Key Takeaways

- Growing demand for digital transformation and national security spending drives strong multi-year revenue and earnings visibility for SAIC’s government-focused technology solutions.

- Shifting toward higher-margin, asset-light contracts and expanding commercial sector presence are expected to structurally boost profitability and diversify earnings sources.

- Heavy dependence on US government contracts, industry competition, and slow digital transition create revenue volatility, margin pressure, and long-term growth risks.

Catalysts

About Science Applications International- Provides technical, engineering, and enterprise information technology (IT) services in the United States.

- The accelerating demand for advanced technology integration in federal agencies, such as AI, machine learning, and cloud services, is rapidly expanding the addressable market for SAIC’s digital modernization offerings. This is evidenced by recent contract wins—like the $1.8 billion system software lifecycle engineering deal and the scaling up of high-tech border and defense programs—which are expected to drive multi-year revenue growth as more agencies prioritize digital transformation and secure IT.

- Increasing geopolitical tensions and heightened focus on national security are fueling sustained and potentially increasing defense-related spending, especially for mission-critical, technology-intensive contracts. With the majority of SAIC’s bid pipeline and backlog focused on mission and enterprise IT for defense and intelligence customers, this backdrop points to strong earnings and revenue visibility, underpinning bullish financial projections.

- SAIC’s strategic transition towards asset-light, higher-margin engagements—including the proactive migration of its contract portfolio from cost-plus to fixed-price structures—is expected to structurally increase EBITDA and net margins in coming years, with management highlighting that new business submissions carry higher implied margins than the current company-wide average.

- Actively expanding its commercial operating sector, where revenues have grown from under $1 million in 2022 to approximately $45 million in 2025 with a goal of reaching $100 million by 2028, SAIC is leveraging its government mission expertise to deliver commercial solutions at healthy margins. This growth vector is expected to become a more meaningful earnings contributor as it scales, supporting both top-line and net margin expansion.

- A robust backlog of over $20 billion in submitted bids—more than half of which are expected to be awarded within two to three quarters—combined with consistently high contract renewal rates and new program wins, gives exceptional multi-year revenue visibility. Management is targeting book-to-bill of 1.2 in the near term, providing strong support for sustained organic revenue growth and predictability of cash flow improvements.

