Narratives are currently in beta

Key Takeaways

- Long-term contract renewal with Comcast secures stable revenue and potential growth, bolstering financial stability.

- Strategic diversification into new sectors aims to drive organic revenue growth, reducing reliance on traditional telecom business.

- Expected lower organic revenue growth and dependence on successful M&A activity may pressure earnings and shareholder returns amid economic and operational challenges.

Catalysts

About CSG Systems International- Provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- CSG Systems International has secured a long-term contract renewal with Comcast, which includes annual price escalators starting in 2026, providing a stable revenue stream from a major client and potential future revenue growth.

- The company is focusing on expanding its non-GAAP operating margin from its previous range of 16-18% to a new target range of 18-20%, with higher profitability leading to significant free cash flow growth expected in 2025 and 2026. This could positively impact net margins and earnings.

- CSG is aggressively pursuing diversification in industry verticals, aiming to increase revenue from sectors other than their traditional telecom and cable broadband business to over 35% by 2026, which should drive organic revenue growth.

- Strong sales performance and strategic expansion into areas such as digital monetization, customer experience (CX), and payments are contributing to CSG's confidence in achieving 2-6% organic revenue growth in the near to medium term.

- The company's commitment to significant shareholder returns through $100 million in share repurchases and dividends in 2024 and 2025 indicates a focus on enhancing earnings per share (EPS).

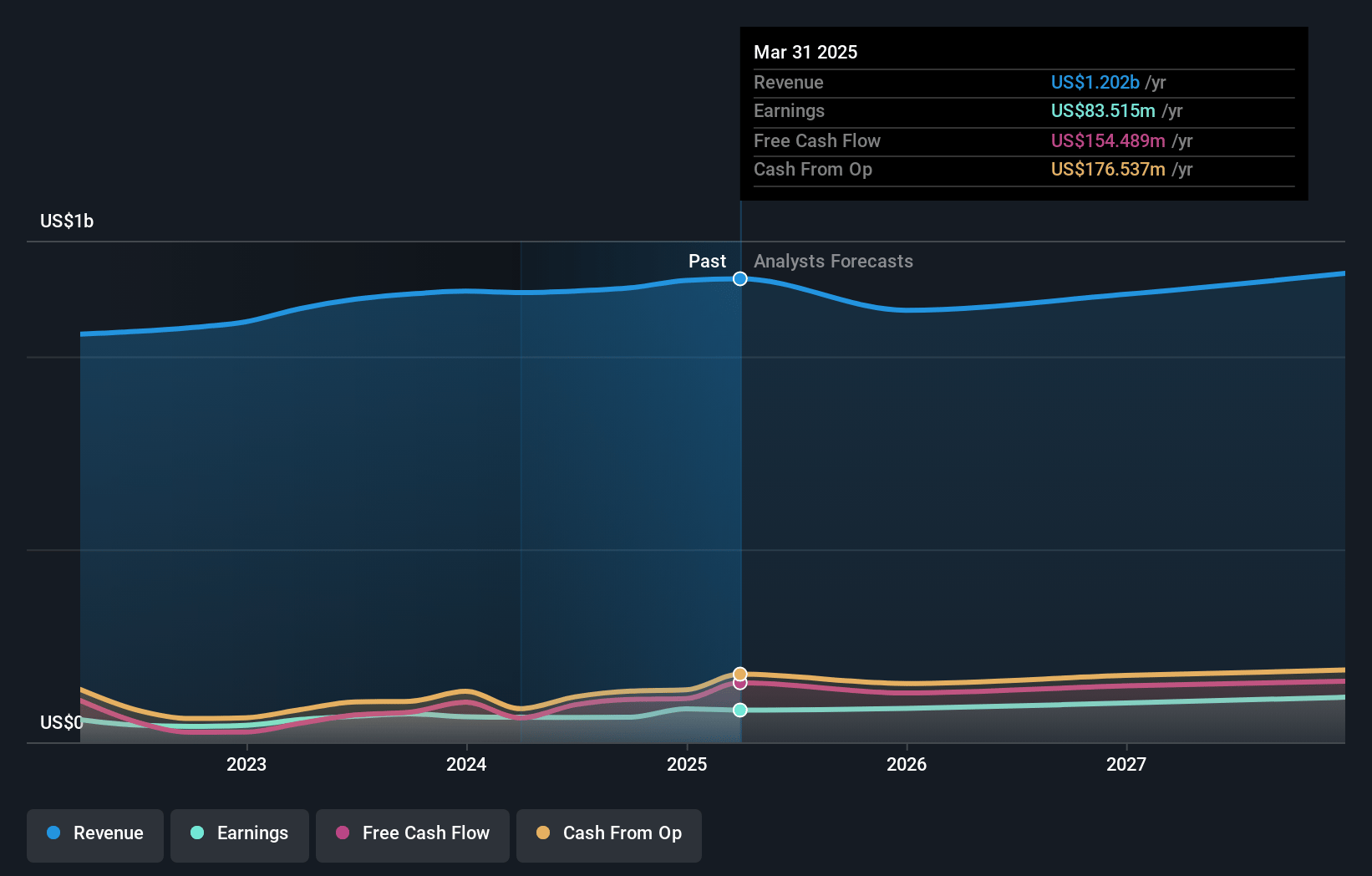

CSG Systems International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CSG Systems International's revenue will grow by 1.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.5% today to 9.2% in 3 years time.

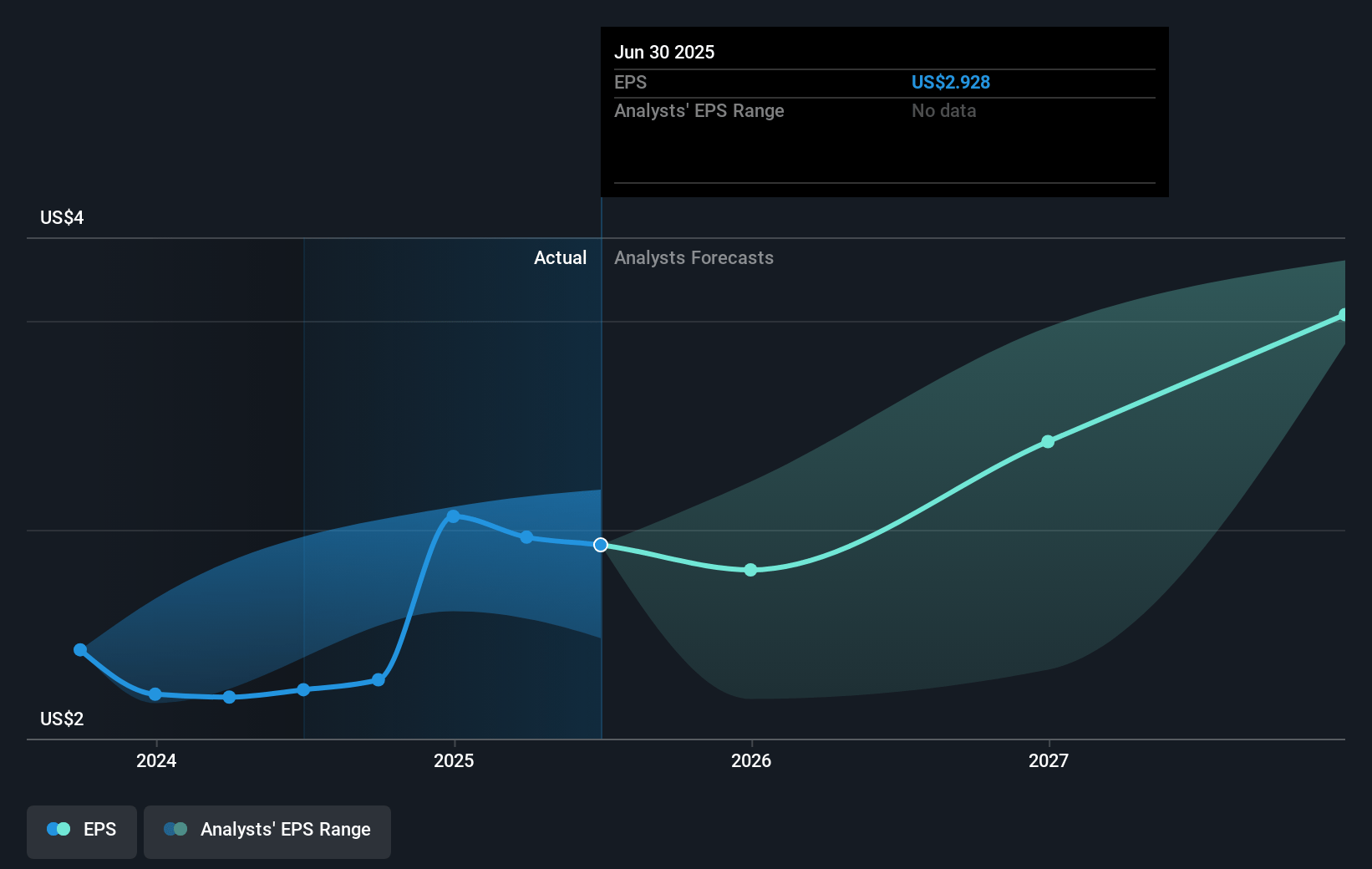

- Analysts expect earnings to reach $113.7 million (and earnings per share of $3.96) by about November 2027, up from $65.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2027 earnings, down from 23.9x today. This future PE is lower than the current PE for the US Professional Services industry at 27.5x.

- Analysts expect the number of shares outstanding to grow by 1.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

CSG Systems International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The renewal of the contract with Comcast includes no price increase for the initial period and relies on future price escalators, suggesting potential pressure on near-term revenues from this key customer.

- The company is facing a period of “lower organic revenue growth,” expecting it to be at the lower end of their projected range due to economic belt-tightening and smaller headwinds in North American broadband, which could dampen revenue expectations.

- Some headwinds are coming from timing-related revenue recognition issues with large global telecommunications deployments, which might defer expected earnings and impact financial results in the short term.

- Investments required for restructuring and cost efficiency actions have short-term impacts on cash flows due to restructuring expenses, potentially affecting net margins and free cash flow performance in the near term.

- A significant portion of anticipated revenue growth depends on successful future M&A activity, and the company acknowledges that slower pace on closing deals might delay achieving its $1.5 billion revenue ambition, possibly affecting earnings and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $66.56 for CSG Systems International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $79.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.2 billion, earnings will come to $113.7 million, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 6.9%.

- Given the current share price of $55.93, the analyst's price target of $66.56 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives