in new markets strengthens recurring income and supports long-term revenue and margin growth.

- Growing digital adoption and enhanced merchandising increase customer loyalty, shopping frequency, and operational efficiency amidst value-focused consumer trends.

- Macroeconomic pressures, shifting consumer behavior, and rising costs threaten revenue growth, margins, and long-term relevance, while demographic trends could structurally challenge BJ's bulk-buying business model.

Catalysts

About BJ's Wholesale Club Holdings- Operates membership warehouse clubs on the eastern half of the United States.

- Accelerating membership growth, particularly in higher-tier memberships and underpenetrated secondary markets, is likely to boost recurring revenues and expand BJ's addressable market, providing a strong base for future earnings growth.

- Expansion of BJ's physical footprint, with 25–30 new clubs planned over two years, especially in high-growth suburban and Sunbelt markets, supports sustained topline revenue growth and fixed cost leverage, which helps drive margin expansion.

- Robust digital adoption-evidenced by 34% quarterly digital sales growth and broad penetration of digital services like BOPIC and ExpressPay-positions BJ's to capture more shopping occasions and larger baskets as omnichannel shopping continues to rise, supporting both revenue and operating efficiencies.

- Ongoing investments in Fresh 2.0 (perishables, meat, and seafood), private label, and data-driven merchandising are increasing customer loyalty, improving basket size, and lifting gross margin rates, all of which are likely to result in higher long-term net margins.

- The current economic environment, marked by persistent inflation and elevated value-seeking consumer behavior, is driving increased traffic-particularly among lower income households-validating BJ's value proposition and supporting market share gains that should translate into higher revenues and durable earnings resilience.

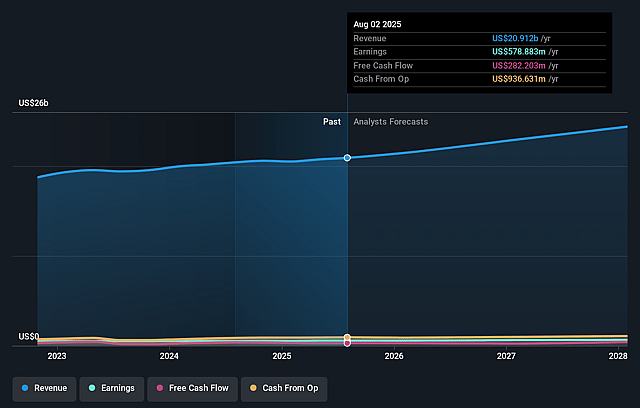

BJ's Wholesale Club Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BJ's Wholesale Club Holdings's revenue will grow by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 2.8% today to 2.7% in 3 years time.

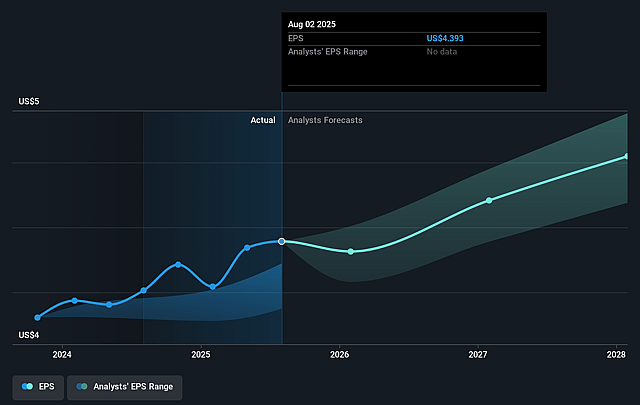

- Analysts expect earnings to reach $683.1 million (and earnings per share of $5.4) by about September 2028, up from $578.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.8x on those 2028 earnings, up from 22.2x today. This future PE is greater than the current PE for the US Consumer Retailing industry at 21.7x.

- Analysts expect the number of shares outstanding to decline by 0.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.08%, as per the Simply Wall St company report.

BJ's Wholesale Club Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing increased caution in its inventory and order levels, particularly in discretionary general merchandise categories impacted by tariffs, which could constrain revenue growth if consumer sentiment unexpectedly improves, and over-prudence may limit top-line upside.

- Tariff-related macro volatility and ongoing uncertainty about consumer behavior are creating a more dynamic and risk-prone environment; management explicitly stated that these headwinds are likely to limit upside and may require short-term investments (e.g., sharper pricing), which could negatively affect net margins and earnings.

- There is a continued struggle with underperformance in the general merchandise and services division (2.2% comp decline this quarter), with challenges in transforming this business for greater relevance; if this trend persists, it could weigh down average basket size and future revenue growth.

- Long-term margin pressures loom due to increased SG&A expense deleverage from new club openings amid rising labor and operational costs, as well as the potential for intensifying price competition in warehouse retail, which could erode operating margins and overall profitability.

- Secular trends such as demographic shifts toward smaller households and increased sustainability/anti-consumption sentiment among younger generations may reduce consumer demand for bulk-buying over time, creating a structural headwind to membership growth and revenue across BJ's core business model.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $115.632 for BJ's Wholesale Club Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $25.2 billion, earnings will come to $683.1 million, and it would be trading on a PE ratio of 26.8x, assuming you use a discount rate of 7.1%.

- Given the current share price of $97.53, the analyst price target of $115.63 is 15.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.