Key Takeaways

- Kforce's focus on technology investments and AI readiness aims to boost long-term growth and enhance profitability through high-value consulting engagements and operational efficiencies.

- Expansion of nearshore and offshore capabilities, alongside proactive capital returns, positions Kforce to compete for larger client opportunities and enhance shareholder value.

- Kforce faces revenue and margin pressures from declining technology segment growth, increased costs, and potential vulnerabilities in smaller business segments amidst economic uncertainties.

Catalysts

About Kforce- Provides professional staffing services and solutions in the United States.

- Kforce's strategic focus on strategically imperative technology investments is expected to increase long-term returns for shareholders by capturing additional market share and generating significant revenue growth through consulting-oriented engagements. This could positively impact earnings and net margins as these projects are high-value and critical for clients.

- The completion of the Workday enterprise cloud application implementation is anticipated to provide immediate efficiency gains starting in early 2026. These gains are expected to contribute to higher profitability as operational efficiencies improve, thus having a positive impact on net margins.

- The development and expansion of Kforce's nearshore and offshore delivery capabilities, particularly with its India development center, positions the company to compete for larger client opportunities at lower costs, potentially increasing revenue while maintaining or improving margins.

- Kforce's investments in AI readiness, including data, cloud, and digital projects, position the firm to capitalize on the growing demand for AI-driven solutions. These projects are expected to drive revenue growth as companies enhance their AI capabilities and require specialized consulting engagements.

- The company's proactive approach to share repurchases and dividends, having returned approximately $1 billion to shareholders since 2007, is expected to be accretive to earnings per share and demonstrates commitment to returning capital, which can enhance shareholder value.

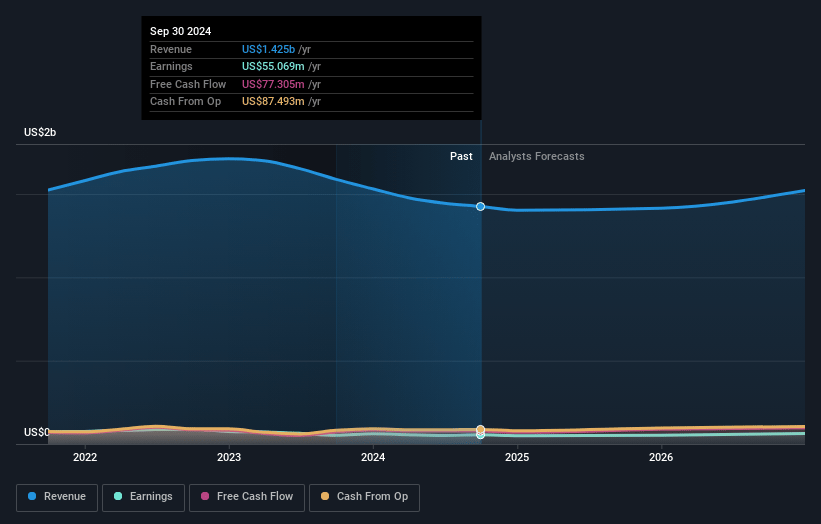

Kforce Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kforce's revenue will grow by 1.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.4% today to 3.8% in 3 years time.

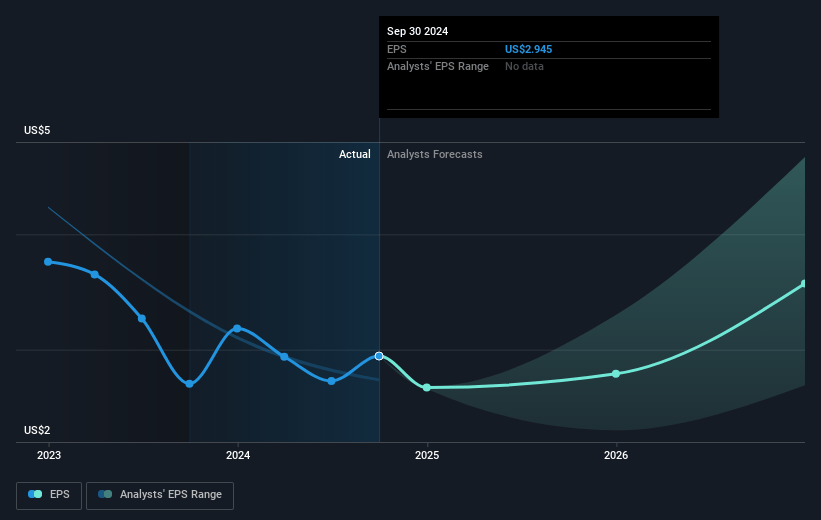

- Analysts expect earnings to reach $55.0 million (and earnings per share of $2.94) by about May 2028, up from $47.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, up from 14.0x today. This future PE is lower than the current PE for the US Professional Services industry at 20.7x.

- Analysts expect the number of shares outstanding to decline by 2.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.55%, as per the Simply Wall St company report.

Kforce Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The announcement of significant tariffs and the unclear outcome and impact of these tariffs reintroduce uncertainties into the U.S. economic outlook, which could delay client investments in technology initiatives, affecting Kforce's revenue growth.

- Revenue from Kforce's technology segment has declined 4.7% year-over-year, which suggests a challenging environment for growth and could impact future earnings if this trend continues.

- Higher-than-expected assignment attrition mid-quarter reflects temporary economic expectations and could affect net margins if it becomes a persistent issue.

- Increased healthcare costs have led to a year-over-year decline in gross margins, impacting profitability and net margins despite stable operational spreads.

- The Direct Hire business, representing approximately 2% of overall revenues, is expected to decline sequentially in Q2, showing potential vulnerability in this smaller revenue segment that might affect overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $52.0 for Kforce based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $55.0 million, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 6.6%.

- Given the current share price of $36.59, the analyst price target of $52.0 is 29.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.