Narratives are currently in beta

Key Takeaways

- Strong sales pipeline and effective margin enhancement initiatives position Huron for sustained growth and improved earnings.

- AI deployment and demand in Healthcare and Education sectors boost efficiency, reduce costs, and drive revenue growth.

- Huron faces challenges in sustaining revenue growth due to market dynamics, declining segment performance, and execution issues impacting revenue and earnings.

Catalysts

About Huron Consulting Group- A professional services firm, provides consultancy services in the United States and internationally.

- Huron Consulting Group's highest quarterly bookings in Q3 2024 indicate a significant future revenue boost as these contracts convert into billable projects. This robust sales pipeline suggests a solid foundation for continued growth into 2025. (Revenue)

- The execution of margin enhancement initiatives, including price increases, careful expense management, and expansion of global delivery capabilities, is expected to drive further improvements in adjusted EBITDA margins and adjust EPS growth. (Net Margins, Earnings)

- Deployment of AI and automation capabilities aims to improve operational efficiencies, allowing Huron to deliver work more efficiently and potentially reduce costs, further enhancing net margins. (Net Margins)

- In the Healthcare segment, rising demand for Managed Services and Digital offerings and partnerships in performance improvement can drive growth, given the dynamic challenges faced by healthcare clients in both thriving and financially distressed states. (Revenue, Earnings)

- In the Education sector, challenges such as declining enrollment present opportunities for Huron to expand its technology services and software product offerings, particularly through its leading Huron Research Suite software, driving revenue growth. (Revenue)

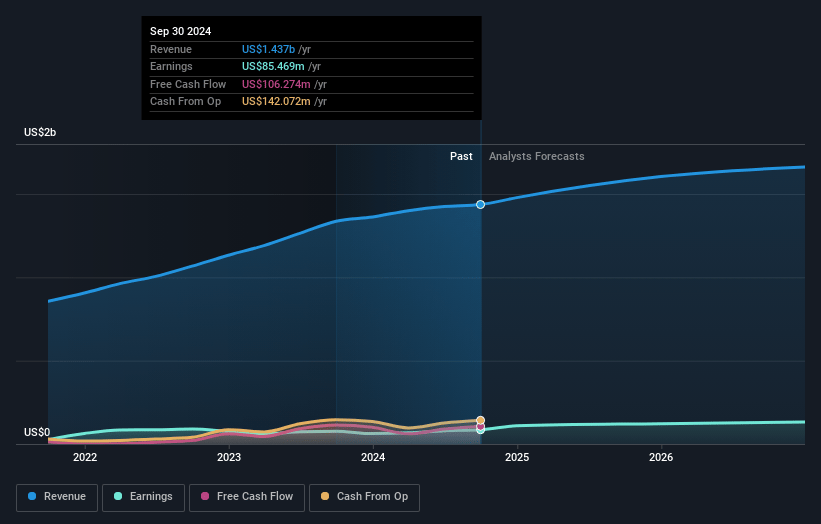

Huron Consulting Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Huron Consulting Group's revenue will grow by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 8.6% in 3 years time.

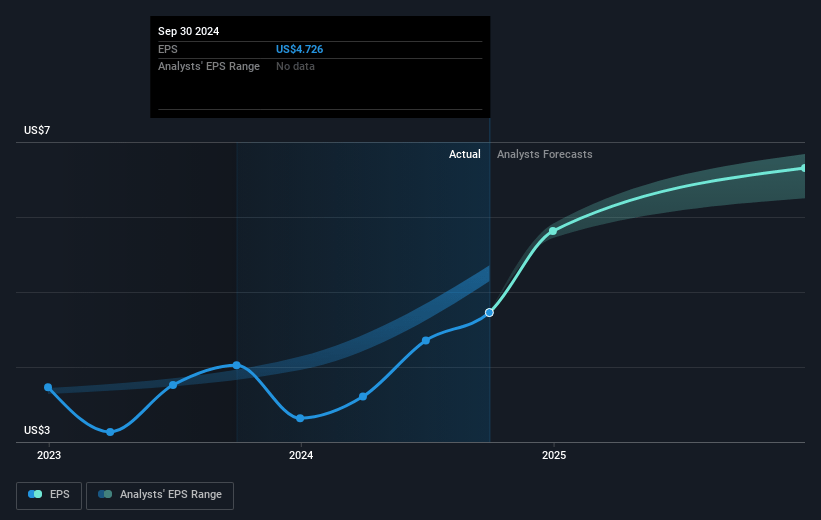

- Analysts expect earnings to reach $153.0 million (and earnings per share of $9.82) by about November 2027, up from $85.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.8x on those 2027 earnings, down from 23.0x today. This future PE is lower than the current PE for the US Professional Services industry at 23.7x.

- Analysts expect the number of shares outstanding to decline by 1.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.7%, as per the Simply Wall St company report.

Huron Consulting Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Huron Consulting Group's revenue growth slowed to 3% in Q3 2024 compared to 26% in Q3 2023, indicating potential challenges in sustaining high revenue growth rates (likely impacting revenue and future earnings).

- The Commercial segment of Huron experienced a year-over-year RBR decline of 3% in Q3 2024, driven by a drop in financial advisory and strategy and innovation offerings, signaling possible instability in these areas (impacting revenue).

- The company expects continued market dynamics and financial challenges in the healthcare provider market, with bifurcation between strong and weak systems possibly leading to volatility in demand for Huron’s services (impacting revenue and net margins).

- Declining undergraduate enrollment and shifting demographics in higher education may challenge future growth, as a significant portion of Huron's business is tied to this segment (impacting revenue and net margins).

- The delays in project starts and timing issues within the Education segment suggest potential execution challenges that could affect revenue recognition and cash flows (impacting revenue and earnings).

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $133.0 for Huron Consulting Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $142.0, and the most bearish reporting a price target of just $110.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.8 billion, earnings will come to $153.0 million, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 6.7%.

- Given the current share price of $120.3, the analyst's price target of $133.0 is 9.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives