Key Takeaways

- Dynamic government procurement and contract changes could risk revenue growth, compress margins, and increase exposure.

- Loss of key NASA program and shifting government priorities may pressure future revenue and earnings.

- Strategic focus on IT capabilities and fixed-price contracts positions SAIC for potential growth, revenue increase, and improved margins in defense sectors.

Catalysts

About Science Applications International- Provides technical, engineering, and enterprise information technology (IT) services in the United States.

- The company's revenue growth may be at risk due to a dynamic government procurement environment, with the administration focusing on technology efficiency initiatives that could introduce further operational challenges and uncertainties.

- There is potential for margin compression if the transition from cost-plus to fixed-price contracts happens too quickly, without adequate controls, potentially leading to increased risk exposure.

- Book-to-bill ratios remain under target, and recompete headwinds, including the loss of a substantial NASA program, may continue to pressure revenue and earnings growth, creating uncertainties in achieving projected performance metrics.

- Tight budget conditions and a potential shift in government spending priorities towards defense could limit growth opportunities in the civil sector, potentially impacting overall revenue expansion projections.

- Despite strong past performance, there is cautious optimism that historical growth rates may not be sustained, with substantial headwinds in on-contract growth expected to challenge maintaining high growth thresholds.

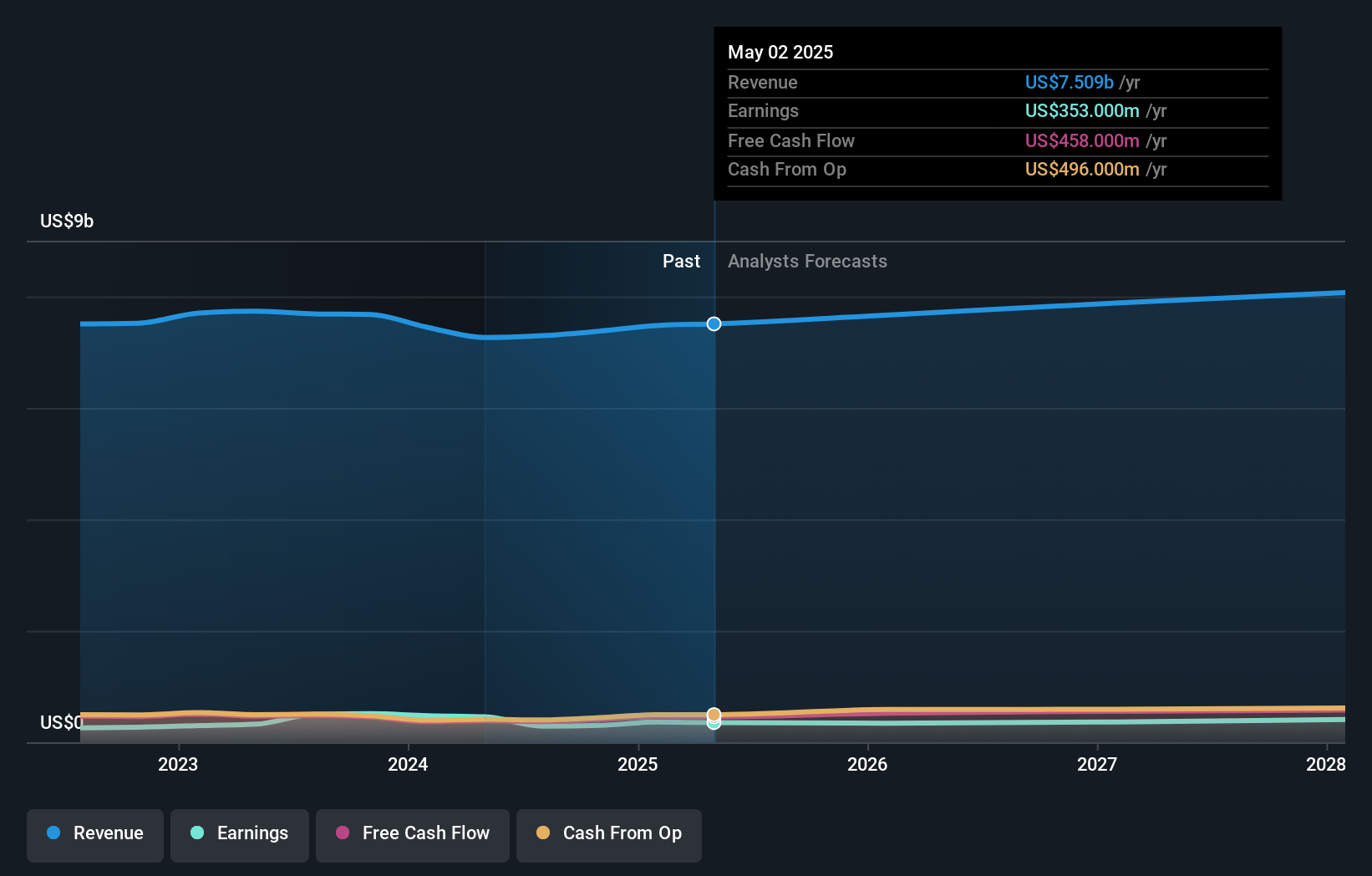

Science Applications International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Science Applications International compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Science Applications International's revenue will decrease by 0.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.7% today to 5.4% in 3 years time.

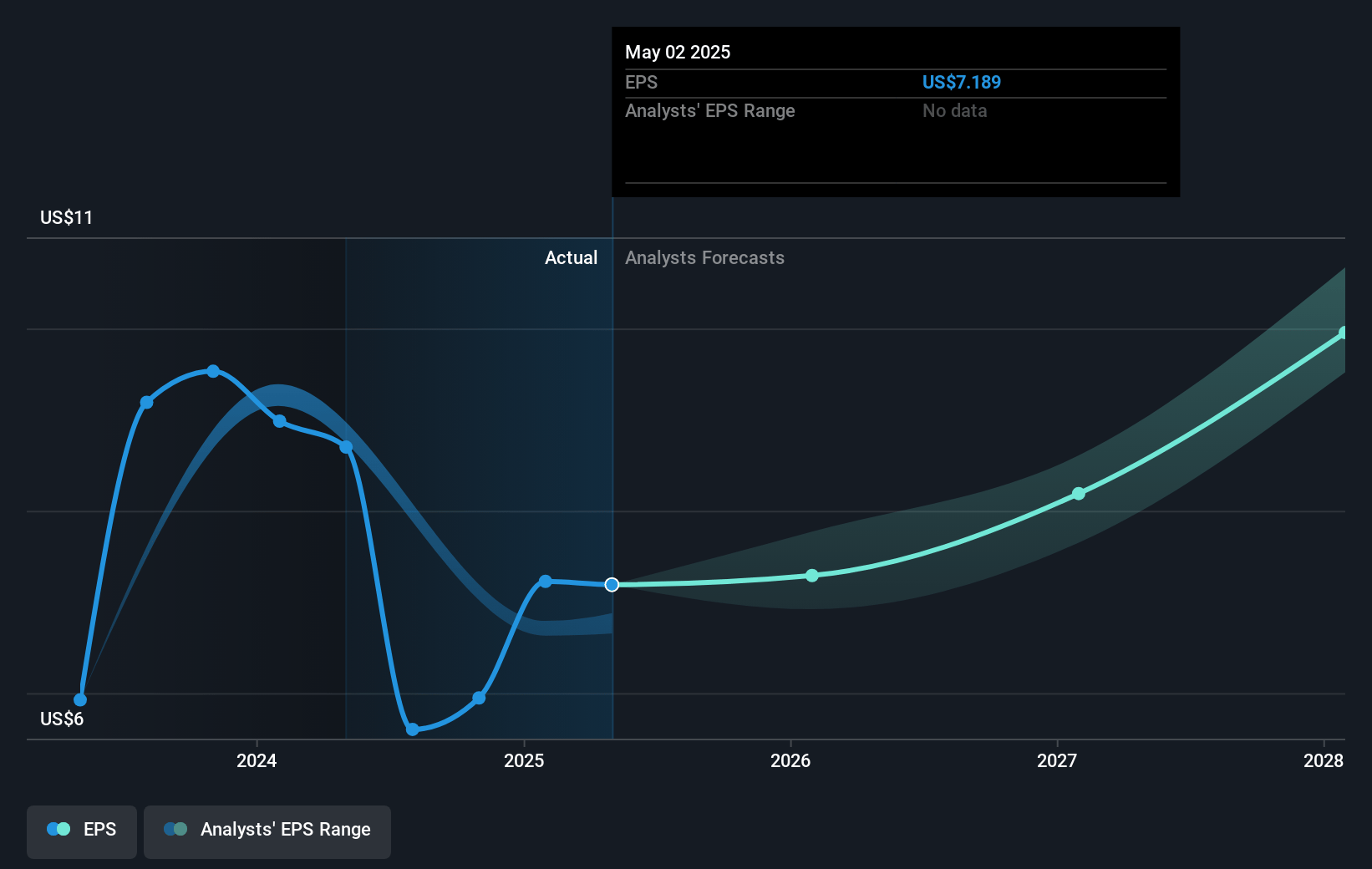

- The bearish analysts expect earnings to reach $405.6 million (and earnings per share of $9.97) by about July 2028, up from $353.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, down from 14.9x today. This future PE is lower than the current PE for the US Professional Services industry at 24.0x.

- Analysts expect the number of shares outstanding to decline by 5.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.34%, as per the Simply Wall St company report.

Science Applications International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SAIC's continued investment in cutting-edge technology and mission-critical solutions positions it to potentially increase future revenues and improve on-contract growth, which could uplift earnings.

- The company's strategic focus on enterprise and mission IT capabilities, coupled with an increase in new bids and higher win rates, suggests potential growth in the defense and intelligence sectors, driving both revenue and margins higher.

- SAIC's transition from cost-plus to fixed-price contracts, where effective, is anticipated to lead to margin improvements, providing a boost to overall net margins.

- The robust backlog of submitted bids and the securing of major contracts such as the SSLE system software life cycle engineering contract provide visibility into future revenue streams and earnings stability.

- The expected increase in commercial sector revenue from $45 million to a target of $100 million by fiscal year 2028, with consistent healthy margins, reflects potential upward pressure on overall company earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Science Applications International is $100.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Science Applications International's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $144.0, and the most bearish reporting a price target of just $100.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $7.5 billion, earnings will come to $405.6 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 7.3%.

- Given the current share price of $111.85, the bearish analyst price target of $100.0 is 11.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.