Narratives are currently in beta

Key Takeaways

- Expanding Human Capital Management offerings and partnerships aims to enhance client engagement, drive revenue growth, and improve net margins.

- Wallet product growth and focus on higher-margin cloud services shift strategy towards profitability and cash flow growth.

- Intense competition and reliance on innovations like Dayforce Wallet could pressure margins and risk revenue growth if adoption underperforms expectations.

Catalysts

About Dayforce- Operates as a human capital management (HCM) software company in the United States, Canada, and internationally.

- The expansion of the Dayforce platform to include a broad set of Human Capital Management (HCM) offerings, which targets larger customers and enhances client engagement, is expected to drive revenue growth.

- The building of the system integrated channel and partnerships with global systems integrators aims to leverage partners' implementation and sales capabilities, potentially lowering costs and expanding sales, thus improving net margins.

- The focus on add-on sales within the existing customer base, with significant upselling of the talent intelligence suite, is anticipated to increase revenue per customer.

- Dayforce's Wallet product is projected to more than double its revenue this year, introducing features like cashless tips and savings, which could contribute significantly to future earnings growth.

- The strategic shift towards profitability with a focus on adjusted EBITDA margin and free cash flow growth aligns with a simplified product offering that targets higher-margin cloud services, likely to enhance net margins and cash flow conversions.

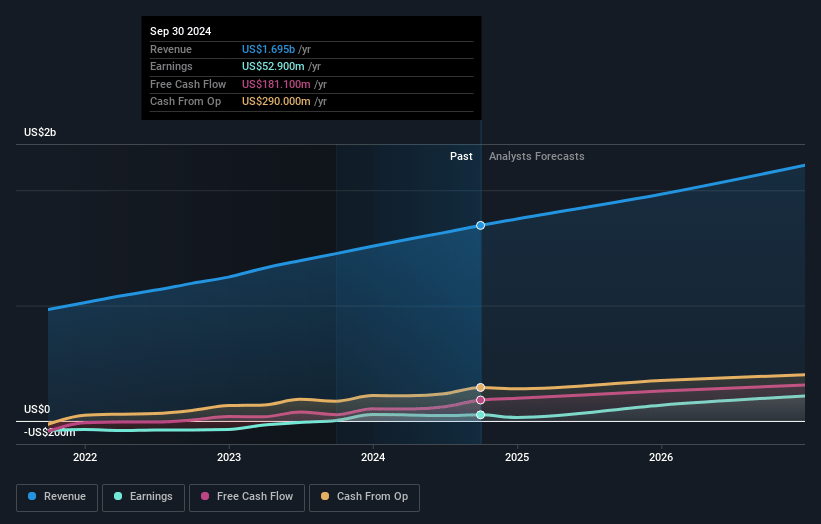

Dayforce Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dayforce's revenue will grow by 13.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 11.9% in 3 years time.

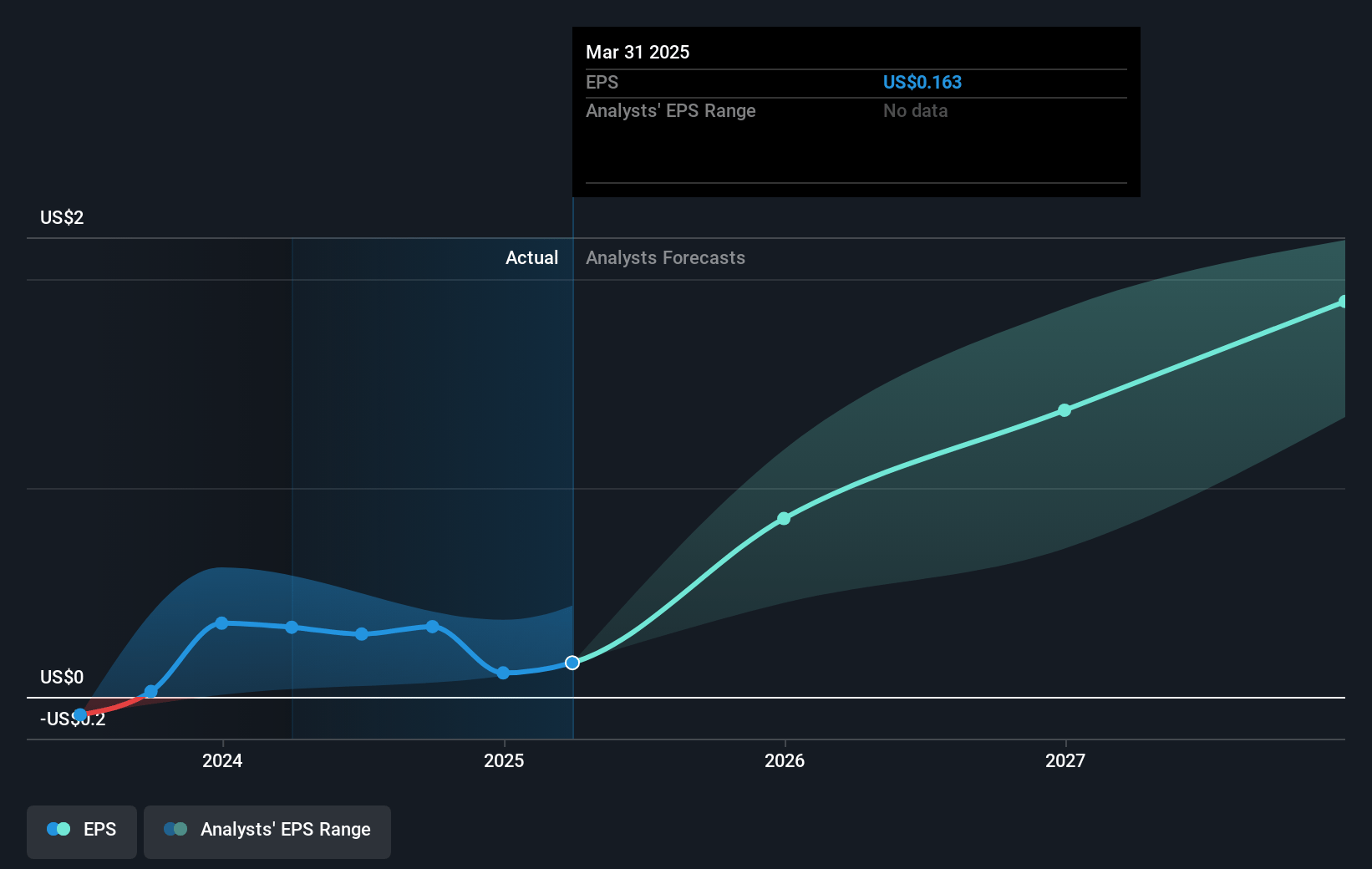

- Analysts expect earnings to reach $291.0 million (and earnings per share of $1.88) by about November 2027, up from $52.9 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $149.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 52.7x on those 2027 earnings, down from 237.5x today. This future PE is greater than the current PE for the US Professional Services industry at 25.7x.

- Analysts expect the number of shares outstanding to decline by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.45%, as per the Simply Wall St company report.

Dayforce Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Instances of elongated sales cycles were observed, which could indicate potential delays in revenue realization and future cash flow timing, impacting revenue projections.

- The weakening Canadian dollar continues to be a headwind versus original 2024 guidance and past year performance, potentially affecting earnings due to currency exchange volatility.

- Forecasts assume employment levels remain stable, but any significant deviations could impact Dayforce’s recurring revenue growth, thereby affecting overall earnings.

- Competition remains intense, as evidenced by competitive bidding situations with other payroll-focused organizations and ERPs, which could pressure margins and market share, ultimately impacting net margins.

- Dependence on revenue through innovations like Dayforce Wallet and AI offerings implies risk if adoption or monetization underperforms expectations, potentially hindering projected revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $82.51 for Dayforce based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $95.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.4 billion, earnings will come to $291.0 million, and it would be trading on a PE ratio of 52.7x, assuming you use a discount rate of 6.4%.

- Given the current share price of $79.68, the analyst's price target of $82.51 is 3.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives