Last Update08 Aug 25Fair value Increased 10%

Barrett Business Services’ fair value estimate has increased as analysts anticipate stronger revenue growth and a modestly higher forward P/E, driving the consensus price target up from $46.75 to $51.50.

What's in the News

- Barrett Business Services completed a $100 million share repurchase program, buying back a total of 1,919,334 shares (7.41% of shares outstanding) under the plan announced in August 2023.

- The Board of Directors authorized a new $100 million share repurchase program, valid for 2 years.

- The company opened full-service branch locations in Chicago, IL, and Dallas, TX, transitioning from an asset-light to a physical presence in both markets.

- BBSI was dropped from multiple Russell value and small-cap indices, including the Russell 2000 Value, 2500 Value, 3000 Value, Microcap Value, and Small Cap Comp Value indices.

Valuation Changes

Summary of Valuation Changes for Barrett Business Services

- The Consensus Analyst Price Target has significantly risen from $46.75 to $51.50.

- The Consensus Revenue Growth forecasts for Barrett Business Services has risen from 7.0% per annum to 7.4% per annum.

- The Future P/E for Barrett Business Services has risen slightly from 19.16x to 19.98x.

Key Takeaways

- Expansion into new markets and technology investments are diversifying revenue and improving operational efficiency, strengthening competitiveness.

- Increasing demand for outsourced HR and benefits services supports recurring revenue growth and enhanced client retention.

- Long-term revenue growth is threatened by declining staffing demand, geographic concentration, regulatory uncertainty, competitive pressures, and lack of recovery in client hiring.

Catalysts

About Barrett Business Services- Provides business management solutions for small and mid-sized companies in the United States.

- Broader adoption of outsourced HR and payroll solutions by small and medium-sized businesses-driven by rising employment law and payroll/tax complexity-continues to expand BBSI's addressable market, supporting sustainable top-line revenue growth as reflected in record client adds and worksite employee numbers.

- Ongoing labor shortages and demographic trends are pushing more clients to seek talent acquisition and retention solutions, increasing reliance on BBSI's PEO and new health benefits offering, which can drive higher average billings per worksite employee and recurring revenue.

- Geographic expansion into major new markets such as Chicago and Dallas, alongside the proven asset-light branch model, enables entry into high-growth regions and diversifies the revenue base, with branch openings expected to bolster both revenue and future earnings.

- Continued investment in BBSI's technology stack-including applicant tracking and comprehensive HRIS enhancements-positions the company to serve larger, white-collar clients and strengthens client retention, with expected positive impacts on net margins through operational efficiency gains.

- Anticipated industry-wide increases in workers' compensation and health insurance pricing are expected to drive more SMBs to seek alternative, cost-effective solutions, enabling BBSI to capture incremental market share and potentially expand margins through favorable underwriting trends and return premium accruals.

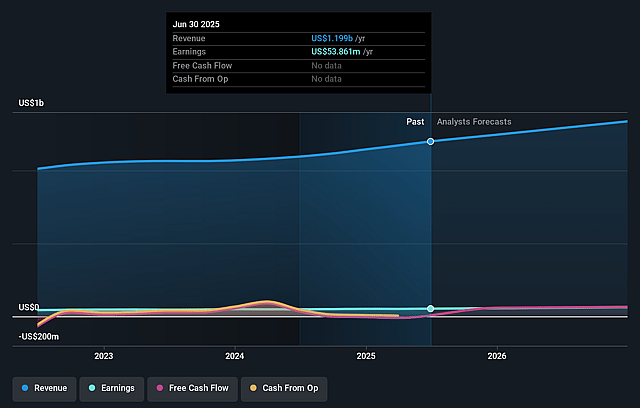

Barrett Business Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Barrett Business Services's revenue will grow by 7.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.5% today to 5.1% in 3 years time.

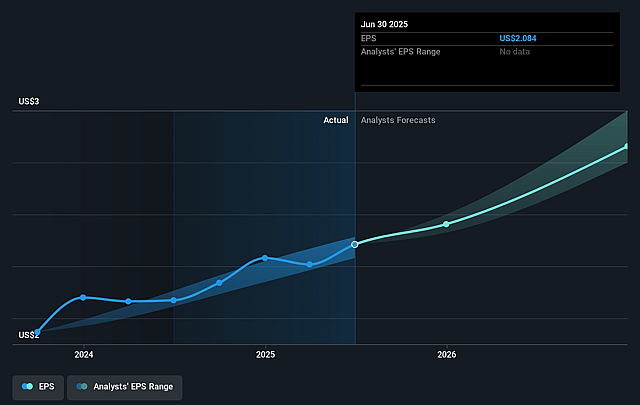

- Analysts expect earnings to reach $75.8 million (and earnings per share of $2.88) by about August 2028, up from $53.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2028 earnings, down from 22.8x today. This future PE is lower than the current PE for the US Professional Services industry at 26.1x.

- Analysts expect the number of shares outstanding to decline by 1.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.01%, as per the Simply Wall St company report.

Barrett Business Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sustained decline in BBSI's traditional Staffing business (down 11.5% YoY and below expectations), combined with macroeconomic uncertainty leading to client reluctance to fill staffing orders, indicates long-term risks from automation, AI, or evolving client preferences for staffing solutions, which could pressure future revenue growth and net earnings.

- Client hiring remains well below historical levels and recovery is uncertain; persistent sluggishness in client hiring due to demographic shifts (aging workforce, declining labor force participation) or widespread adoption of remote/automated business models could constrain future worksite employee growth and limit top-line revenue expansion.

- BBSI remains heavily concentrated in specific geographies, such as Southern California (largest region) and the Pacific Northwest (which experienced a 4% billing decline and economic out-migration); this geographic risk exposes BBSI to regional downturns or adverse local economic trends, directly impacting revenue and earnings volatility.

- Rising competition and industry consolidation in the PEO and staffing sector-coupled with BBSI's strategy of moving into white-collar and larger client segments-may compress margins if BBSI lacks sufficient technological differentiation or scale versus larger, more integrated national providers; this could negatively affect net margins and long-term market share.

- Exposure to regulatory changes, especially regarding workers' compensation and labor practices, remains significant; state-by-state rate changes, complex approval processes (like in California), and potential for tighter regulation in PEO/insurance models all introduce uncertainty around claims costs, client pricing, and net profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $51.5 for Barrett Business Services based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $75.8 million, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 7.0%.

- Given the current share price of $47.76, the analyst price target of $51.5 is 7.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.