Narratives are currently in beta

Key Takeaways

- Strategic technology investments in AI and analytics aim to boost service offerings, attracting clients and enhancing revenue and margins.

- Expanding large deal pipeline and sales infrastructure investment aim to accelerate revenue growth and improve competitive positioning.

- Declines in revenue from healthcare and travel sectors, along with increased costs, challenge WNS's earnings predictability and pressure profit margins.

Catalysts

About WNS (Holdings)- A business process management (BPM) company, provides data, voice, analytical, and business transformation services worldwide.

- WNS is actively expanding its large deal pipeline, with over 20 significant deals exceeding $500 million in annual contract value, potentially boosting future revenue and providing revenue acceleration in fiscal 2026.

- Strategic investments in proprietary technology, analytics, AI, and generative AI are expected to enhance WNS's service offerings, attracting new clients and retaining existing ones, thereby potentially increasing revenue and net margins.

- The company is enhancing its analytics practice with advanced data management services and AI capabilities, which enables WNS to deliver higher value solutions, thereby potentially enhancing net margins and earnings.

- WNS's focus on expanding its front-office consulting capabilities and nurturing strategic client relationships may improve client satisfaction and retention, possibly leading to increased revenue growth.

- Ongoing investments in sales infrastructure and strategic M&A opportunities aim to further enhance WNS's competitive position, potentially boosting revenue and contributing to long-term profitable growth.

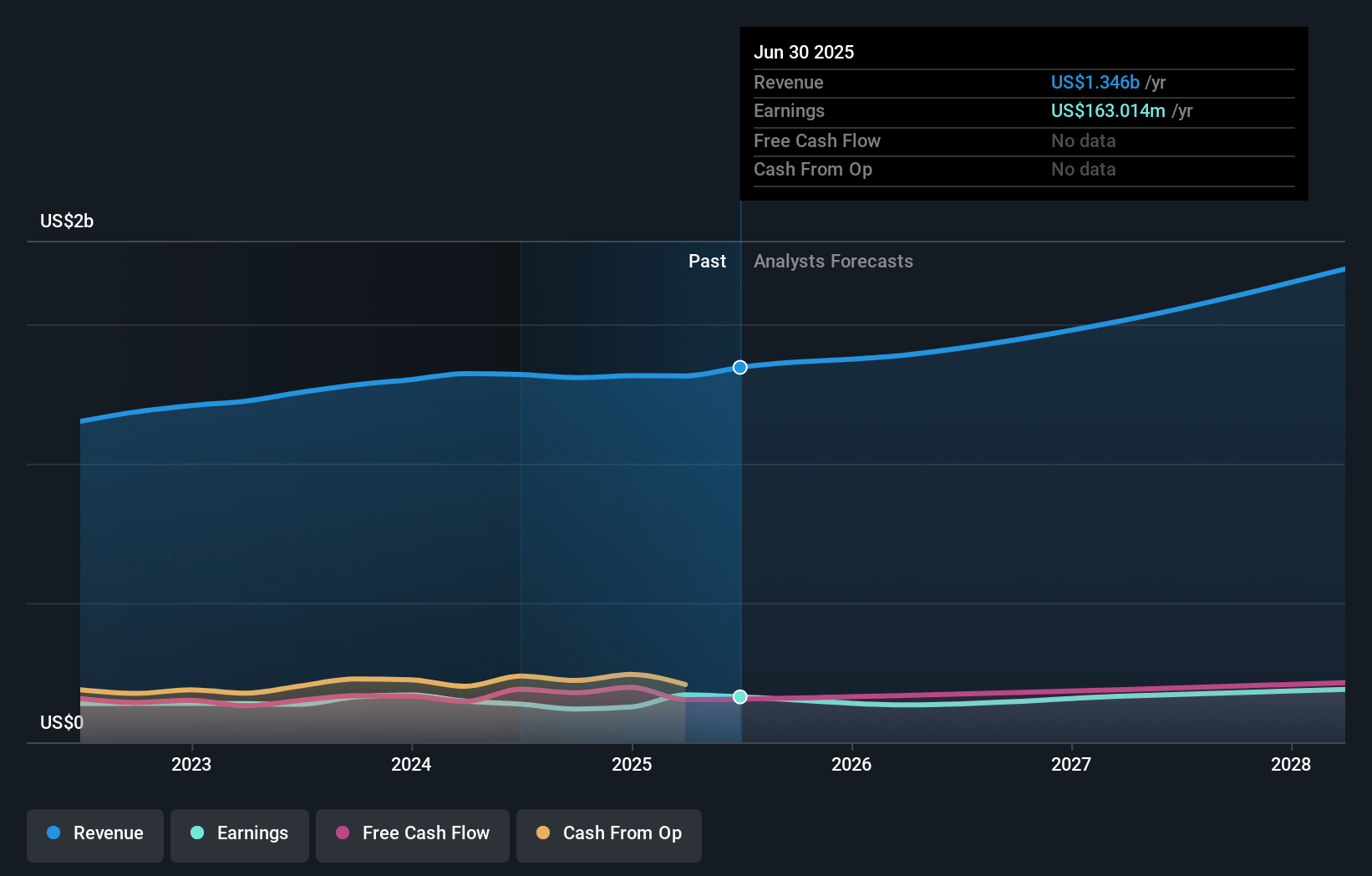

WNS (Holdings) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming WNS (Holdings)'s revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.1% today to 13.2% in 3 years time.

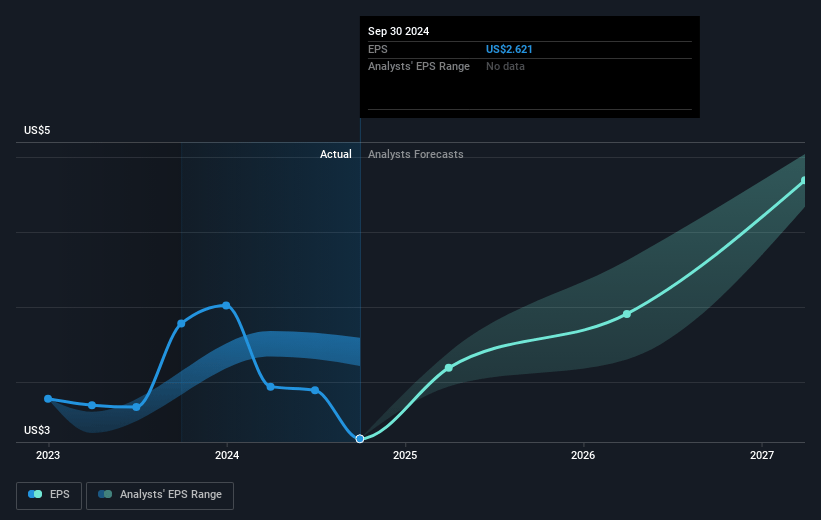

- Analysts expect earnings to reach $202.7 million (and earnings per share of $4.34) by about November 2027, up from $119.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2027 earnings, down from 19.8x today. This future PE is lower than the current PE for the US Professional Services industry at 26.9x.

- Analysts expect the number of shares outstanding to grow by 2.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.11%, as per the Simply Wall St company report.

WNS (Holdings) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has experienced a year-over-year decrease in net revenue by 4.4%, with particularly significant declines from the loss of a large healthcare client and reductions in online travel revenues, which could impact revenue and net income.

- The company's updated fiscal guidance has removed expected revenue contributions from large deals due to uncertainty, which implies challenges in timing and predictability, potentially affecting future revenue and earnings.

- There have been ongoing volume reductions in online travel, which alone account for a 1-2% decline in guidance, and a potential further reduction is expected, impacting revenue.

- Adjusted operating margins declined year-over-year due to lower revenue, increased infrastructure and sales investments, and higher SG&A, reflecting pressures on profit margins.

- The effective tax rate for the quarter was reduced due to a one-time tax benefit, inflating EPS; without this, earnings could appear weaker in subsequent periods.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $57.0 for WNS (Holdings) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $66.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.5 billion, earnings will come to $202.7 million, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 9.1%.

- Given the current share price of $54.56, the analyst's price target of $57.0 is 4.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

RY

rynetmaxwell

Community Contributor

WNS's Margins Improve w/ Automation and Outcome-Based Pricing

Meaning WNS began operations as an internal-service unit within British Airways in 1996. After separating from British Airways in 2002, WNS began to operate as a Business Process Outsourcing (BPO) company servicing several clients including insurance companies, British Airways, and a few other diversified companies.

View narrativeUS$88.48

FV

43.9% undervalued intrinsic discount7.50%

Revenue growth p.a.

3users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

about 1 month ago author updated this narrative