Narratives are currently in beta

Key Takeaways

- Strategic focus on retail pharmacy strengths and store optimization is aimed at stabilizing core economics and enhancing revenue growth.

- Initiatives on owned brand expansion and cost discipline target improved margins and operating income stability.

- Store closures and legal liabilities present significant risks, impacting revenue, pharmacy margins, and cash flow amid broader profitability challenges.

Catalysts

About Walgreens Boots Alliance- Operates as a healthcare, pharmacy, and retail company in the United States, Germany, the United Kingdom, and internationally.

- The strategic shift to focus on Walgreens Boots Alliance's core strength as a retail pharmacy-led company aims to leverage key assets such as consumer trust and convenience. This reorientation is expected to stabilize core economics and drive future revenue growth by making the company more relevant and dynamic in responding to consumer behavior.

- The planned closure of approximately 1,200 underperforming stores over the next three years is expected to reduce fixed costs and optimize the store footprint. This footprint optimization program aims to enhance net margins and cash flow by focusing investments on profitable stores.

- Re-negotiation of reimbursement rates with Pharmacy Benefit Managers (PBMs) is anticipated to gradually stabilize and potentially improve pharmacy margins. Management's approach to ensuring fair compensation for drug procurement and services is a key long-term strategy for enhancing operating income.

- Continued expansion of owned brand offerings and a refreshed product assortment, particularly in health and wellness categories, are initiatives intended to boost retail sales and improve gross margins by shifting the product mix towards higher-margin offerings.

- Focus on cost discipline and working capital management, including achieving $500 million in working capital initiatives and reducing capital expenditures, is set to enhance operating cash flows and bolster Walgreens Boots Alliance's earnings stability and financial flexibility.

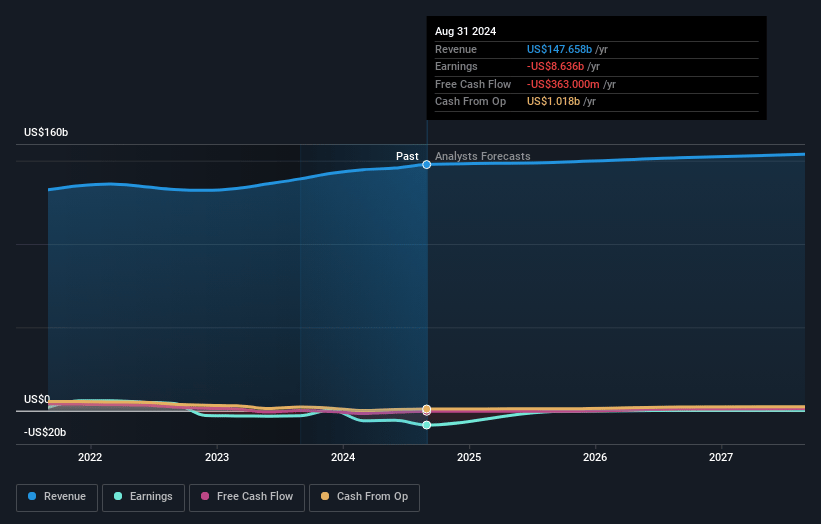

Walgreens Boots Alliance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Walgreens Boots Alliance's revenue will grow by 1.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -5.8% today to 0.2% in 3 years time.

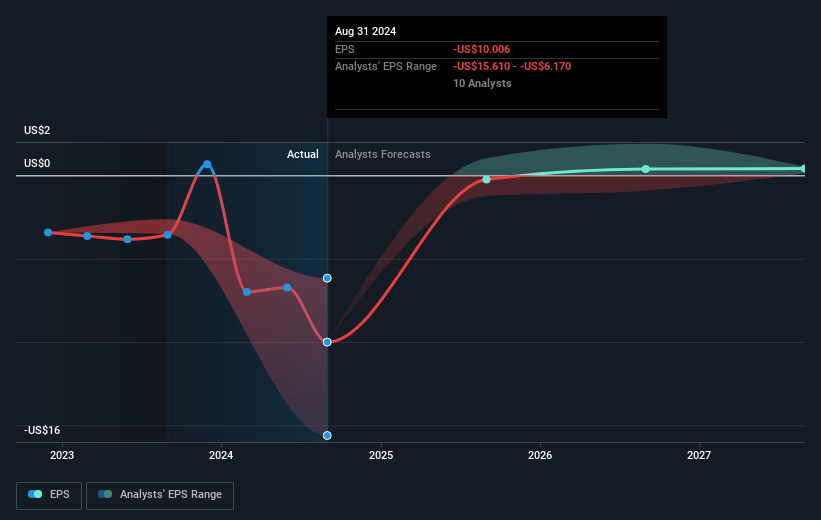

- Analysts expect earnings to reach $277.7 million (and earnings per share of $0.41) by about November 2027, up from $-8.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $444.4 million in earnings, and the most bearish expecting $111 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.3x on those 2027 earnings, up from -0.9x today. This future PE is greater than the current PE for the US Consumer Retailing industry at 22.0x.

- Analysts expect the number of shares outstanding to decline by 7.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

Walgreens Boots Alliance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decision to close approximately 1,200 underperforming stores could lead to short-term revenue pressures and a potential loss of pharmacy customers if retention strategies aren't effective.

- Persistent pressure on pharmacy reimbursement rates could negatively impact Walgreens' pharmacy margins, making it difficult in the short-term to stabilize or grow earnings.

- Adjusted EPS for fiscal 2024 saw a significant decline of 41% year-over-year, reflecting challenges in maintaining profitability amidst changing market dynamics in both retail and pharmacy sectors.

- The legal payments, including opioid-related liabilities, are expected to increase in fiscal 2025, further straining the company's cash flow and financial flexibility.

- Execution of planned store closures and the restructuring of supplier contracts require precise implementation to achieve projected savings and preserve revenue, posing a significant operational risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.84 for Walgreens Boots Alliance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $153.9 billion, earnings will come to $277.7 million, and it would be trading on a PE ratio of 36.3x, assuming you use a discount rate of 10.9%.

- Given the current share price of $9.03, the analyst's price target of $10.84 is 16.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives