Narratives are currently in beta

Key Takeaways

- Brady's focus on product innovation and differentiation through R&D and acquisitions positions them for future revenue and margin growth.

- Strategic expansion in sales, digital capabilities, and growing Asian markets supports organic growth and market penetration.

- Declining global profitability and cash flow, combined with macroeconomic challenges and currency risks, threaten Brady's future growth and stability.

Catalysts

About Brady- Manufactures and supplies identification solutions (IDS) and workplace safety (WPS) products to identify and protect premises, products, and people in the United States and internationally.

- Brady's launch of new integrated solutions, such as the bundled I-5300 printer and V-4500 barcode scanner, highlights their focus on R&D to provide niche, problem-solving products. This is expected to drive future revenue growth through product innovation and market differentiation.

- The acquisition of Gravotech adds laser and mechanical part marking capabilities to Brady's portfolio, enhancing their position in providing comprehensive identification solutions. This should contribute to revenue growth and potentially improve net margins by streamlining production processes.

- Brady's strategic investment in expanding their sales force and enhancing digital capabilities points to a focus on organic sales growth and improving sales efficiency, which can drive an increase in revenue and potentially net margins through better market penetration.

- Strong performance and organic growth in the Asia region, particularly in India and Southeast Asia, indicate significant potential for future revenue growth as Brady capitalizes on expanding markets outside of China, with ongoing industrial investment in these regions.

- Brady's historical cash generation and disciplined capital allocation strategy suggest continued reinvestment in growth, such as R&D and opportunistic acquisitions, which positions them well for future earnings growth and maintaining robust net margins.

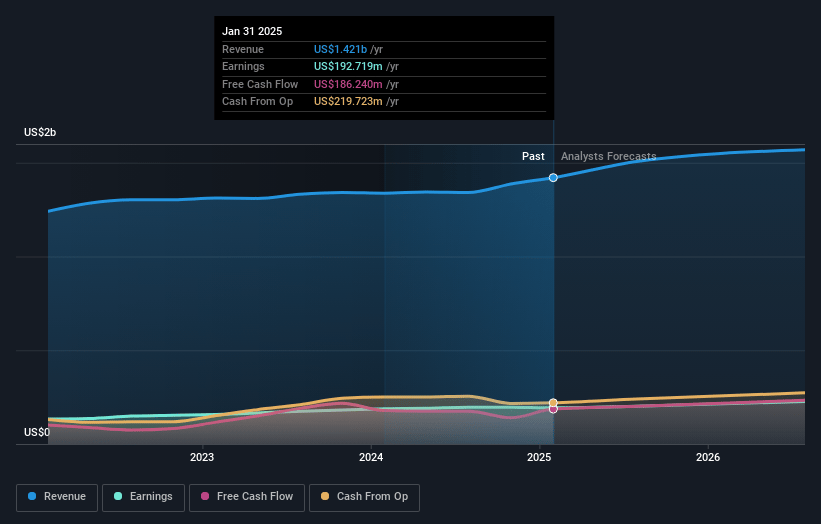

Brady Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Brady's revenue will grow by 8.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.1% today to 14.2% in 3 years time.

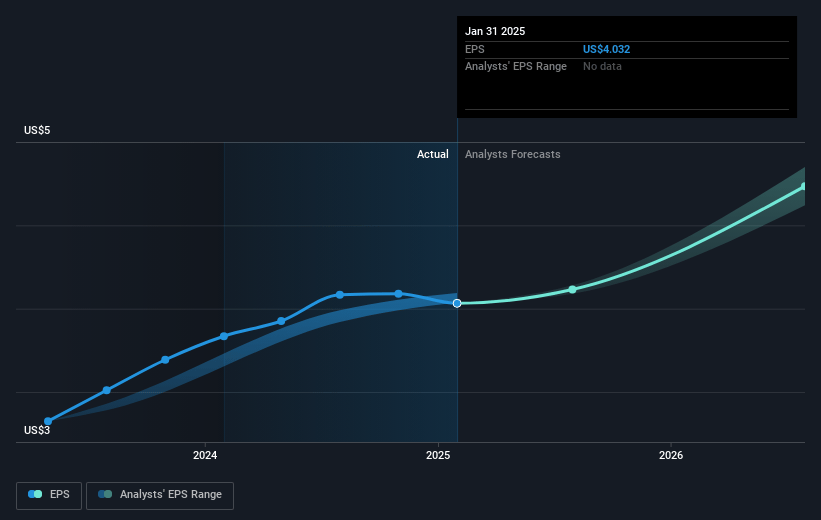

- Analysts expect earnings to reach $249.9 million (and earnings per share of $5.2) by about November 2027, up from $196.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.2x on those 2027 earnings, up from 17.0x today. This future PE is lower than the current PE for the US Commercial Services industry at 30.6x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Brady Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Brady's gross profit margin decreased from 51.7% to 50.3% with potential pressures from acquisition-related adjustments, indicating potential risks to future profitability.

- Cash flow has decreased significantly compared to last year due to timing shifts in vendor payments and normalized inventory levels, potentially impacting free cash flow and operational liquidity.

- Segment profit in Europe and Australia declined by 21.7% due to sluggish macroeconomic conditions, which may continue to affect revenue in these regions.

- Brady reported a decline in their business in China by over 6%, which could be a risk for those expecting future growth in Asia, impacting revenue from the region.

- Potential risks include strengthening of the U.S. dollar, inflationary pressures, or an economic slowdown, which could negatively influence margins and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $87.0 for Brady based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.8 billion, earnings will come to $249.9 million, and it would be trading on a PE ratio of 20.2x, assuming you use a discount rate of 6.5%.

- Given the current share price of $69.64, the analyst's price target of $87.0 is 20.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives