Narratives are currently in beta

Key Takeaways

- Fiverr's strategy of moving upmarket and enhancing value-added services is boosting spend per buyer, revenue potential, and take rate growth.

- AI tools and Fiverr Pro are poised to improve buyer experience and capture larger budgets, potentially increasing project size and net margins.

- Challenging macro conditions and competitive pressures could impact Fiverr's revenue growth, future earnings, and require strategic financial management of outstanding debt.

Catalysts

About Fiverr International- Operates an online marketplace worldwide.

- Fiverr's strategy to move upmarket and expand value-added services is driving robust growth in spend per buyer, increasing revenue potential.

- The integration of AI-powered tools like Neo and Dynamic Matching is expected to enhance the buyer experience and increase project size, thus potentially boosting revenue and take rate.

- Fiverr Pro, with services such as project management and hourly contracts, is designed to capture larger business budgets, potentially increasing net margins through higher-value transactions.

- Expansion of value-added services, which have higher take rates, is likely to continue contributing to Fiverr's take rate growth, positively impacting earnings.

- Strong cash flow and a solid balance sheet enable continued investment in product development and technology, which is aimed at sustaining long-term revenue growth and optimizing returns to shareholders through buybacks.

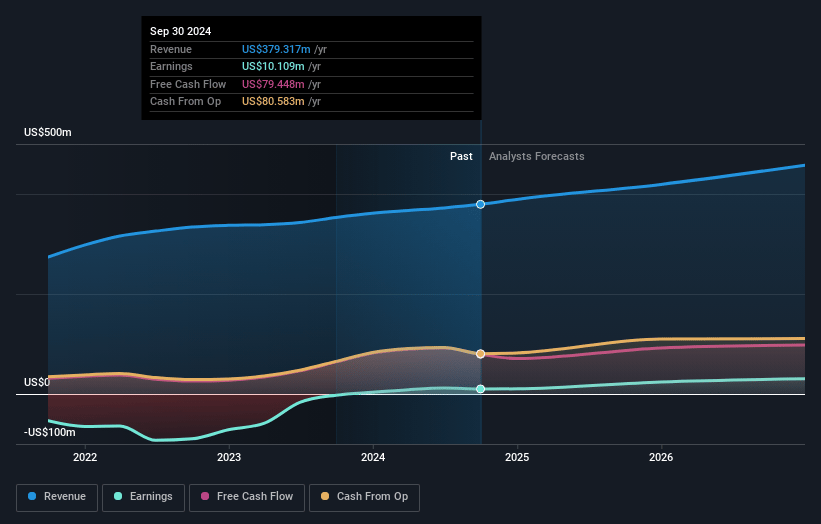

Fiverr International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fiverr International's revenue will grow by 11.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 14.4% in 3 years time.

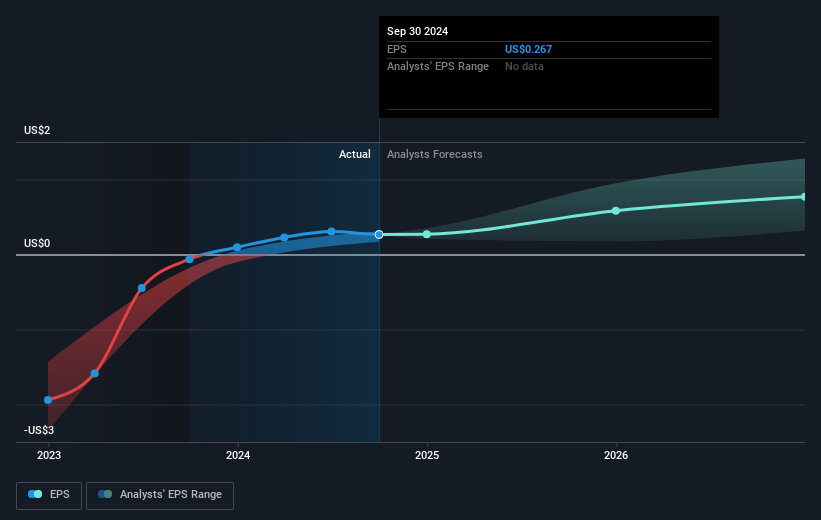

- Analysts expect earnings to reach $76.2 million (and earnings per share of $1.62) by about November 2027, up from $10.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.6x on those 2027 earnings, down from 105.9x today. This future PE is greater than the current PE for the US Professional Services industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 9.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.11%, as per the Simply Wall St company report.

Fiverr International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The professional staffing industry is down double digits year-over-year, and the overall SMB sentiment remains historically low, which may impact overall revenue growth.

- Active buyer growth is muted, despite an increase in spend per buyer, indicating that while current buyers are spending more, new customer acquisition may be a challenge, impacting future revenue potential.

- Macro conditions, including a challenging hiring environment and weak overall SMB sentiment, pose risks to Fiverr’s GMV recovery and overall financial growth, which could affect both revenue and earnings.

- There is mention of a $460 million convertible note outstanding, necessitating strategic financial management to avoid potential negative impacts on net margins and cash flow if market conditions shift unfavorably.

- Competitive pressure from traditional offline agencies and other online platforms offering similar services could potentially hinder Fiverr's ability to maintain its current take rate and expand revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $34.9 for Fiverr International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $28.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $529.8 million, earnings will come to $76.2 million, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 8.1%.

- Given the current share price of $30.35, the analyst's price target of $34.9 is 13.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

WallStreetWontons

Community Contributor

Fiverr: Freelancing faces slowing growth despite steps taken into AI

Catalysts Products or Services Impacting Sales and Earnings : Fiverr’s first-quarter 2024 results are expected to show year-over-year revenue growth of 4-6%. Here are some factors contributing to this growth: Complex Services : Fiverr’s expansion into more complex services, such as mobile app development, e-commerce management, and financial consulting, likely boosted profitability during Q1 2024.

View narrativeUS$21.45

FV

42.9% overvalued intrinsic discount8.03%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

4 months ago author updated this narrative