Key Takeaways

- Rising automation, regulatory complexity, and intensifying competition threaten Dayforce's future revenue growth, margins, and profitability despite current momentum.

- Heavy investment needs, sector concentration, and international expansion plans heighten exposure to downturns and risk sustained pressure on earnings.

- Strong sales momentum, platform adoption, international growth, AI-driven differentiation, and operational efficiency signal accelerating revenue, margin expansion, and sustained profitability.

Catalysts

About Dayforce- Operates as a human capital management (HCM) software company in the United States, Canada, Australia, and internationally.

- Despite the current strong top-line growth and record bookings, Dayforce faces the risk that acceleration in automation and AI-driven self-service HR/payroll processes will increasingly allow organizations to bypass centralized HCM platforms, ultimately shrinking Dayforce's long-term addressable market and leading to stalling or even declining revenue over time.

- Increasing global regulatory complexity and localization requirements may drive up Dayforce's compliance and R&D costs, especially as it expands internationally, eroding gross and net margins as keeping pace with varying employment laws becomes more resource-intensive and increasingly difficult to scale cost-effectively.

- Intensifying competition from larger software suites such as Oracle, SAP, Workday, and ADP, along with nimble cloud-native entrants, raises the likelihood of price wars and customer churn, which could drag down Dayforce's future revenue per customer and compress profitability as switching costs fall across the industry.

- Reliance on rapid expansion into international and enterprise markets, coupled with concentration in a relatively narrow set of verticals, increases sensitivity to sector-specific downturns or contract delays; this vulnerability could trigger significant revenue volatility and margin compression in periods of economic or industry-specific weakness.

- The ongoing need to invest heavily in product innovation, customer success, and compliance to maintain differentiation and win deals—despite cost-saving initiatives—could result in operating expenses growing faster than revenue, eliminating operating leverage and putting sustained downward pressure on earnings growth in future years.

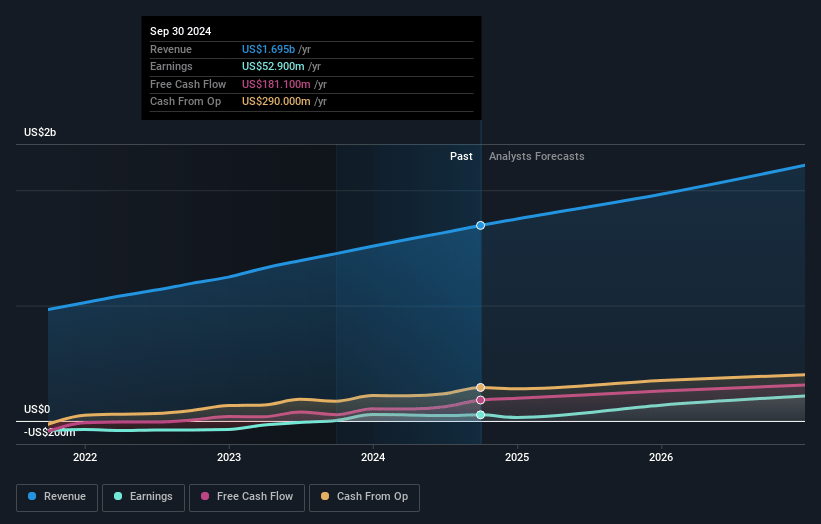

Dayforce Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Dayforce compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Dayforce's revenue will grow by 9.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.4% today to 8.9% in 3 years time.

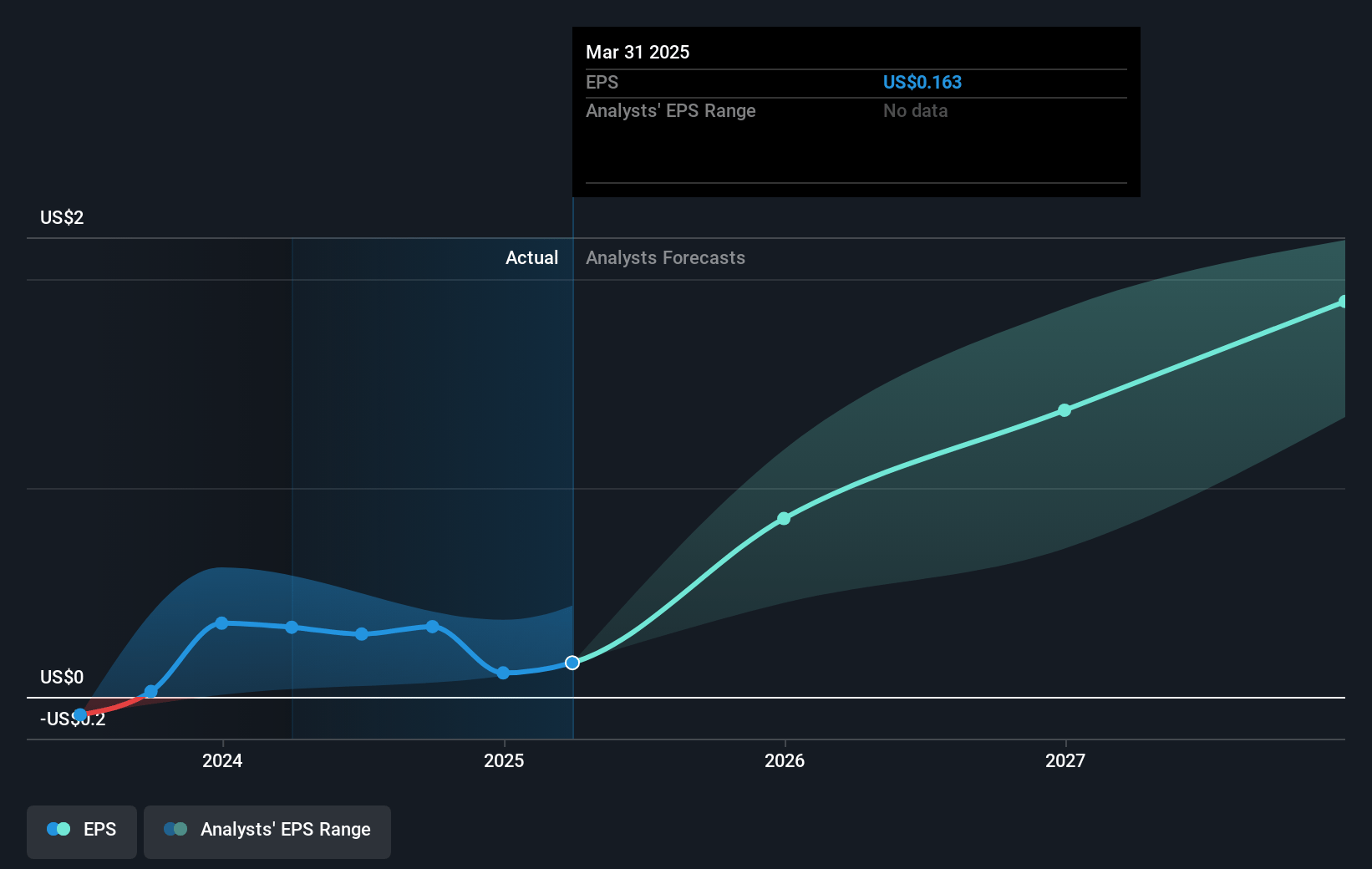

- The bearish analysts expect earnings to reach $212.0 million (and earnings per share of $1.32) by about May 2028, up from $25.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 50.7x on those 2028 earnings, down from 332.7x today. This future PE is greater than the current PE for the US Professional Services industry at 21.2x.

- Analysts expect the number of shares outstanding to grow by 0.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.65%, as per the Simply Wall St company report.

Dayforce Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong and accelerating sales momentum in both new business wins and add-on sales, with bookings in the first half of 2025 expected to be up approximately 40 percent year-over-year, indicating robust demand and a healthy future revenue pipeline that could drive top-line growth above expectations.

- Increasing adoption of Dayforce’s full-suite platform, with nearly 100 percent penetration in core target segments and a clear value proposition of replacing multiple HR applications with a unified solution, positioning the company for higher recurring revenue per customer and improved customer retention rates.

- Significant traction in international expansion and continued success with large enterprise and government contracts, suggesting greater market penetration and geographic diversification, which could support long-term revenue growth and reduce earnings volatility.

- Rapid innovation in AI and integration of Copilot/AI Assistant features, reflected in a 50 percent attach rate in new deals and ongoing investment in advanced modules, which may increase product differentiation, upsell opportunities, and average revenue per user, leading to margin expansion and higher earnings.

- Effective execution of an efficiency plan, including cost reductions and a focus on operating leverage, has led to improved adjusted EBITDA and free cash flow margins, signaling increasing profitability and strong earnings potential even as the business scales.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Dayforce is $55.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Dayforce's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $95.0, and the most bearish reporting a price target of just $55.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $212.0 million, and it would be trading on a PE ratio of 50.7x, assuming you use a discount rate of 6.7%.

- Given the current share price of $54.44, the bearish analyst price target of $55.0 is 1.0% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.