Narratives are currently in beta

Key Takeaways

- Robust legal and regulatory services growth, and strong Antitrust practice performance, highlight sustained service demand and promising future revenue prospects.

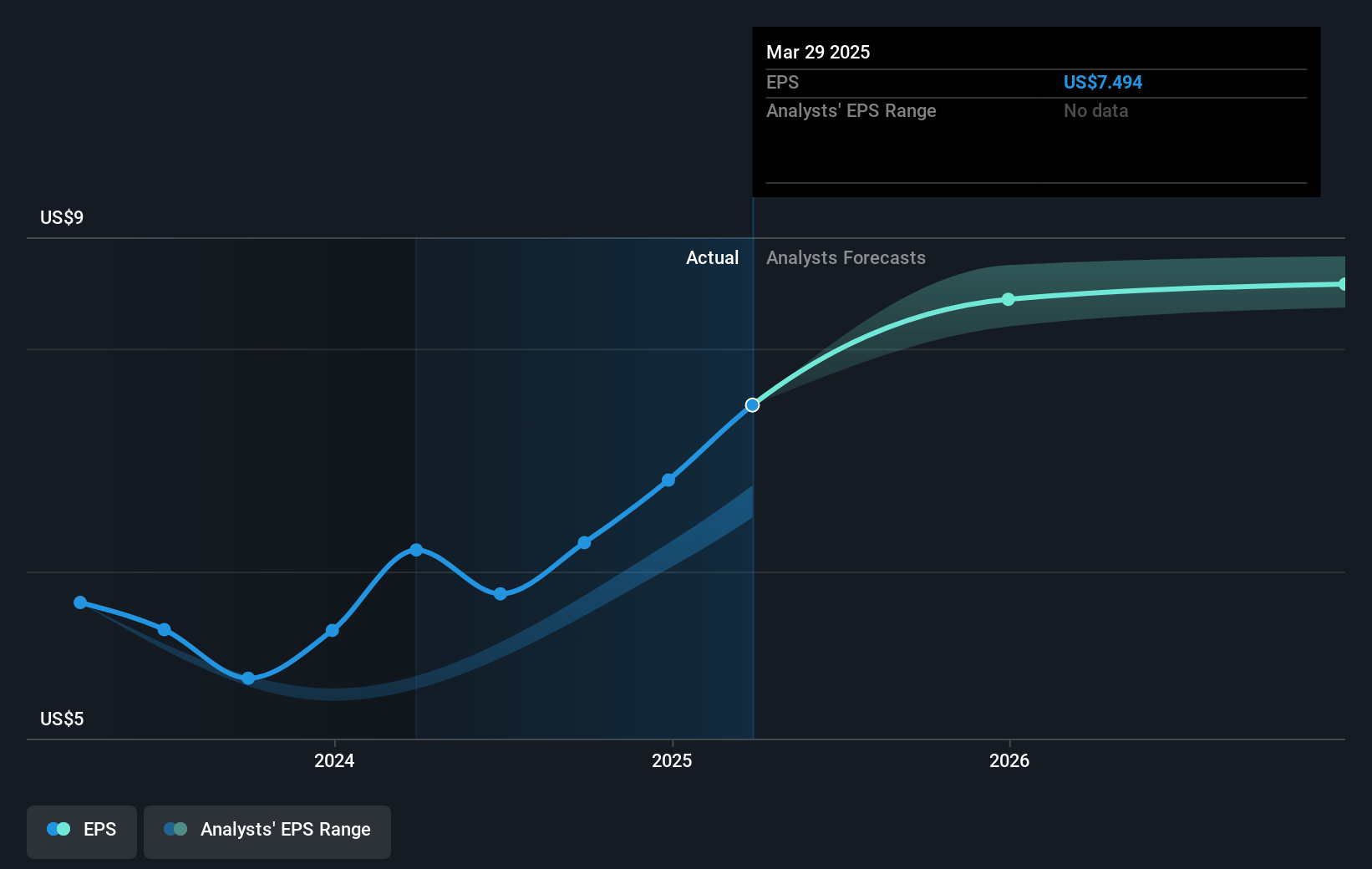

- Strategic capital deployment through share buybacks and dividends reflects confidence in financial health, potentially boosting EPS and investor appeal.

- High utilization rates and reduced consultant headcount may lead to staff overextension, affecting future revenue and growth if demand decreases or burnout occurs.

Catalysts

About CRA International- Provides economic, financial, and management consulting services worldwide.

- Strong growth in legal and regulatory services, increase in revenue nearly 20% year-over-year, and improved consultant utilization, indicating potential for future revenue growth.

- Expansion and strong performance in key practices such as Antitrust & Competition Economics, with revenue growth nearly 30% year-over-year, suggesting continued high demand for these services and positive impact on future earnings.

- CRA's Energy practice benefitting from hiring senior resources and expanding service offerings to clients, promising increased revenue and profit margins as demand expands.

- Ongoing model validation and fair lending testing services in the Financial Economics practice for fintech lending platforms could support sustainable revenue growth by capitalizing on the fintech boom.

- Strategic capital deployment through increased dividends and share repurchases demonstrates confidence in financial strength, likely enhancing earnings per share (EPS) and attracting investors.

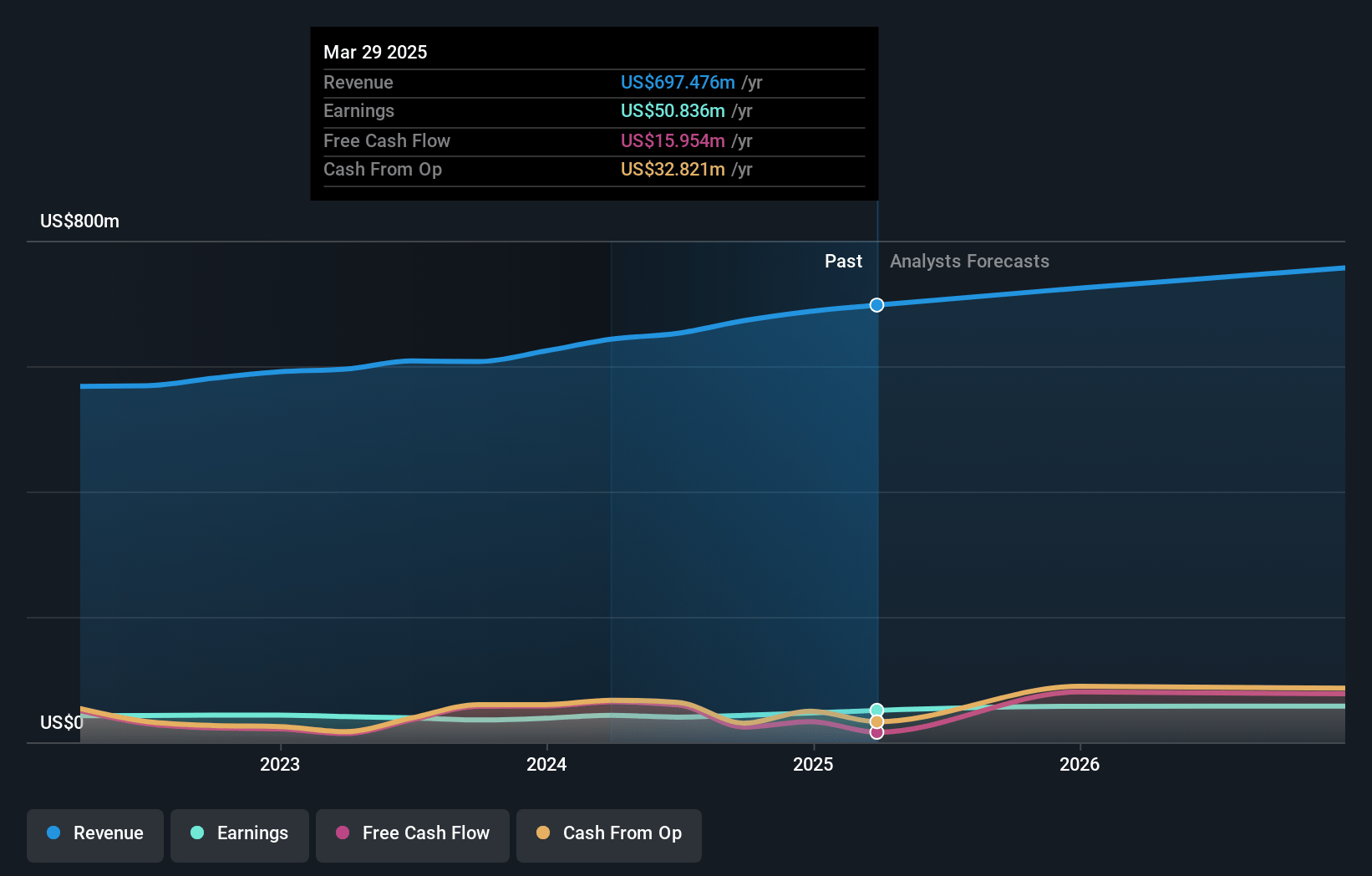

CRA International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CRA International's revenue will grow by 2.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.4% today to 8.4% in 3 years time.

- Analysts expect earnings to reach $59.9 million (and earnings per share of $9.21) by about November 2027, up from $43.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.5x on those 2027 earnings, down from 31.4x today. This future PE is lower than the current PE for the US Professional Services industry at 26.9x.

- Analysts expect the number of shares outstanding to decline by 1.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.47%, as per the Simply Wall St company report.

CRA International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High utilization rates and reduced consultant headcount, while beneficial in the short term, could lead to overextension of existing staff, potentially impacting future revenue and profit growth if demand slows or staff burnout occurs.

- A significant portion of growth is attributed to the Antitrust & Competition Economics practice fueled by M&A activity; any regulatory changes or economic shifts reducing merger activities could negatively impact this high-revenue stream and its associated earnings.

- The Life Sciences practice has shown a trend of stabilization rather than growth, which, if prolonged, could hinder the company’s overall revenue growth and strategic diversification if other segments do not compensate for this stagnation.

- Planned capital expenditures and continued high outlays for share repurchases and dividends may put constraints on cash flow, impacting the ability to invest in growth opportunities and affecting net margins and liquidity.

- The increase in the effective tax rate indicates a higher tax burden, which could negatively impact net income and margins if it continues or worsens, especially without a corresponding increase in pre-tax earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $211.0 for CRA International based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $716.2 million, earnings will come to $59.9 million, and it would be trading on a PE ratio of 25.5x, assuming you use a discount rate of 6.5%.

- Given the current share price of $198.86, the analyst's price target of $211.0 is 5.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives