Key Takeaways

- Strategic focus on AI-driven, high-margin services and global diversification is enhancing revenue stability and positioning for strong, sustainable earnings growth.

- Partnerships and continuous automation investments are creating cost efficiencies, driving profitability, and accelerating adoption of innovative digital solutions.

- Rising AI adoption, pricing pressure, client concentration, wage inflation, and high leverage threaten profitability, revenue stability, and future competitiveness in a commoditized market.

Catalysts

About TELUS International (Cda)- Offers digital customer experience and digital solutions in the Asia-Pacific, the Central America, Europe, Africa, North America, and internationally.

- TELUS International is well positioned to capitalize on the accelerating adoption of advanced AI, machine learning, and automation by enterprises, as evidenced by sustained growth in its AI and data solutions division and increased demand from clients across technology, social media, and financial services. This directly supports expanding future revenue opportunities and underpins the most bullish projections for top-line growth.

- The company’s ability to combine human expertise with proprietary technology platforms such as Fuel iX enables it to deliver scalable, differentiated services in high-value areas like trust, safety, identity verification, and large language model training. This shift toward higher-margin, technology-driven services is expected to drive structural improvements in net margins and long-term earnings.

- Recent client wins and expansions—across both new and existing customers in diverse regions and industry verticals, including health care, e-commerce, gaming, and financial services—highlight successful execution of a broad-based global diversification strategy. This diversification should enhance recurring revenue stability and support consistent, compounding revenue growth over the long term.

- Deep strategic partnerships, particularly with TELUS Corporation as an anchor client, provide the company with unique opportunities to test, scale, and monetize end-to-end digital transformation, customer experience, and AI-first solutions across multiple business lines. These partnerships are expected to fuel organic growth and help accelerate new service adoption, supporting robust EBITDA expansion.

- The ongoing proactive investment in automation and AI-powered service delivery is creating significant cost efficiencies, enabling optimization of headcount and reduction of indirect costs. As more of the workforce transitions to supporting complex, value-added digital projects, operating leverage should improve and result in a gradual, sustainable uplift in profitability and cash flow margins.

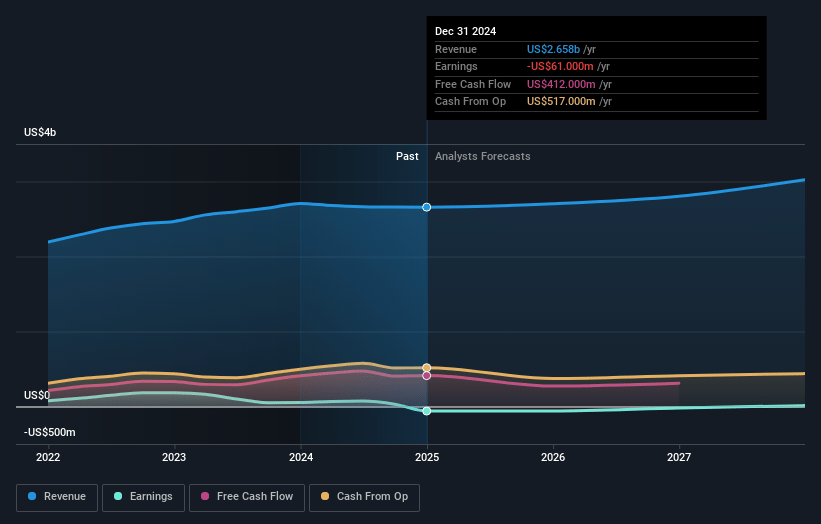

TELUS International (Cda) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on TELUS International (Cda) compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming TELUS International (Cda)'s revenue will grow by 5.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -4.3% today to 0.9% in 3 years time.

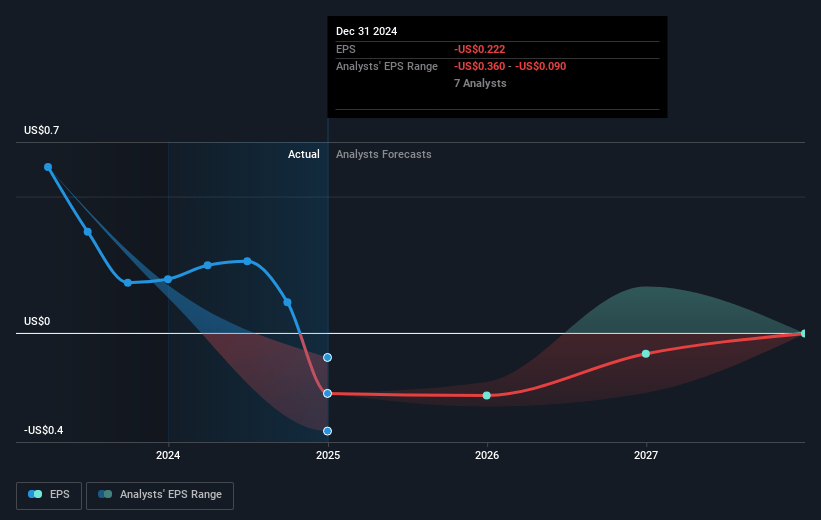

- The bullish analysts expect earnings to reach $27.6 million (and earnings per share of $0.04) by about May 2028, up from $-114.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 78.0x on those 2028 earnings, up from -7.0x today. This future PE is greater than the current PE for the US Professional Services industry at 23.5x.

- Analysts expect the number of shares outstanding to grow by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.55%, as per the Simply Wall St company report.

TELUS International (Cda) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acceleration of AI and automation is reducing the need for outsourced human-powered services, and company executives explicitly noted opportunities to decrease headcount as more tasks are handled by AI, which may cap or shrink the company’s addressable market and thus negatively impact long-term revenue growth.

- Intense pricing pressure and competition in a highly commoditized digital services and BPO market were acknowledged by management, who noted stable but competitive pricing and a need for constant efficiency improvements, indicating persistent margin erosion risks and lower future net margins.

- TELUS International remains highly reliant on a small set of major clients, especially TELUS Corporation and a few large technology companies, so the loss or downsizing of any major contract would expose the company to revenue concentration risk and potentially cause volatility in both revenues and earnings.

- Ongoing global wage inflation and increased salaries and benefits costs are outpacing revenue growth, as reported in the quarter, directly contributing to a decline in EBITDA margin and putting further downward pressure on profitability going forward.

- High leverage, with a net debt to adjusted EBITDA ratio of 3.4 times, restricts the company’s financial flexibility, increases interest expenses, and limits its ability to invest in innovation, which could reduce net income and hamper longer-term competitiveness in a rapidly evolving industry.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for TELUS International (Cda) is $5.79, which represents two standard deviations above the consensus price target of $3.87. This valuation is based on what can be assumed as the expectations of TELUS International (Cda)'s future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.1 billion, earnings will come to $27.6 million, and it would be trading on a PE ratio of 78.0x, assuming you use a discount rate of 9.5%.

- Given the current share price of $2.86, the bullish analyst price target of $5.79 is 50.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.