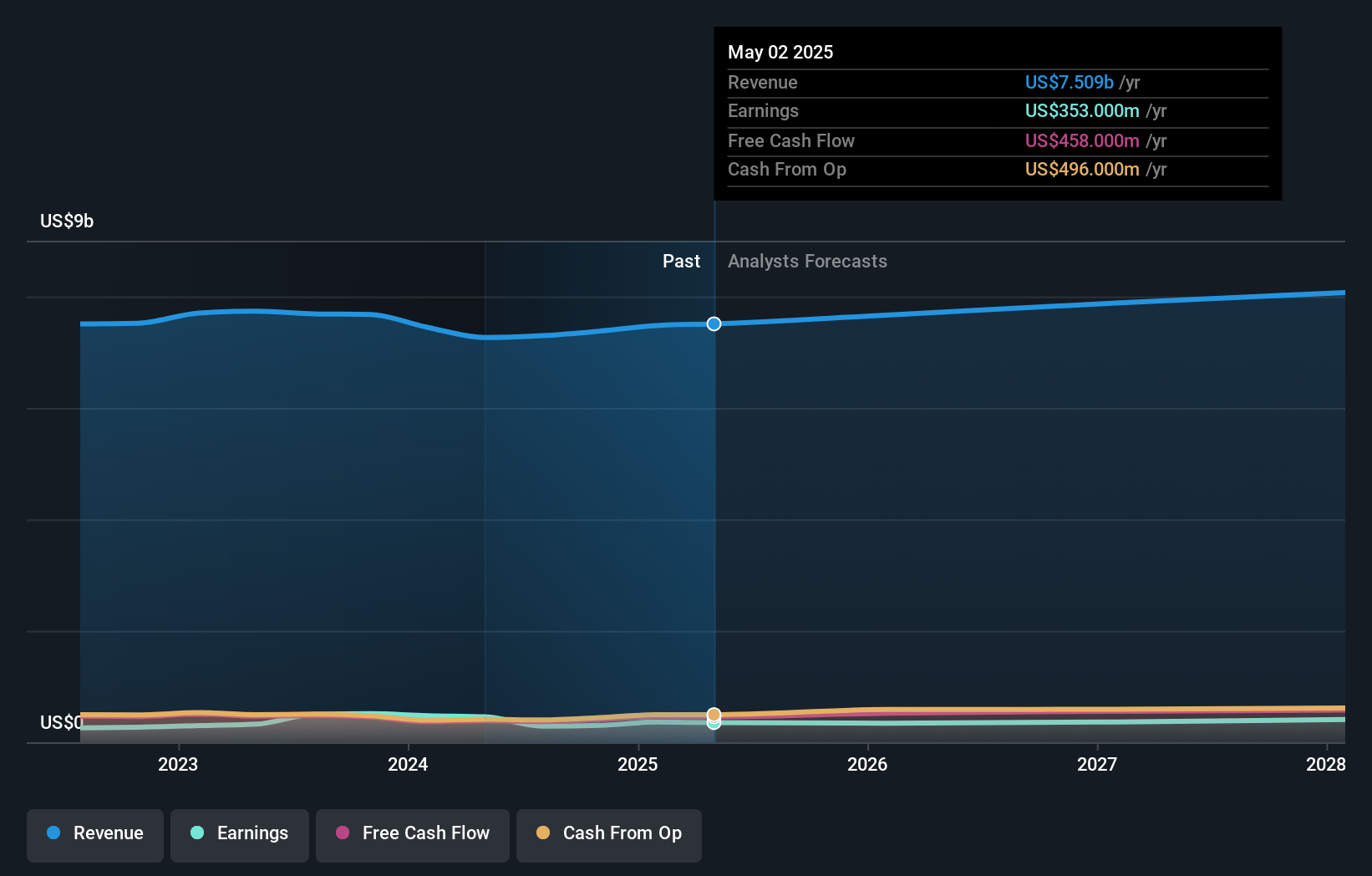

Science Applications International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Science Applications International compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Science Applications International's revenue will grow by 3.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.8% today to 5.0% in 3 years time.

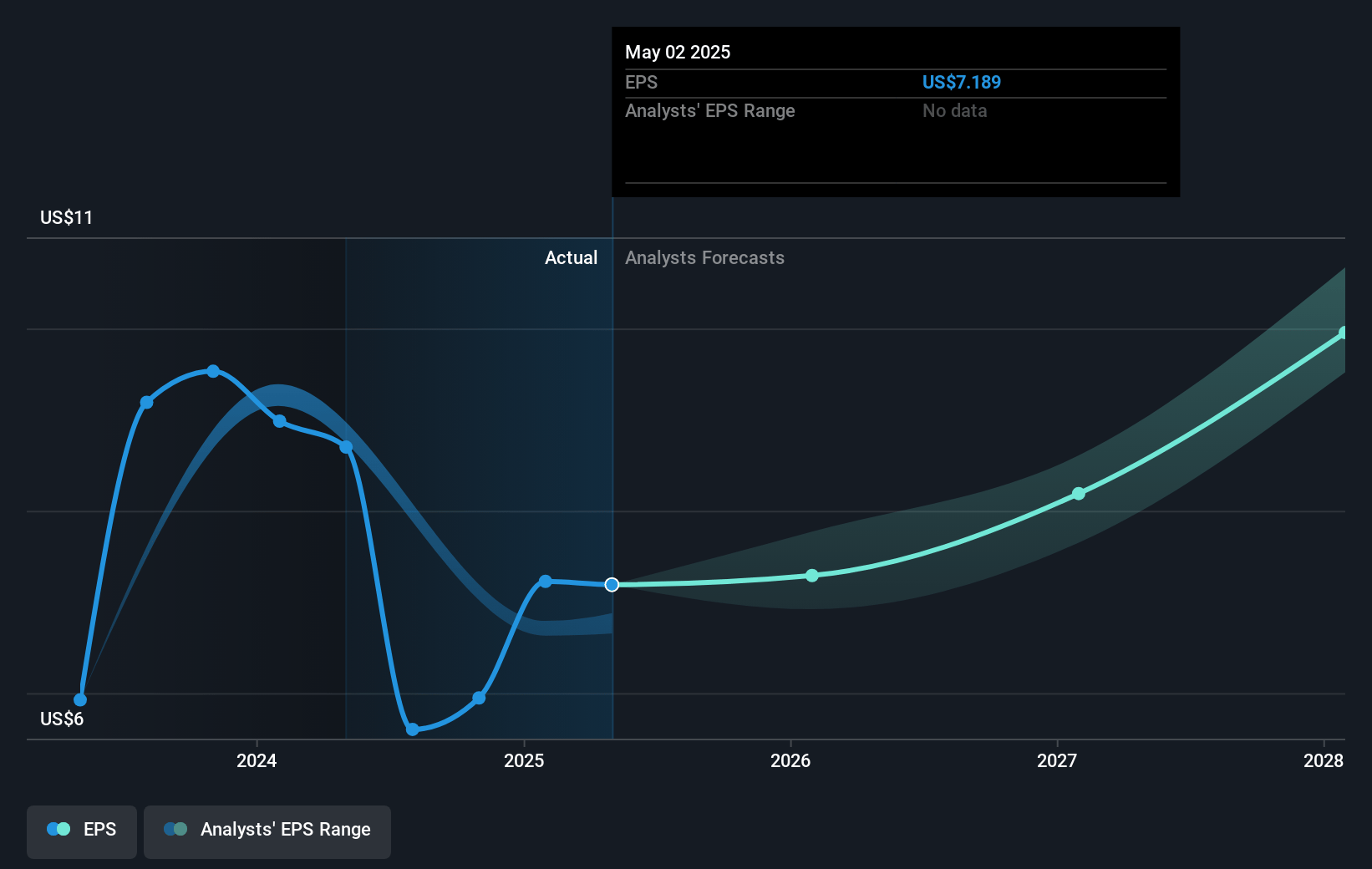

- The bullish analysts expect earnings to reach $419.1 million (and earnings per share of $9.88) by about April 2028, up from $362.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, up from 15.8x today. This future PE is lower than the current PE for the US Professional Services industry at 19.8x.

- Analysts expect the number of shares outstanding to decline by 6.82% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.12%, as per the Simply Wall St company report.

Science Applications International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating adoption of artificial intelligence and automation across government and commercial sectors could reduce the demand for traditional IT and professional services, threatening SAIC’s core revenue base and potentially causing top-line revenue growth to stall or decline.

- Persistent and unpredictable pressure on US federal budgets and the risk of ongoing continuing resolutions could slow discretionary spending and increase procurement delays, which may result in fewer contract opportunities, more intense competition on recompetes, and downward pressure on both revenue and margins.

- SAIC’s heavy reliance on US government contracts, particularly in defense and intelligence, exposes it to political, budgetary, and policy uncertainties; shifts in government priorities or spending caps could lead to abrupt reductions in contracted work and introduce volatility into revenue and earnings.

- Industry-wide margin pressures from increased use of commoditized cloud and IT services, as well as competition from large, global providers and low-cost entrants, could lead to decreased client willingness to pay premium prices, compressing operating margins and limiting SAIC’s long-term earnings growth.

- A slower pace of internal adoption and development of next-generation digital and cloud solutions compared to peers puts SAIC at risk of losing high-value contracts and market share, which could result in declining revenue and difficulty sustaining or expanding net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Science Applications International is $155.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Science Applications International's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $155.0, and the most bearish reporting a price target of just $94.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $8.3 billion, earnings will come to $419.1 million, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 7.1%.

- Given the current share price of $119.83, the bullish analyst price target of $155.0 is 22.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:SAIC. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.