Narratives are currently in beta

Key Takeaways

- Expansion in commercial deposits and strategic team hires are set to enhance revenue and improve net interest margins.

- Diversified lending and asset growth, coupled with operational efficiencies, aim to drive earnings and improve net margins.

- Competitive loan markets and deposit pricing pressures could strain Axos' net interest margins, while rising nonperforming assets signal potential credit losses affecting net income.

Catalysts

About Axos Financial- Provides consumer and business banking products in the United States.

- Axos Financial is expanding its commercial deposit franchise, which is expected to support lower-cost deposit growth and enhance net interest margins.

- The company has strategically invested in team hires across various commercial lending and deposit businesses, contributing to increased loan and deposit growth and potentially boosting revenue.

- Axos has a diversified lending portfolio, including new business verticals such as technology and life sciences banking, which may drive future growth in earnings by attracting new clients and expanding geographic presence.

- The continued growth in assets under custody and net new asset growth in the custody business is expected to drive incremental fee and transaction-based revenues, positively impacting net margins.

- The implementation of operational productivity initiatives and scalable processes in Axos Clearing is anticipated to enhance operating leverage, thereby improving net margins over time.

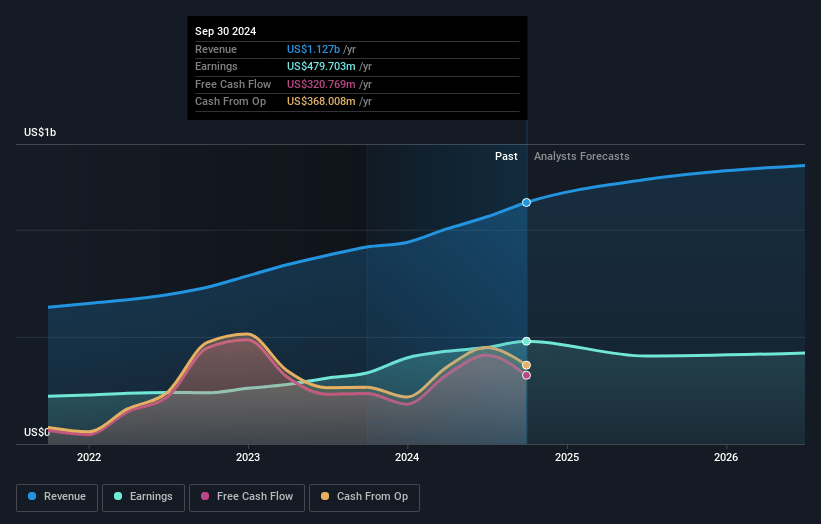

Axos Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Axos Financial's revenue will grow by 8.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 42.6% today to 24.8% in 3 years time.

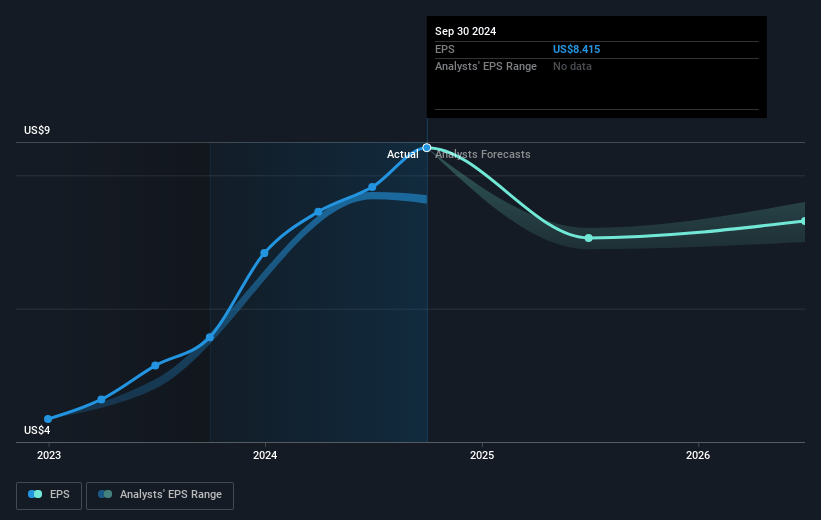

- Analysts expect earnings to reach $361.2 million (and earnings per share of $6.08) by about November 2027, down from $479.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.4x on those 2027 earnings, up from 8.0x today. This future PE is greater than the current PE for the US Banks industry at 11.8x.

- Analysts expect the number of shares outstanding to grow by 1.34% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 5.8%, as per the Simply Wall St company report.

Axos Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The highly competitive loan market might force Axos to make pricing concessions, potentially affecting net interest margins and future revenue growth.

- Increased prepayment rates in several loan categories like multifamily and single-family jumbo mortgages could lead to higher-than-expected net attrition, impacting loan growth and future interest income.

- Nonperforming assets in particular loan segments, like the C&I asset base and cash flow lending businesses, have risen, indicating potential credit losses which could impact net income.

- Pressure from competitive deposit pricing could affect Axos’ ability to maintain low-cost deposits, putting additional strain on net interest margins.

- Regulatory pressures or unexpected economic downturns, as indicated by concerns over nonaccrual loans and restructuring transactions, may pose risks to revenue stability and growth prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $79.43 for Axos Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.5 billion, earnings will come to $361.2 million, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 5.8%.

- Given the current share price of $67.61, the analyst's price target of $79.43 is 14.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives