Key Takeaways

- Artificial intelligence tools and new services like Title Express are set to improve efficiency and boost Copart's insurance revenue by enhancing operational margins.

- Diversification beyond insurance into sectors like financial institutions and car fleets is expected to drive growth by broadening Copart's customer base and auction liquidity.

- Potential retaliatory tariffs, exchange rate fluctuations, and macroeconomic uncertainties could suppress auction selling prices and revenue growth for Copart.

Catalysts

About Copart- Provides online auctions and vehicle remarketing services in the United States, Canada, the United Kingdom, Brazil, the Republic of Ireland, Germany, Finland, the United Arab Emirates, Oman, Bahrain, and Spain.

- Copart's advancements in artificial intelligence-enabled image recognition tools and vertical expansion into new service offerings, such as Title Express, are expected to improve efficiency and increase revenue from its insurance business. These technologies are likely to enhance operational margins by reducing processing times and increasing the accuracy of total loss decisions.

- The expansion of Copart's business with sellers beyond the insurance industry to include financial institutions, rental car fleets, and corporate fleets is anticipated to drive revenue growth by tapping into a broader customer base, thus bolstering auction liquidity and increasing earnings.

- The rise in total loss frequency, driven by increased costs of repair parts and labor, provides more vehicles for Copart's auctions, enhancing its unit economics and boosting overall revenue. This trend is expected to continue, positively impacting both revenue and net margins.

- Investment in technology, real estate, and personnel is expected to fuel Copart's future growth, potentially increasing operational capacity and efficiency. This strategic investment should lead to higher earnings through improved service offerings and expanded market reach.

- The potential for international expansion and increased global sales, as Copart continues to drive auction volume growth and fee unit increases, particularly in underserved international markets, is likely to positively impact revenue and earnings growth.

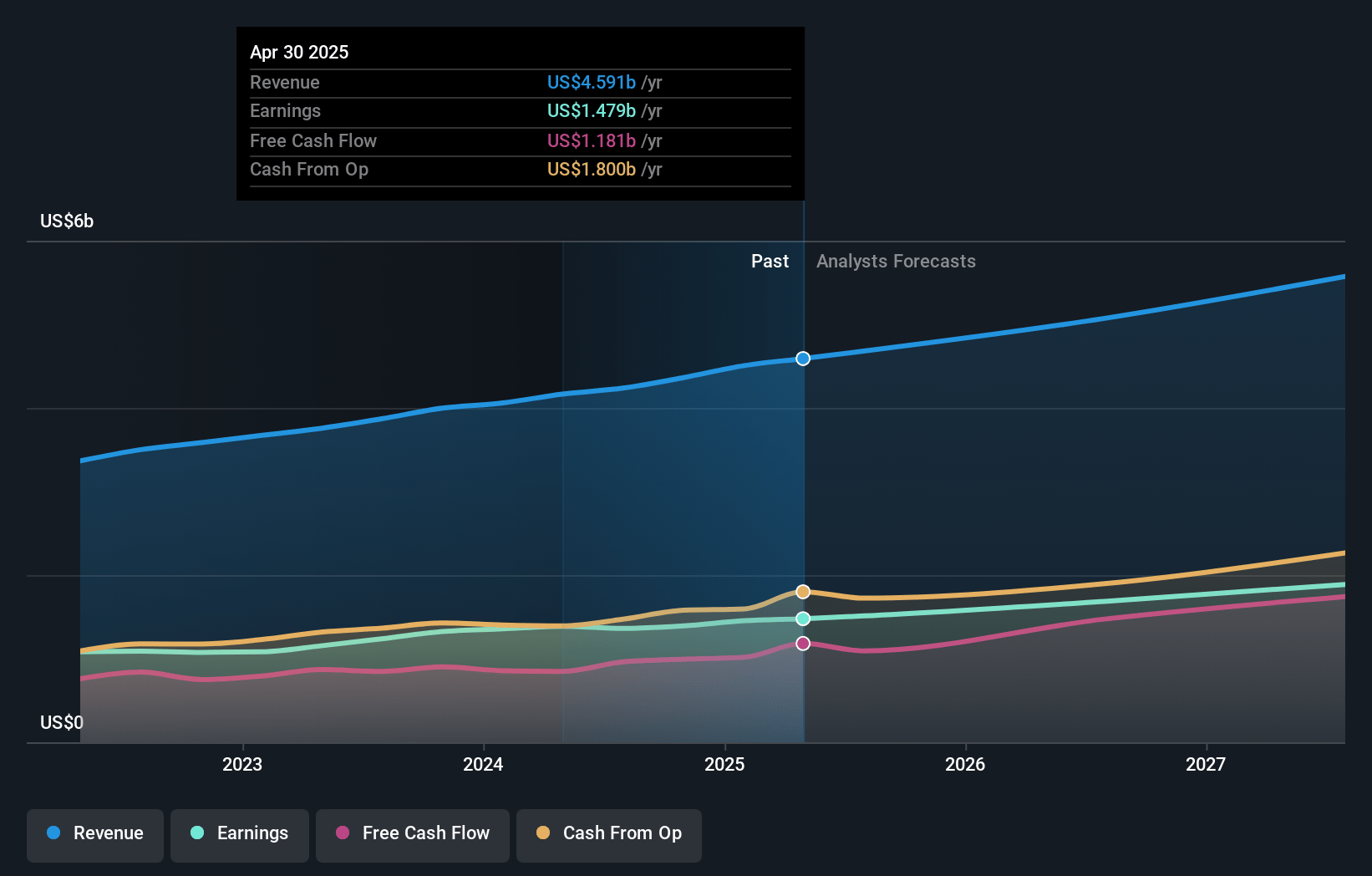

Copart Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Copart's revenue will grow by 13.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 32.2% today to 31.5% in 3 years time.

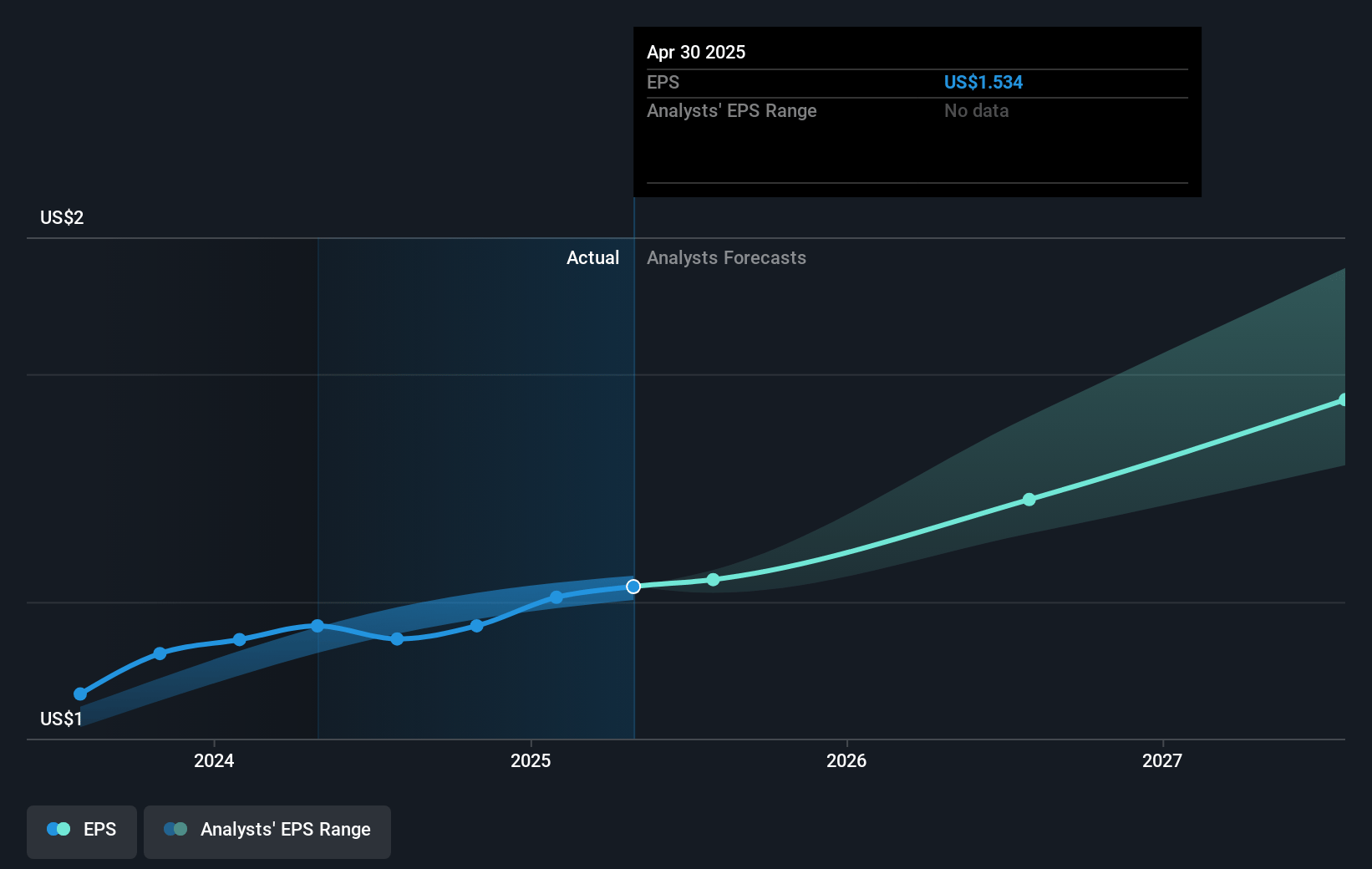

- Analysts expect earnings to reach $2.1 billion (and earnings per share of $2.15) by about July 2028, up from $1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.5x on those 2028 earnings, up from 30.0x today. This future PE is greater than the current PE for the US Commercial Services industry at 27.5x.

- Analysts expect the number of shares outstanding to grow by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.5%, as per the Simply Wall St company report.

Copart Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Potential retaliatory tariffs from countries affected by U.S. inbound tariffs could suppress selling prices for Copart's vehicles at auction, impacting revenue and operating profit.

- An increase in the uninsured population due to higher auto insurance rates could offset growth in Copart's insurance business, affecting revenue streams dependent on insurance partnerships.

- The wait-and-see approach adopted by sellers due to macroeconomic uncertainties may affect future volume and thus revenue growth in Copart's auction business.

- The transition of certain key international clients, like those in Germany, to a consignment model may lead to initial decreases in revenue until the shift is fully integrated and stable.

- The impact of exchange rate fluctuations, such as a stronger U.S. dollar, might suppress the demand from international buyers, thus affecting auction selling prices and revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $59.5 for Copart based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $66.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.7 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 33.5x, assuming you use a discount rate of 6.5%.

- Given the current share price of $45.9, the analyst price target of $59.5 is 22.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.