Key Takeaways

- The sale of GES strengthens Pursuit's finances, enabling investments in the Refresh, Build, Buy strategy for future revenue and EBITDA growth.

- Strategic acquisitions and expansion projects at iconic locations bolster growth through operational synergies and higher visitor capacity, supporting increased earnings.

- Impairment charges, natural disasters, currency risks, and divestitures challenge Pursuit's profitability and highlight vulnerabilities in market fluctuations and operational transition.

Catalysts

About Pursuit Attractions and Hospitality- An attraction and hospitality company, owns and operates hospitality destinations in the United States, Canada, and Iceland.

- The recent completion of the GES sale provides Pursuit with a significant financial transformation, eliminating high-cost debt and establishing substantial liquidity to accelerate investment in the Refresh, Build, Buy strategy, which is expected to drive double-digit growth in revenue and adjusted EBITDA in 2025.

- The strategic tuck-in acquisitions in iconic locations, such as Apgar Village and Jasper SkyTram, offer new growth opportunities through operational and cross-sell synergies, potentially enhancing revenue and expanding net margins by leveraging economies of scale.

- The expected post-wildfire return of leisure travel to Jasper provides a significant tailwind for revenue recovery, contributing to anticipated growth in net earnings as operations normalize and visitor numbers rebound.

- The expansion projects, such as the Sky Lagoon and FlyOver Chicago, are increasing visitor capacity and ticket prices, directly contributing to higher attraction ticket revenue and improving net margins through increased scale and enhanced experiences.

- Pursuit's strong balance sheet and low leverage create capacity for further investments in high-return projects and strategic acquisitions, positioning the company to capitalize on growth opportunities that could drive increased earnings and higher stock valuations.

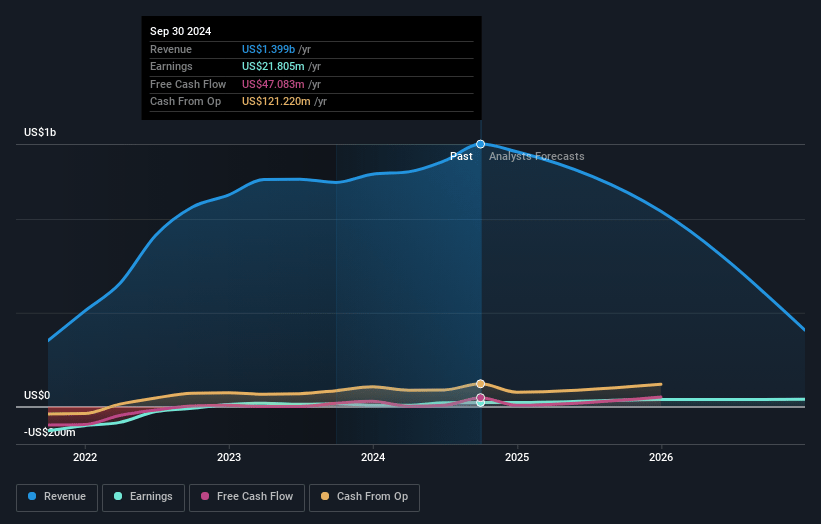

Pursuit Attractions and Hospitality Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pursuit Attractions and Hospitality's revenue will grow by 8.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -41.1% today to 18.2% in 3 years time.

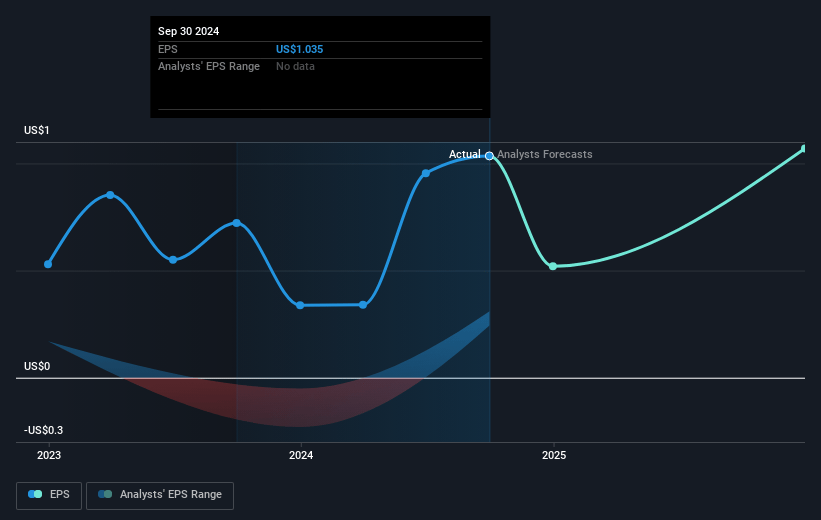

- Analysts expect earnings to reach $86.2 million (and earnings per share of $2.15) by about April 2028, up from $-150.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.4x on those 2028 earnings, up from -5.6x today. This future PE is lower than the current PE for the US Commercial Services industry at 28.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.74%, as per the Simply Wall St company report.

Pursuit Attractions and Hospitality Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced impairment charges of $47.6 million for the full year and $41.5 million in the fourth quarter, including a $27.5 million asset write-down related to FlyOver Las Vegas and a $14 million goodwill write-off; this reflects slower-than-expected ramping at certain attractions, potentially impacting future earnings and profitability.

- The Jasper wildfires resulted in a revenue impact of approximately $23 million and a $15 million decrease in adjusted EBITDA for the second half of 2024, illustrating the risk of natural disasters on regional revenues and earnings.

- The company is subject to currency exchange rate risk, as indicated by the $7 million EBITDA impact from translating Canadian results into U.S. dollars due to a weaker Canadian dollar, which could affect net margins and earnings.

- The recent divestiture of GES, while providing cash flow and debt reduction, leaves the company more reliant on the singular performance of its Attractions and Hospitality operations, increasing risk exposure to market fluctuations and potential revenue variances.

- The need for seasonal adjustments and the impact of legacy corporate costs on EBITDA highlights the complexity and potential inefficiencies in transitioning from a holding company to a single operating business structure, possibly affecting net margins and overall financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $55.0 for Pursuit Attractions and Hospitality based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $472.4 million, earnings will come to $86.2 million, and it would be trading on a PE ratio of 26.4x, assuming you use a discount rate of 6.7%.

- Given the current share price of $29.91, the analyst price target of $55.0 is 45.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.