Key Takeaways

- Innovative AI-driven solutions and strategic partnerships are expected to enhance Genpact's technology capabilities, driving revenue and margin growth.

- Focus on Data-Tech-AI expansion and operational efficiency may increase market share, earnings, and appeal to investors seeking strong returns.

- Limited revenue predictability, competition in AI, partnership shifts, and economic changes could challenge Genpact's growth and operational strategy.

Catalysts

About Genpact- Provides business process outsourcing and information technology services in India, rest of Asia, North and Latin America, and Europe.

- The launch of Agentic solutions powered by proprietary LLMs and GenAI for accounts payable and other AI-driven operations positions Genpact to drive significant innovation and efficiency in digital operations, potentially boosting revenue growth.

- Strategic partnerships, such as those with Databricks and several hyperscalers, are expected to enhance Genpact's technological capability and go-to-market strategy in Data-Tech-AI, likely contributing to increased revenue and margin expansion.

- Genpact's focus on expanding its Data, Tech, and AI segment, as evidenced by ongoing strategic relationships and high-profile deal wins, suggests a forward-looking strategy to capture a larger market share in high-growth areas, impacting both revenue and earnings positively.

- The establishment of the Genpact Gigafactory aims to accelerate the scaling of AI solutions and may significantly increase the speed and scale at which AI-driven transformations occur, likely supporting substantial EPS growth through increased operational efficiency and client acquisition.

- Ongoing efforts to streamline operations and improve cash flows, coupled with a disciplined capital allocation strategy, including significant share buybacks and dividends, are likely to result in healthier net margins and earnings growth, appealing to investors looking for efficient return on investment.

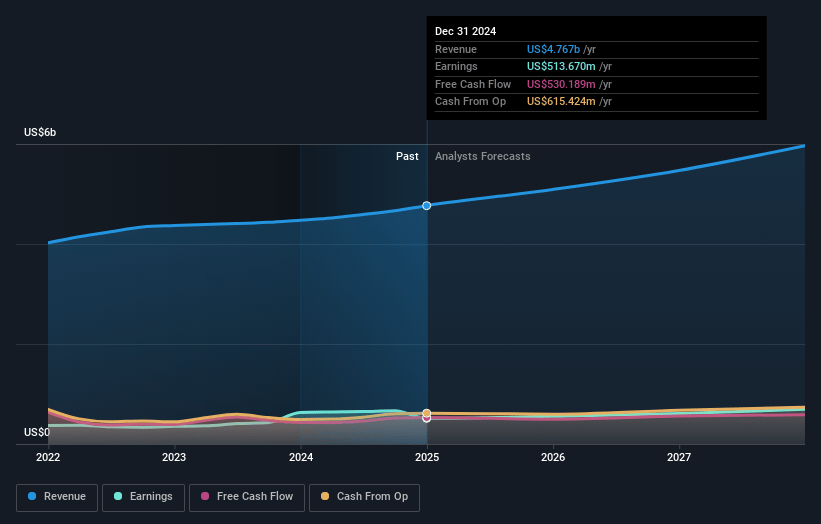

Genpact Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Genpact's revenue will grow by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.8% today to 11.6% in 3 years time.

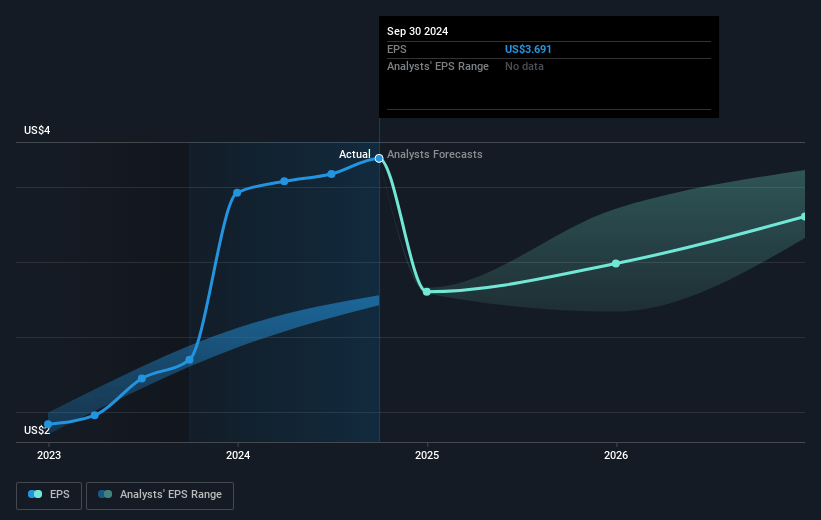

- Analysts expect earnings to reach $688.3 million (and earnings per share of $3.82) by about May 2028, up from $513.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, down from 16.9x today. This future PE is lower than the current PE for the US Professional Services industry at 21.2x.

- Analysts expect the number of shares outstanding to decline by 2.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.71%, as per the Simply Wall St company report.

Genpact Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a lack of visibility and predictability in 25% of Genpact's revenue pipeline, which may lead to potential shortfalls if bookings for non-annuitized business don't meet expectations, impacting revenue growth.

- The shift of dollars to generative AI solutions, rather than new incremental spending, may limit overall revenue expansion if clients continue reallocating existing budgets rather than expanding them.

- Increased competition and technological developments in AI may lead to operational and strategic challenges, potentially impacting future revenue and margins if Genpact cannot maintain its innovation lead.

- Any alterations in key partnership dynamics, especially with large technology partners, may hinder revenue for the Data-Tech-AI segment, affecting overall business performance.

- Changes in macroeconomic conditions or unexpected regulatory shifts, similar to those affecting content moderation, could lead to revenue impacts, particularly in sensitive service areas like trust and safety.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $56.125 for Genpact based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.9 billion, earnings will come to $688.3 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 6.7%.

- Given the current share price of $49.68, the analyst price target of $56.12 is 11.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.